Vietnamese businesses seek higher market share in logistics market

Vietnam now has favorable conditions for logistics services to develop: an e-commerce boom, increased consumption, and shift of production from China to SE Asia.

The 2016 annual report of Gemadept JSC, one of the few large port developers and logistics service providers, showed the company’s outstanding growth in business scale and efficiency in the context of a bustling logistics market.

Illustrative photo (source: logistics-institute.vn)

In October 2016, Mekong Logistics in Song Hau IZ in Hau Giang province, the largest frozen product distribution center in the country with the capacity of 10,464 pallets, developed by Gemadept and Minh Phu Seafood Group, was put into operation in the first phase.

The center was set up to satisfy the demand for storing seafood imports/exports and FMCG which have been increasing rapidly in Mekong Delta. Kline Gemadept Logistics with PDI function that serves car importers/exporters has also become operational.

While Gemadept’s shipping services are still in big difficulties, logistics services have been making large contributions to the company’s business.

In 2014, the pure revenue from logistics reached VND1.875 trillion out of the total revenue of VND3.013 trillion. The figure rose to VND1.893 trillion out of VND3.586 trillion the next year and then to VND2.116 trillion out of VND3.742 trillion in 2016.

Since 2014, the revenue from logistics always makes up more than 50 percent of Gemadept’s total revenue. In 2016, for example, the port development brought 43 percent of total revenue, while logistics services 57 percent.

A report of WB showed that Vietnam ranks 64th among 160 countries in terms of logistics development level and fourth in ASEAN, after Singapore, Malaysia and Thailand. With annual growth rate of 16-20 percent, logistics has had stable growth for many years.

Regina Lim, head of the capital market research pision of JLL, in July commented that ASEAN is ready for the logistics industry boom. He said the regional market now has best conditions to stimulate the development of logistics services.

By 2050, ASEAN would have the scale equivalent to Europe, becoming the fourth largest economy after China, India and the US, while Vietnam is expected to become the 20th largest economy in the world.

The 2016 report on Vietnam’s logistics market says the three factors – export, industry expansion and FMCG development – will serve as the major driving force to stimulate demand for logistics in the context of signed FTAs.

Most read

Recommended

National

National

Vietnam News Today (Apr. 25): Vietnam Emerges As Fastest Growing Digital Economy in ASEAN

National

National

ASEAN's Robust Youth - The Key to the Region's Future Success

Focus

Focus

Foreign Minister Highlights Significance of Geneva Accords

National

National

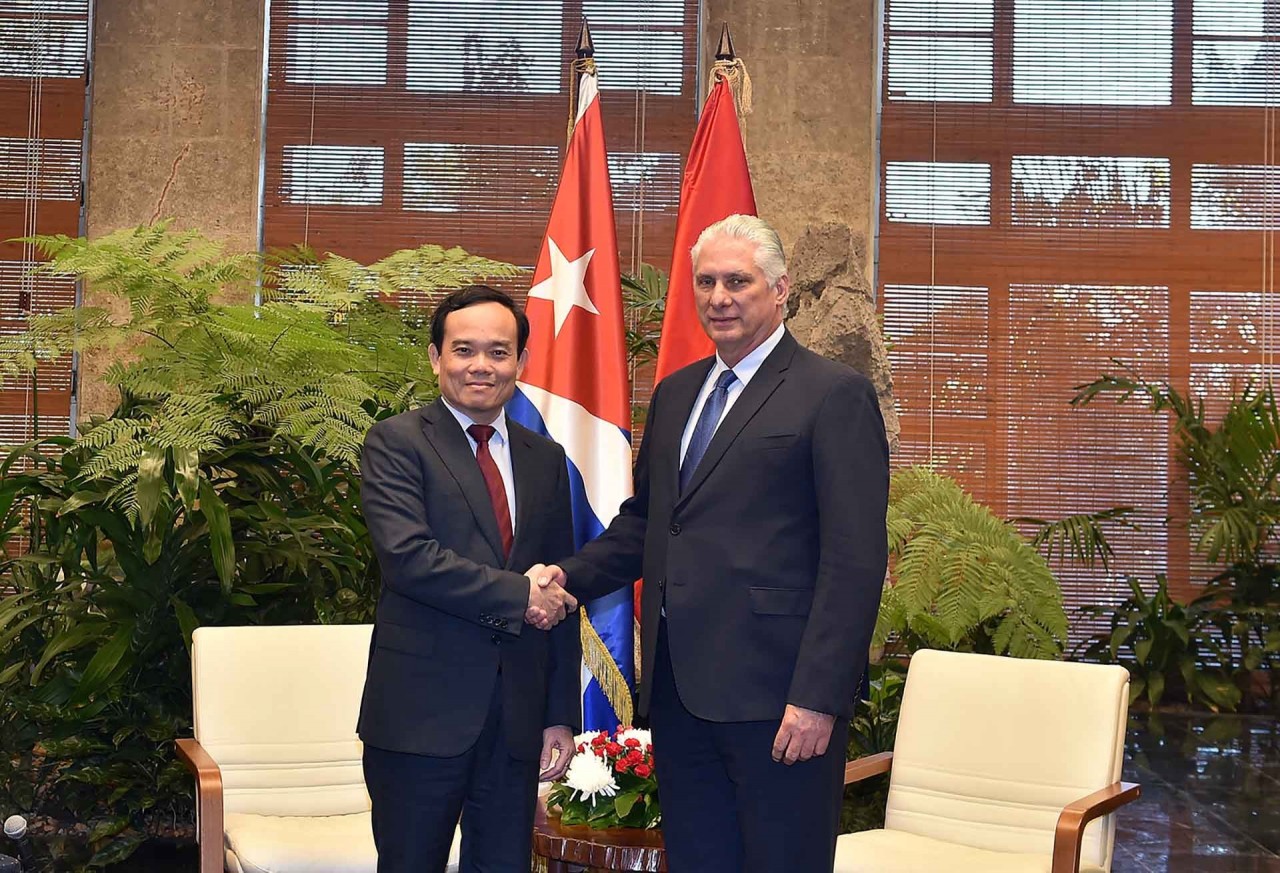

Deputy Prime Minister Tran Luu Quang's Visit to Cuba And Venezuela Deepens Relations

Popular article

National

National

Vietnam News Today (Apr. 24): Vietnamese And Chinese Localities Seek Stronger Cooperation

National

National

Dien Bien Phu Victory - A Proud Example of Vietnam's Military Might

National

National

Vietnam News Today (Apr. 23): HCM City Travel Firms Gear Up For Summer Peak

National

National