Cushman & Wakefield

For Cushman & Wakefield's latest contributions to VietnamTimes, see below:

Hong Kong Rejoins Global Top Ten Data Center Markets, Ranked Second in Asia Pacific

24/01/2022 14:30

Hong Kong is in sixth position in 2022 data center global rankingsShanghai retains fourth-placed ranking for total market size HONG KONG SAR - Media OutReach - 24 January 2022 - Asia Pacific's data center market continues to grow at a relentless pace and is set to become the world's largest data center region over the next decade.

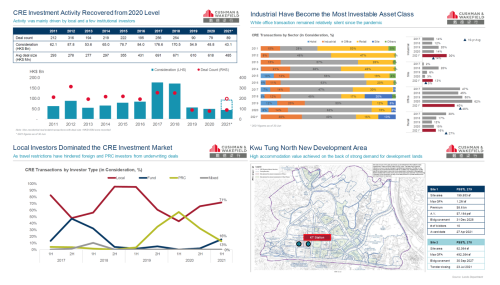

Cushman & Wakefield: CRE Investment Activity Back On The Rise

15/07/2021 21:45

Global real estate services firm, Cushman & Wakefield, announced the Hong Kong investment market 2021 Q2 review and forecast today.

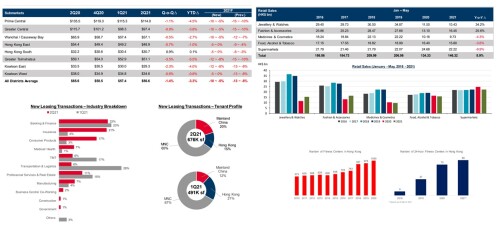

Cushman & Wakefield: Office Leasing Activity Grows but Availability Remains High

07/07/2021 13:30

Global real estate services firm Cushman & Wakefield revealed today that both office and retail rental markets have shown initial signs of stabilization in Q2 2021.

Cushman & Wakefield Takes Home Top Honors Across Multiple Service Lines at the RICS Awards China 2021

29/06/2021 20:00

HONG KONG SAR - Media OutReach - 29 June 2021 - Global real estate services firm Cushman & Wakefield has again been recognized for its leading service excellence and industry achievements at the Royal Institution of Chartered Surveyors (RICS) Awards in China. The firm took home a number of top honors.K K Chiu, Chief Executive, Greater China, Cushman & Wakefield said, "Congratulations to our expert teams on their outstanding performance.

Hong Kong's data center stands firmly in the market

22/06/2021 11:40

Ranks the third most attractive data center location in APAC. Land supply increase through HSITP in the Lok Ma Chau Loop advisable

Cushman & Wakefield and China real estate association release 2020 Asia REIT Market Report

15/06/2021 11:15

Cushman & Wakefield, a leading global real estate services firm, released the 2020 Asia REIT Market Report today at the 9th China Real Estate Finance Forum, in conjunction with the China Real Estate Association (CREA).

Cushman & Wakefield voted as Hong Kong’s second most attractive employer

08/06/2021 20:10

Cushman & Wakefield has been voted as the second most attractive employer in Hong Kong in the Randstad 2021 Employer Brand Research (REBR) survey.

Economic recovery drives total residential transactions to a 9-year high

08/06/2021 17:30

Economic recovery in Hong Kong has driven residential transaction upsurge by 20% q-o-q, reaching a nine-year high and its peak since 2012.

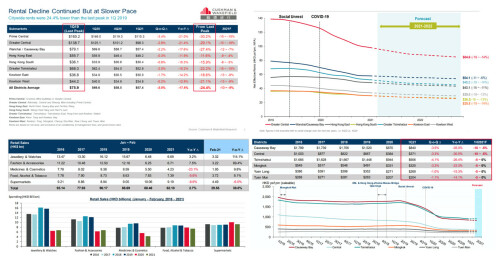

Tsim Sha Tsui Ranked #1 as the Most Expensive Shopping Street in Asia Pacific Despite Biggest Rent Drop in Hong Kong’s History

22/04/2021 16:10

Rent Declined by 43% for Causeway BayHong Kong, Tokyo, Sydney ranked Top 3 in Asia PacificHONG KONG SAR - Media OutReach - 22 April 2021 - Two-thirds of retail strips in Asia Pacific saw rental declines in 2020, with Causeway Bay in Hong Kong experiencing the steepest decline at 43%, according to Cushman & Wakefield's latest Asia Pacific Main Streets Report. Causeway Bay had been #1 across the globe in retail rental value in the last 2 years. Yet, its position was taken over by Tsim Sha Tsui in 2020. Retail rental dropped by 42% and 35% year-on-year for Central and Tsim Sha Tsui respectively. On average, retail space rental

Cushman & Wakefield : Office Availability Rate to Rise and Rent to Drop Further throughout 2021

12/04/2021 07:00

Highlights of Office Market:Citywide rents down 24.4% from the last peak in 1Q 2019Negative net absorption of 900,000 sq. ft.Availability at record high of 14% since 2Q 2004Forecast rents to decline further till the end of 2022Highlights of Retail Market:Local demand drove retail sales up by 30% Y-o-Y in FebruaryShort-term leases improved high street occupancyRent adjustment will continue throughout 1H 2021Forecast gradual recovery mainly driven by F&B sectorsHONG KONG SAR - Media OutReach - 12 April 2021 - While office and retail rental performance went in the same downward direction, retail sales picked up gradually from the

Cushman & Wakefield Ranked No.1 Commercial Real Estate Investment Brokerage in Mainland China for Third Consecutive Year

25/03/2021 12:00

HONG KONG SAR - Media OutReach - 24 March 2021 - Real Capital Analytics (RCA), a firm specializing in the analysis of global commercial real estate capital markets, ranked Cushman & Wakefield in first place for commercial real estate investment brokerage transactions in mainland China for the third consecutive year, in their Top Global Investment Brokers 2020. The RCA analysis confirms that Cushman & Wakefield represented 31% of commercial sell-side transactions, priced at US$2.39 billion, by total investment volume in mainland China in 2020, securing the top spot among all brokerage firms. In mainland China, the Cushman &

Government Work Report to Promote the Steady Development of Real Estate Market

23/03/2021 19:20

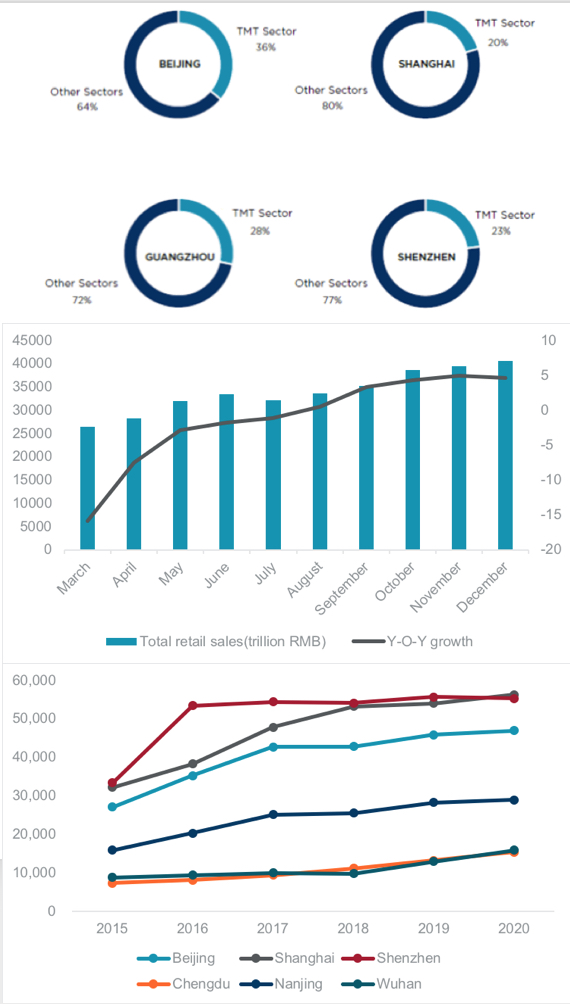

BEIJING, CHINA - Media OutReach - 23 March 2021 - Cushman & Wakefield (NYSE: CWK), a leading global real estate services firm today released their China's Two Sessions 2021: Interpretation of Real Estate Policies in the 2021 Government Work Report paper. Sabrina Wei, Chief Policy Analyst, Cushman & Wakefield, pointed out that key policies in the 2021 Government Work Report will promote the sustained development of the office, retail, logistics and residential markets in China, and help stabilize land prices, housing prices and market expectations from both the supply and demand sides.Figure 4. Total retail sales of consumer goods

Wealth Effect Sends S&Ps Surging 66% y-o-y in January and February, and expected to jump to 74% y-o-y in Q1

11/03/2021 09:00

Residential market remained most active with total transactions rising by 69% y-o-y for January and February combined, and expected to jump by 73% y-o-y in Q1Investment into non-residential properties continues pickup commencing in Q4 2020, with retail and industrial properties remaining most favoured HONG KONG SAR - Media OutReach - 11 March 2021 - Strengthened market sentiment helped boost Hong Kong real estate market growth in Q1, unleashing pent-up demand and transactions in both residential and investment markets. The wealth effect was amplified by the stabilizing COVID-19 situation locally and the eagerly

Prev Next