Vietnam Applies Special Preferential Taxes for Countries Under the RCEP Agreement

|

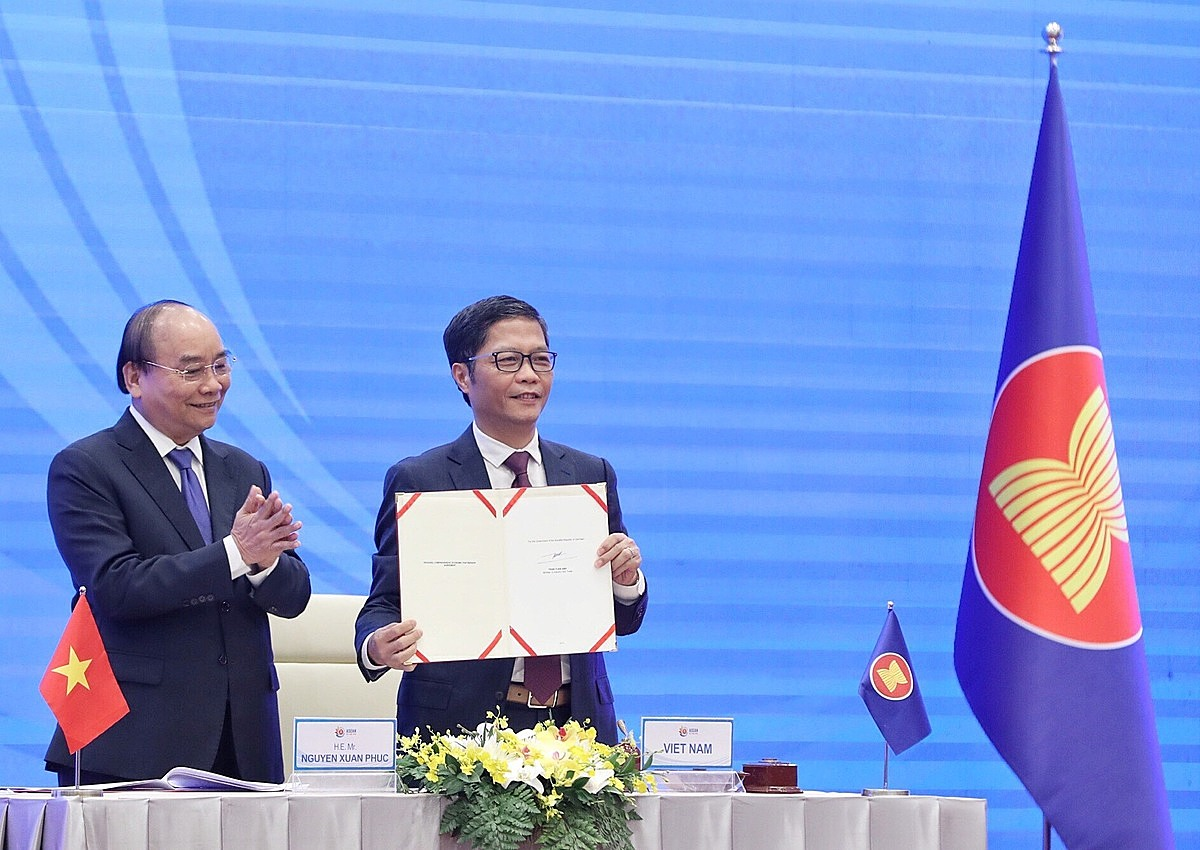

| The 4th RCEP Summit in November 2020. (Photo: AFP) |

According to the recently issued Decree No. 84/2023/ND-CP, amending and supplementing articles of Decree No. 129/2022/ND-CP dated December 30, 2022, a new special preferential import tariff of Vietnam from countries in the Regional Comprehensive Economic Partnership (RCEP) for the period 2022 - 2027 will be implemented.

To implement Vietnam's commitments to the RCEP Agreement, on December 30, 2022, the Government issued Decree No. 129/2022/ND-CP on Vietnam's Special Preferential Import Tariff to implement the RCEP Agreement for the period 2022-2027.

The Decree applies to ASEAN countries including Brunei, Cambodia, Indonesia, Laos, Malaysia, Singapore, and Thailand (except Myanmar and the Philippines), and partner countries including China, South Korea, Japan, Australia, and New Zealand). To date, the RCEP Agreement has taken effect with Myanmar and the Philippines.

| According to the Ministry of Finance of Vietnam, the RCEP Agreement was signed by ASEAN Economic Ministers and partner countries including China, South Korea, Japan, Australia, and New Zealand on November 15, 2020. On July 6, 2021, the Government issued Resolution No.18/NQ-CP approving the RCEP Agreement. |

Accordingly, Decree No. 84/2023/ND-CP was issued for amending and supplementing articles of Decree No. 129/2022/ND-CP dated December 30, 2022, on preferential import tariffs. To supplement regulations applicable to Myanmar and the Philippines, Decree No. 84/2023/ND-CP adds at the end of point A, Clause 3, Article 3 of Decree No. 129/2022/ND-CP as follows: "From March 4, 2022, to December 31, 2022, for with the Republic of the Union of Myanmar".

The Decree No. 84/2023/ND-CP added at the end of point b of Clause 3, Article 3 of Decree No. 129/2022/ND-CP as follows: "From January 1, 2023, to December 31, 2023, for the Republic of the Union of Myanmar; from January 2, 2023 to December 31, 2023, for the Republic of the Union of Myanmar; from January 2, 2023 /6/2023 to December 31, 2023 for the Republic of the Philippines".

Two other points were also added. Points N and O after point m of Clause 2, Article 4 of Decree No. 129/2022/ND-CP are as follows: "n) Republic of the Union of Myanmar; o) Republic of the Philippines".

| RCEP Agreement: New opportunities, new challenges After eight years of negotiations, the Regional Comprehensive Economic Partnership (RCEP) Agreement have been signed by 10 ASEAN member countries and five partners – Japan, ... |

| Vietnam - UK: Take Advantages of FTAs to Increase FDI Attraction The dual impulse from FTAs will create more incentives for UK goods and services in the Vietnamese market, as well as increase investment attraction. |

| Vietnam Benefits From Vietnam-EU Free Trade Agreement Karl Van den Bossche, ambassador of the Kingdom of Belgium to Vietnam, said that Vietnam is benefiting from the Vietnam-European Union (EU) Free Trade Agreement. |