Ten Cheapest States To Live In The United States

The average price for a four-bedroom or 2,400-square-foot home in the United States is almost $366,000, according to the 2020 fourth-quarter Cost of Living Index report by the Council for Community and Economic Research.

That figure can vary broadly across different metropolitan areas in the U.S., however. While the average price for a four-bedroom home in the Dayton, Ohio, metropolitan area is just over $260,000, a similar home in Brooklyn, New York, and the surrounding area will run some $1.2 million on average.

Here are the 10 cheapest states in the U.S

1. Alabama

|

| Photo: Road Affair |

Living in Alabama is less expensive than it is on average across the U.S. as a whole. According to data from the Bureau of Economic Analysis, goods and services in the state cost 13.6% less than they do on average nationwide. Compared with all other states, Alabama has the third-lowest overall cost of living.

In general, living in dense, urban metro areas is more expensive than living in more rural areas. Alabama is home to 12 metropolitan areas. The most expensive in the state is the Daphne-Fairhope-Foley metro area, where the cost of goods and services is 9.7% lower than the national average and 3.9% higher than the statewide average.

Just as the cost of living varies from state to state, it also varies from place to place within states. In Alabama, Shelby County, home to the city of Hoover, has the highest overall cost of living for a family of four at $89,433 per year, well above the statewide average of $77,433 per year.

Meanwhile, Franklin County is the least expensive place in Alabama. The average annual cost of living for a family of four in the area is just $68,723, $8,710 less than it is across the state as a whole. Russellville is the most populous community in Franklin County.

2. West Virginia

|

| Photo: Travel + Leisure |

Living in West Virginia is less expensive than it is on average across the U.S. as a whole. According to data from the Bureau of Economic Analysis, goods and services in the state cost 12.2% less than they do on average nationwide. Compared with all other states, West Virginia has the fifth-lowest overall cost of living.

In general, living in dense, urban metro areas is more expensive than living in more rural areas. West Virginia is home to seven metropolitan areas. The most expensive in the state is the Morgantown metro area, where the cost of goods and services is 10.1% lower than the national average and 2.1% higher than the statewide average.

Few expenses vary as much from state to state as taxes. Accounting for state and federal income taxes, as well as Social Security contributions and Medicare payroll, the average adult working in West Virginia pays $6,007 annually in taxes -- slightly below the national average of $6,542.

Excluding federal taxes and incorporating state and local taxes such as property and sales taxes -- the state and local tax burden in West Virginia is in line with the average across the U.S. as a whole. Per capita state tax collections in West Virginia come out to $3,000 per year, compared to the $3,151 average across all states.

Excluding federal taxes and incorporating state and local taxes such as property and sales taxes -- the state and local tax burden in West Virginia is in line with the average across the U.S. as a whole. Per capita state tax collections in West Virginia come out to $3,000 per year, compared to the $3,151 average across all states.

Cost of Living by County or County Equivalent

Just as cost of living varies from state to state, it also varies from place to place within states. In West Virginia, Jefferson County, home to the town of Corporation of Ranson, has the highest overall cost of living for a family of four at $88,574 per year, well above the statewide average of $79,573 per year.

Meanwhile, Ritchie County is the least expensive place in West Virginia. The average annual cost of living for a family of four in the area is just $71,994, $7,580 less than it is across the state as a whole. Harrisville is the most populous community in Ritchie County.

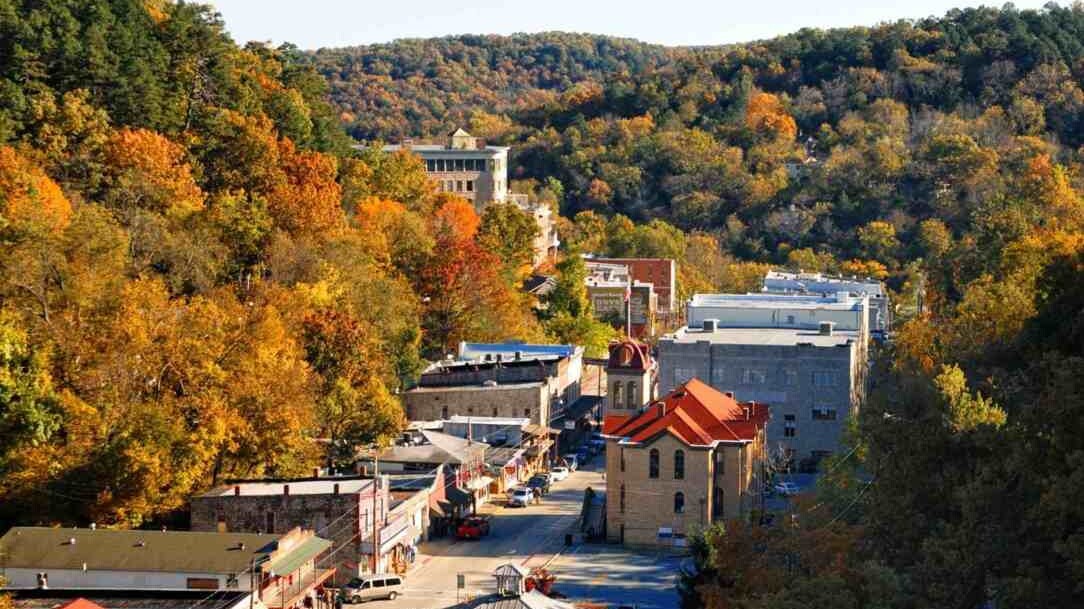

3. Arkansas

|

| Photo: Travel + Leisure |

Arkansas is a state in the southern region of the United States, home to over 3 million people as of 2018. Its name is of Siouan derivation from the language of the Osage denoting their related kin, the Quapaw Indians. The state's diverse geography ranges from the mountainous regions of the Ozark and the Ouachita Mountains, which make up the U.S.

Arkansas is ranked number 35 out of all states in overall healthcare access and affordability. Healthcare costs make up a significant part of the cost of living. The ability to afford healthcare as well as the ability to access care are key indicators of how much you will be paying for this important resource if you move to another state. Affordability is generally measured by the rates set for insurance coverage in a state, as well as the out-of-pocket expenses that need to be paid by you when receiving the care. If rates or out-of-pocket expenses are high, your cost of living will increase. Access to healthcare is how easy or difficult it may be to receive the care. Access is measured by identifying barriers that might prevent the delivery of care such as the inability to obtain insurance coverage, having to travel long distances to health care centers and lack of sufficient facilities and/or healthcare professionals. The timeliness of care, how fast you can get to see a healthcare provider, is other important measure.

Arkansas has one of the highest state-wide average temperatures during the summer months of June, July, and August. If you live in Arkansas, it is likely that your air conditioner will be running non-stop for most of the summer. This could contribute to higher energy costs during the summer based on your thermostat setting and preference for a cool indoor climate. A hot summer is usually followed by cooler temperatures during the winter months when heating expenses may be below. Because the cost of living is linked to energy costs, expect an increase in those costs during the summer months if you live in Arkansas.

4. Indiana

|

| Photo: Visit The USA |

Living in Indiana is less expensive than it is on average across the U.S. as a whole. According to data from the Bureau of Economic Analysis, goods and services in the state cost 10.7% less than they do on average nationwide. Compared with all other states, Indiana has the 12th lowest overall cost of living.

In general, living in dense, urban metro areas is more expensive than living in more rural areas. Indiana is home to 12 metropolitan areas. The most expensive in the state is the Bloomington metro area, where the cost of goods and services is 8.3% lower than the national average and 2.4% higher than the statewide average.

Few expenses vary as much from state to state as taxes. Accounting for state and federal income taxes, as well as Social Security contributions and Medicare payroll, the average adult working in Indiana pays $5,366 annually in taxes -- below the national average of $6,542.

Excluding federal taxes and incorporating state and local taxes such as property and sales taxes -- the state and local tax burden in Indiana is lower than the average across the U.S. as a whole. Per capita state tax collections in Indiana come out to $2,899 per year, compared to the $3,151 average across all states.

5. Missouri

|

| Photo: City of Liberty |

Living in Missouri is less expensive than it is on average across the U.S. as a whole. According to data from the Bureau of Economic Analysis, goods and services in the state cost 11.2% less than they do on average nationwide. Compared with all other states, Missouri has the ninth-lowest overall cost of living.

In general, living in dense, urban metro areas is more expensive than living in more rural areas. Missouri is home to eight metropolitan areas. The most expensive in the state is the Kansas City metro area, where the cost of goods and services is 7.1% lower than the national average and 4.1% higher than the statewide average.

Few expenses vary as much from state to state as taxes. Accounting for state and federal income taxes, as well as Social Security contributions and Medicare payroll, the average adult working in Missouri pays $5,639 annually in taxes -- below the national average of $6,542.

Excluding federal taxes and incorporating state and local taxes such as property and sales taxes -- the state and local tax burden in Missouri is lower than the average across the U.S. as a whole. Per capita state tax collections in Missouri come out to $2,126 per year, compared to the $3,151 average across all states.

6. Utah

|

| Photo: Getty Images |

Living in Utah is less expensive than it is on average across the U.S. as a whole. According to data from the Bureau of Economic Analysis, goods and services in the state cost 3.4% less than they do on average nationwide. Compared with all other states, Utah has the 24th highest overall cost of living.

In general, living in dense, urban metro areas is more expensive than living in more rural areas. Utah is home to five metropolitan areas. The most expensive in the state is the Salt Lake City metro area, where the cost of goods and services is 1.3% lower than the national average and 2.1% higher than the statewide average.

Few expenses vary as much from state to state as taxes. Accounting for state and federal income taxes, as well as Social Security contributions and Medicare payroll, the average adult working in Utah pays $5,938 annually in taxes -- below the national average of $6,542.

Cost of Living by County or County Equivalent

Just as the cost of living varies from state to state, it also varies from place to place within states. In Utah, Summit County, home to the city of Park City, has the highest overall cost of living for a family of four at $97,617 per year, well above the statewide average of $79,786 per year.

Meanwhile, Box Elder County is the least expensive place in Utah. The average annual cost of living for a family of four in the area is just $74,095, $5,692 less than it is across the state as a whole. Brigham City is the most populous community in Box Elder County.

7. Mississippi

|

| Photo: mississippi |

Mississippi is bordered to the north by Tennessee, to the east by Alabama, to the south by Louisiana and a narrow coast on the Gulf of Mexico; and to the west, across the Mississippi River, by Louisiana and Arkansas. In addition to its namesake, major rivers in Mississippi include the Big Black River, the Pearl River, the Yazoo River, the Pascagoula River, and the Tombigbee River.

Mississippi is ranked number 50 out of all states in overall healthcare access and affordability. Healthcare costs make up a significant part of the cost of living. The ability to afford healthcare as well as the ability to access care are key indicators of how much you will be paying for this important resource if you move to another state. Affordability is generally measured by the rates set for insurance coverage in a state, as well as the out-of-pocket expenses that need to be paid by you when receiving the care. If rates or out-of-pocket expenses are high, your cost of living will increase. Access to healthcare is how easy or difficult it may be to receive the care. Access is measured by identifying barriers that might prevent the delivery of care such as the inability to obtain insurance coverage, having to travel long distances to health care centers and lack of sufficient facilities and/or healthcare professionals. The timeliness of care, how fast you can get to see a healthcare provider, is another important measure.

8. Tennessee

|

| Photo: Getty Images |

Tennessee borders eight other states: Kentucky and Virginia to the north; North Carolina to the east; Georgia, Alabama, and Mississippi on the south; Arkansas and Missouri on the Mississippi River to the west. Tennessee is tied with Missouri as the state bordering the most other states. The state is trisected by the Tennessee River. The highest point in the state is Clingmans Dome at 6,643 feet (2,025 m).

If you want to buy a home in the beautiful state of Tennessee, you will find that home prices are generally below the median compared to most residential home markets in the country. Purchasing a home can be a lengthy and complex process. Besides the down payment, which is usually 15-20% of the selling price, there will be closing costs. If you own a home in your former location the sale of that home needs to be completed as well. Once you have purchased and moved into your new home, there will be utility and maintenance costs as well as property taxes and home insurance that will contribute to your cost of living. The advantages of living in Tennessee are many, and below-median prices for homes is one of them to consider.

Tennessee has no state income tax! This means that if you work in Tennessee, your paycheck will be free of taxes other than the federal income taxes and the soon-to-be abolished (2022) hall tax, which is a tax on dividends and interest. The absence of state income tax will make your take-home pay higher and provide more income for the basic cost of living purchases. Tennessee does, however, have a statewide 7% sales tax.

9. Minnesota

|

| Photo: Shutterstock |

Living in Minnesota is less expensive than it is on average across the U.S. as a whole. According to data from the Bureau of Economic Analysis, goods and services in the state cost 2.5% less than they do on average nationwide. Compared with all other states, Minnesota has the 20th highest overall cost of living.

In general, living in dense, urban metro areas is more expensive than living in more rural areas. Minnesota is home to five metropolitan areas. The most expensive in the state is the Minneapolis-St. Paul-Bloomington metro area, where the cost of goods and services is 2.6% higher than the national average and 5.1% higher than the statewide average.

Accounting for state and federal income taxes, as well as Social Security contributions and Medicare payroll, the average adult working in Minnesota pays $6,132 annually in taxes -- slightly below the national average of $6,542.

Excluding federal taxes and incorporating state and local taxes such as property and sales taxes -- the state and local tax burden in Minnesota is greater than the average across the U.S. as a whole. Per capita state tax collections in Minnesota come out to $4,758 per year, compared to the $3,151 average across all states.

10. Kentucky

|

| Photo: Kentucky Tourism |

Kentucky, officially the Commonwealth of Kentucky, is a state located in the east south-central region of the United States. Although styled as the "State of Kentucky" in the law creating it, (because in Kentucky's first constitution, the name state was used) Kentucky is one of four U.S. states constituted as a commonwealth (the others being Virginia, Pennsylvania, and Massachusetts).

If you want to buy a home in the beautiful state of Kentucky, you will find that home prices are generally some of the lowest compared to most residential home markets in the country. Purchasing a home can be a lengthy and complex process. Besides the down payment, which is usually 15-20% of the selling price, there will be closing costs. If you own a home in your former location the sale of that home needs to be completed as well. Once you have purchased and moved into your new home, there will be utility and maintenance costs as well as property taxes and home insurance that will contribute to your cost of living. The advantages of living in Kentucky are many, and below-median prices for homes are one of them to consider.

| The Cheapest Places To Live On A Budget In The United States If you are looking for an affordable, cheap place in the United States, these destinations in the article below will be perfect for your budget. |

| Top cheapest places to live in Vietnam In 2020, Hanoi had the most expensive cost of living index while Hau Giang province was the cheapest, according to the General Statistics Office (GSO). |

| Hanoi, one of the cheapest cities to live for expats in the world Hanoi is one of the best places to live on a budget when you want to settle down in a city outside your hometown, which ... |

Recommended

World

World

"Will continue offering our full support to Indian govt": US FBI Director after Pahalgam attack

World

World

"Great Leader": JD Vance Lauds PM Modi During His India Visit

World

World

Trump’s Tariff Pause: A Strategic Move from “The Art of the Deal”?

World

World

"Indian Navy's participation in AIKEYME exercise matter of great happiness": Admiral Dinesh Kumar Tripathi

World

World

ASEAN and US Tariff Dilemma: Hybrid Approach to Global Trade Tensions

World

World

Vietnam Affirms Its Active and Responsible Role at UNESCO

World

World

US Imposes 125% Tariff on China, Pauses Tariffs for 90 Days on Over 75 Countries

World

World