Vietnam car market ranks fourth in Southeast Asia

| DPRK representatives visit VinFast automobile manufacturing facility | |

| Vietnam’s automobile market expects a boom in second half of 2018 | |

| Vietnamese automobile manufacturers growing up to the task |

|

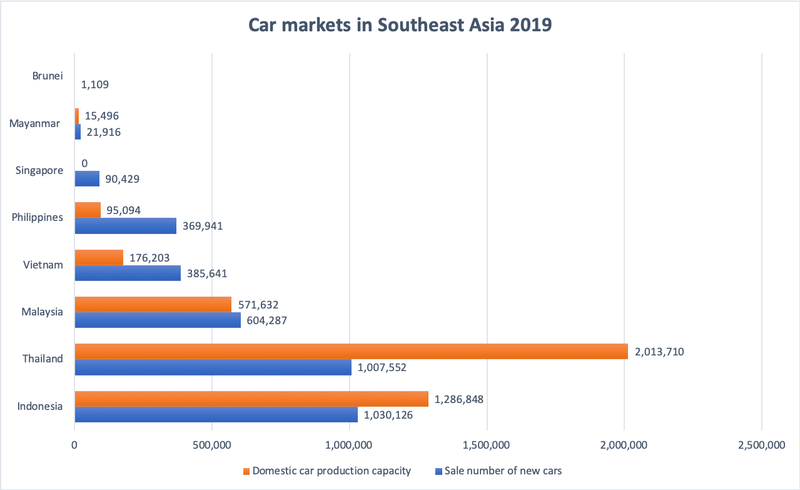

| Source: AAF, VAMA, TC Motor. Chart: Hai Yen. |

Vietnam’s car market ranks fourth in the Southeast Asia in terms of sale s volume and domestic production capacity, according to Asean Automotive Federation (AAF).

The AAF complied the data provided by automobile associations from countries in the region, except for Timor Leste, Laos and Cambodia, VnExpress reported.

In 2019, the region posted a combined sales volume of new vehicles at 3,458,482, down 3% year-on-year, in which Indonesia is the largest market with over one million units sold, followed by Thailand with around 22,500 less.

Malaysia came third with over 600,000 units, but this country’s car sales are still 1.5 times more than Vietnam’s.

Declines in the sale volume of Indonesia (-11%) and Thailand (-3%) were the main reasons leading to a slight decrease in the number of the region.

Among countries with positive growth rates in car sale numbers, Myanmar and Vietnam recorded the highest with 25% and 9.4%, respectively.

Meanwhile, Thailand was named at the top spot in domestic car production capacity. The localization rate in the country is currently over 80% and is an attractive option for car manufacturers from Japan, the US and Germany in search for destination for car manufacturing plant.

As the largest car market in Southeast Asia, Indonesia has been an attractive alternative for Thailand, however, the former remained far behind the latter in terms of production capacity.

The last two years witnessed a sharp increase of car imports from Thailand and Indonesia into Vietnam, mainly because the ASEAN Trade in Goods Agreement (ATIGA), which took effect in the beginning of 2018, eliminates automobile import tariffs for models with localization rate of over 40%.

After 20 years of setting target for localization rate of 35 – 45% for the automobile industry, Vietnam is still way off the target, with the rate standing at 7 – 10% as of present for passenger cars of under nine seats.

Vietnam’s major automobile manufacturers Thaco Truong Hai, TC Motor and Toyota Vietnam mainly import car parts for domestic assembling. The incursion of VinFast, a subsidiary of Vingroup, in 2017 is expected to be a major boost for the domestic automobile industry in the long term./.