Bloomberg: Hong Kong and Mumbai Have Some of the Most Unaffordable Housing

World's most expensive major cities are located in Asia. According to the Bloomberg, big metropolis like Hong Kong, Mumbai are having some of the most unaffordable housing.

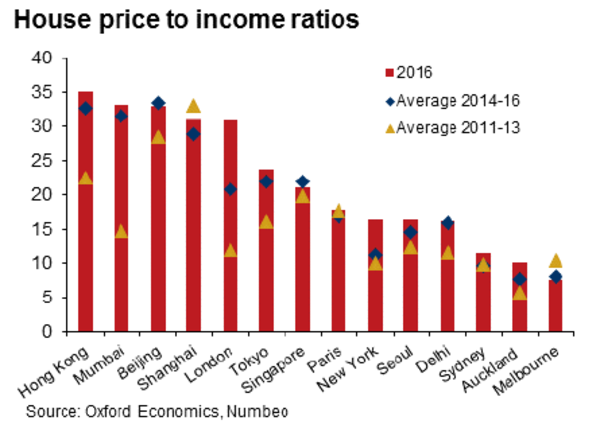

For all the talk of how expensive it is to buy a house in London or New York, the most expensive major cities in the world are all in Asia. In Hong Kong, Mumbai, Beijing and Shanghai, it now takes more than 30 years for a household with the local median income to buy a 90 square meter (970 square foot) apartment. That's according to Oxford Economics examination of price-to-income ratios across the world.

|

Graph: House price to income ratios (source: Oxford Economics)

And the return from rents in Mumbai, Shanghai, Beijing, and also Delhi are "remarkably low," which could be an indicator that the valuations in those cities are "stretched." In all four cities, gross rental yield was lower than 10 year government bond yields in 2016, unlike places such as Tokyo, Sydney, New York and Seoul.

"We expect housing price increases to moderate in the coming years across Asia, with outright falls possible in some markets," economists Tianjie He and Louis Kuijs wrote in the report. In addition to rising supply and efforts in some places to cool red-hot markets, changes in interest rates will also put downward pressure on prices.

Low interest rates in the last decade have helped fuel house price growth across the world, and the rise in rates in the U.S. and elsewhere will reverse that trend by making mortgages more expensive. Further rate rises by the Federal Reserve may attract money back to the U.S., which would affect property prices in Asia.

In the long term, rising prosperity and demographic factors still point to strong demand in many large Asian cities, especially those in the less developed economies, which should continue to support house prices there. However, the population of Tokyo and Seoul will likely shrink over the next eight years, which would reduce demand for housing./.

bloomberg ( Phi Yen )

Recommended

National

National

Vietnam News Today (Jun. 7): Prime Minister works with Estonian firms to accelerate projects in Vietnam

National

National

Vietnam News Today (Jun. 6): Foreign Investment in Vietnam Surges in Five Months

National

National

Vietnam News Today (Jun. 5): PM sets off for attendance at UNOC 3 in France, official visits to Estonia, Sweden

National

National

Vietnam News Today (Jun. 4): Vietnam - Promising Candidate for Southeast Asia’s Next Powerhouse

National

National

Shangri-La Dialogue 22: Vietnam Highlights Some Issues of Ensuring Stability in a Competitive World

National

National

Vietnam News Today (Jun. 3): PM Pham Minh Chinh to Attend UN Ocean Conference, Visit Estonia, Sweden

National

National

Vietnam News Today (Jun. 2): Vietnamese Trade Mission Sounds Out Business Opportunities in United States

National

National