Vietnam: promising market for education investors

High profitability, stable growth and low risks are driving investors into the education sector.

Vietnam is the promising market for education investors

Nguyen Anh Toan, advisor to the International Business Management (IBM), noted that one of the weak points of Vietnamese students is limited English and soft skills.

In addition, textbooks for junior colleges and universities are not designed well enough. The demand for high-quality education is high, especially as Vietnamese are now more willing to spend more money on education.

Vietnamese spend $3 billion every year to pay for their children’s study overseas, but the local education market has not been able to take advantage of this spending.

Tran Thi Phi Yen, managing director of IvyPrep, a preparatory school, thinks political stability and economic growth are the reasons behind the increased investment in education. However, the capital poured into the education sector remains modest.

The demand for professional knowledge and language skills to satisfy the requirements of the labor market has been increasing, she said.

A report found that 42 percent of Vietnamese are under 24 years of age, the golden age for nearly all education programs.

Kieu Xuan Hung, president of the HCMC University of Economics and Finance, said in Forbes that investment in tertiary education will continue as non-state schools now train only 15 percent of total students, while the government wants to raise the proportion to 30 percent.

In Japan and South Korea, 70 percent of students attend private schools.

Under a plan to develop universities and junior colleges by 2020, Vietnam would have 2.2 million students at schools. It is expected that by that time Vietnam will have 224 universities and 236 junior colleges.

Many M&A deals in the education sector have been made recently. Cognita, an education fund, bought International School of HCMC (ISHCMC) and Saigon Pearl primary school. The North Anglia fund bought British International School, while TPG, an investment fund from the US, bought the Vietnam-Australia School (VAS).

The EQT fund has invested in ILA, an English center; IFC has poured money in the Vietnam-USA Society English Centers (VUS); Mekong Capital in the YOLA English Center; and IAE in Western University.

Expected stable profits are drawing investors, they know it will take a long time to recover the investment capital.

Forbes Vietnam reported that 77 percent of 43 surveyed schools have receipts higher than spending. Foreign language training brings profitability of 20 percent at minimum./.

VNF/Vietnamnet

Recommended

National

National

Vietnam News Today (May 14): US Businesses Affirm Long-Term Commitment to Vietnam

National

National

Vietnam News Today (May 13): Vietnam Maintains High Human Development Index Despite Global Slowdown

National

National

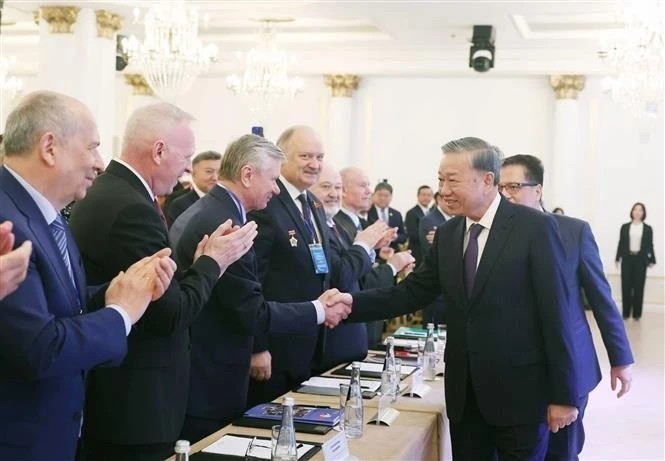

Vietnam News Today (May 12): Party General Secretary Meets With Russian Experts, Intellectuals

National

National

Vietnam News Today (May 11): Vietnam, Austria to Boost Cooperation in High-Tech Development, Innovation

National

National

Vietnam News Today (May 10): Vietnamese Peacekeepers Honored with UN Medal in South Sudan

National

National

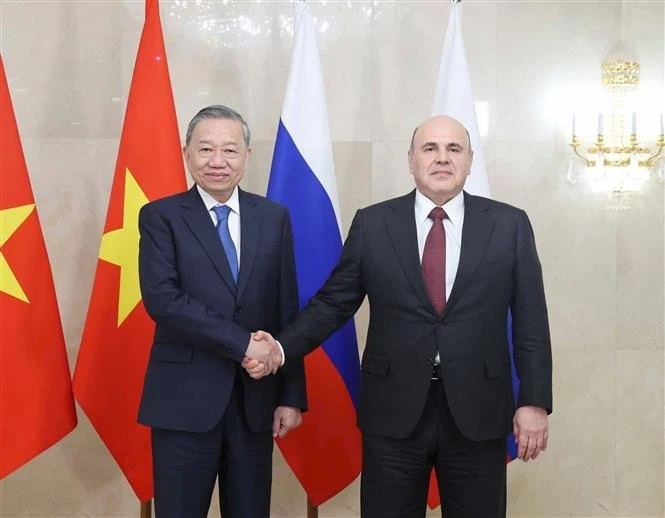

Vietnam News Today (May 9): Vietnam Ready to Work With Russia to Elevate Relations

National

National

Vietnam News Today (May 8): Vietnam Remains Committed to UNCLOS

National

National