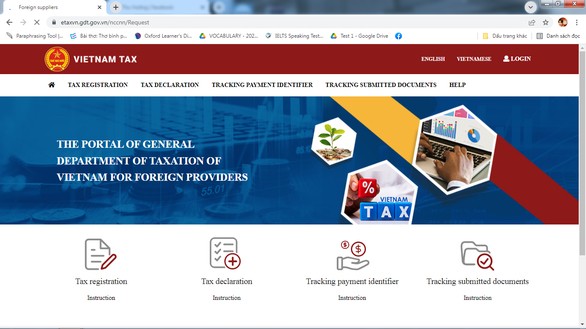

Foreign Suppliers Portal for Taxation is Ready to Launch

The General Department of Taxation held a conference on March 21, 2022 to announce the e-commerce portal for foreign suppliers.

This important event will receive the participation of the leaders of the Ministry of Finance, the leaders of the General Department of Taxation and a representative of a member of the General Department of Taxation, ministries and branches; representatives of a number of public officials; Commercial banks and a number of auditing companies authorized by the state government to declare and pay taxes...

The e-portal (URL: Etaxvn.gdt.gov.vn) is establish to facilitate the best conditions for overseas suppliers who do not have a permanent establishment in Vietnam to smoothly implement tax legislation.

|

| The General Department of Taxation held a conference on March 21, 2022 to announce the e-commerce portal for foreign employees. Photo: Bao Tin Tuc |

Starting from March 21, 2022, foreign suppliers with income from Vietnam will be able to register, declare and pay tax through the portal.

The leader of Tax Department for Large Enterprises, General Department of Taxation stressed that the construction and trial operation of the State-owned electronic portal has been completed and is ready to operate.

After putting into operation, all transactions from registration, declaration, tax payment, etc., are done online through the website of the State Government, and the taxpayers do not have to submit hard copies of documents to the Vietnamese tax authorities.

|

| Photo: Tuoi Tre Online |

According to the General Department of Taxation, when registering to conduct electronic tax transactions, taxpayers register for electronic tax transactions together with tax registration for the first time through the State Government electronic portal, and must ensure that the following conditions are met: the ability to access and use the internet, a working email address to deal with the tax authority directly, procedures are authenticated by electronic transaction authentication codes.

The code is sent to the email that the taxpayer registered with the Vietnamese tax authority when making the first tax registration and registering to change information (if any).

At the same time, taxpayers are only allowed to register an official email address to receive all notifications during the transaction with the tax authority directly managing it. After successfully completing the tax registration procedure for the first time, the e-Portal sends information about the electronic transaction account and tax identification number to the registered taxpayer's email address to carry out the procedures.

Tax identification numbers for cases where the public official directly or authorized to register, declare and pay tax shall comply with the provisions of Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance guiding on tax registration.

Taxpayers are required to make direct tax registration according to Form No. 01/NCCNN issued together with Appendix I of this Circular on the e-portal.

In case of change of tax registration information according to Form No. 01-1/NCCNN issued together with Appendix I of the circular, the tax authority can directly manage it on the electronic portal.

To authenticate when registering for tax, the taxpayer uses the electronic transaction authentication code issued by the tax authority through the e-portal.

From then on, the General Department of Taxation is the tax authority that directly responsible for granting tax identification numbers to foreign suppliers, receiving tax declarations and performing tasks related to tax declaration, payment, etc.

The General Department of Taxation is also responsible for updating the list of foreign suppliers directly or authorized by tax registration and tax declaration on the portal; coordinating with relevant agencies to identify and announce the name and website address of the state taxpayers who have not yet registered in the system but the goods and service have transacted in Vietnam.

In addition, tax authorities in Vietnam have the right to coordinate with tax authorities in foreign countries to exchange and urge public employees to declare and pay taxes; arrears tax collection against foreign public servants if it is proved that the taxpayers' declaration and payment of tax are not correct; coordinate with competent agencies to implement and handle measures in accordance with law in case of non-compliance with tax obligations by foreign public servants in Vietnam.

For tax declaration, taxpayers make quarterly tax declarations, using form No. 02/NCCNN (issued together with Circular No. 80/2021/TT-BTC). Revenue subject to value-added tax and CIT as a percentage of the business revenue generated from Vietnam.

The list of foreign organizations and individuals involved in tax administration for e-commerce and digital-based business activities and other services without a permanent establishment in Vietnam (Circular 80/2021/TT-BTC of the Ministry of Finance)Firstly, foreign suppliers who do not have a permanent establishment in Vietnam, conduct e-commerce, digital-based business and other services with organizations and individuals in Vietnam. Secondly, organizations and individuals in Vietnam purchase goods and services of foreign public servants. Thirdly, tax agents operating under Vietnamese law are authorized by state authorities to perform tax registration, declaration and payment in Vietnam on behalf of foreign suppliers. Fourthly, commercial banks, payment intermediary service providers, and organizations and individuals have rights and obligations related to e-commerce business, digital business and other services of the foreign suppliers.. |

In particular, the tax rates of certain groups of goods and services are as follows: In case the foreign public servant belongs to a country or territory that has signed a tax agreement with Vietnam, he/she may carry out procedures for tax exemption or reduction under the Agreement on avoidance of double taxation

A reminder for taxpayers: after receiving the identification code of the amount payable to the state budget announced by the General Department of Taxation, the taxpayer will declare and pay tax in a freely convertible foreign currency into the state budget revenue account. The correct identification code of the amount payable to the state budget sent by the General Department of Taxation must be recorded.

| Vietnam Attracts Foreign Direct Investment From US FDI inflows from the US are forecasted to flow more strongly into Vietnam in areas such as digital economy, green energy, and healthcare. |

| Vietnam-Japan Partnership Thriving: Party Official The Vietnam-Japan extensive strategic partnership is growing strongly and practically in many fields. |

| Sputnik: “Made in Vietnam” Products Winning Larger Shares in International Market “Made in Vietnam” products are winning larger shares in the international market and Vietnam would become a new production hub of the world. |

Recommended

Expats in Vietnam

Expats in Vietnam

Look Forward to New Developments in Vietnam - US Relations

Expats in Vietnam

Expats in Vietnam

Doseba Tua Sinay's Dedication to Vietnam's Children

Expats in Vietnam

Expats in Vietnam

The Swede Who Fell in Love with Hoi An

Expats in Vietnam

Expats in Vietnam

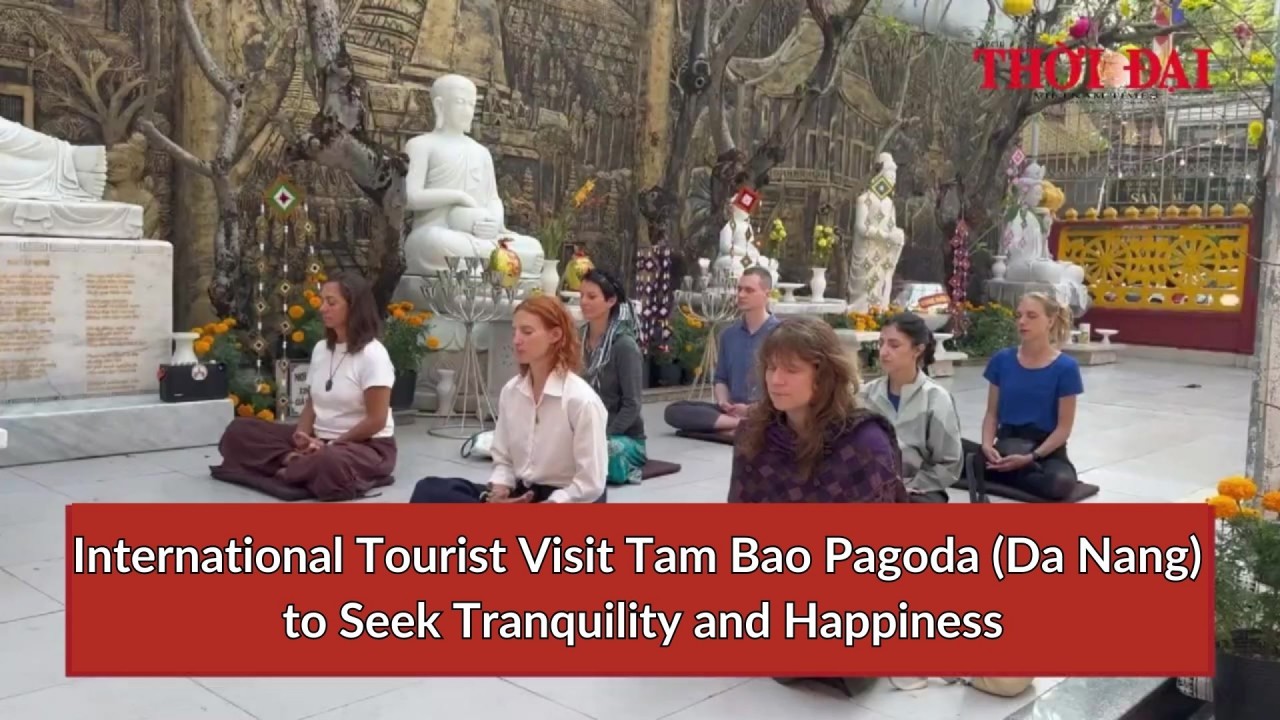

International Tourist Visit Tam Bao Pagoda (Da Nang) to Seek Tranquility and Happiness

Expats in Vietnam

Expats in Vietnam

Enticing Passion for Vietnam

Expats in Vietnam

Expats in Vietnam

Tet Through the Eyes of Foreign Visitors

Focus

Focus

Memories of Traditional Tet through the Lens of British Photographer

Multimedia

Multimedia