Vietnamese carmaker VinFast: New rival of THACO, Toyota and TC MOTOR?

The four largest car manufacturers in Vietnam's automobile market

THACO, Toyota and TC MOTOR – the three big bosses

In the first half of 2019, Vietnam’s automobile market experienced remarkable changes. According to the Vietnam Automobile Manufacturer Association, by the end of July 2019, members of the Association have sold 171,640 units in different categories, leading to an year-on-year increase of 20%. (Cars sold in 2018 was around 143,324 units).

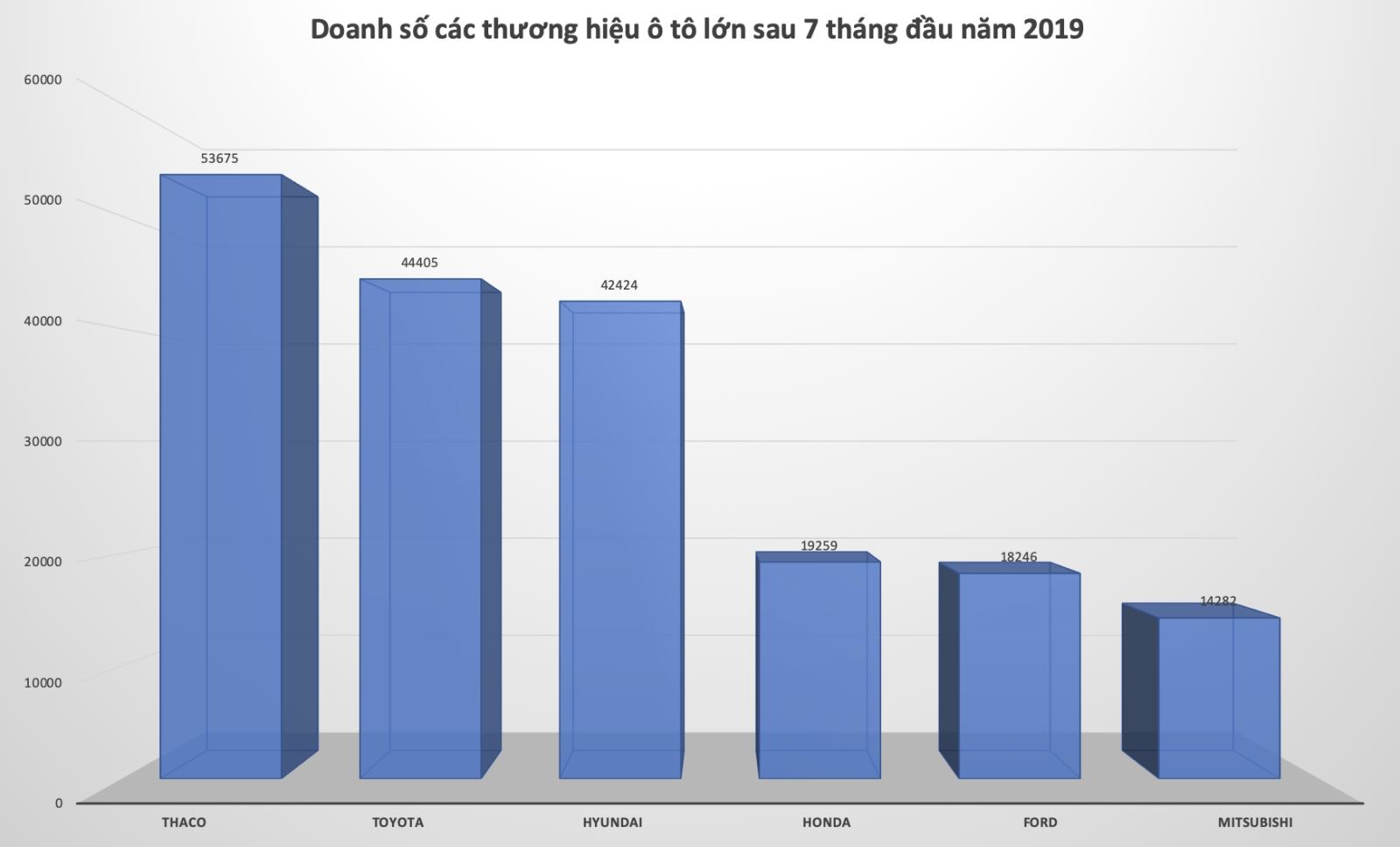

THACO – Truong Hai Auto Corporation’s sale still tops the list with 53,657 units sold and its market share was 31.3%, placing it on the top of VAMA. However, the sale of THACO is decreasing, comparing to the same period in 2018 when it sold 57,906 units and its market share was 40.4% of VAMA.

Giant car manufacturers' sales in the first seven month of 2019.

Mazda is still the independent brand with the best sale of THACO as 20,160 units was sold. Its growth rate higher than the same period in 2018 by 7%. Meanwhile, KIA – a Korean brand is ranked after Mazda as 16,496 units was sold after the first 7 months of 2019.

THACO is followed by Toyota Vietnam (TMV) as this joint venture sold 44,405 units, sharply raise 28% comparing to the same period in 2018. Many products have helped Toyota achieve its success in last months in 2019. Especially, Vios, a sedan car production, sold 15,000 units. Vios has also been the best – selling car in the market since early 2019. Other cars such as Fortuner, Innova or Camry still reserve their position in the market.

The first half of 2019 is the period that TMV constantly adjusted its sale and production policies. Significantly, it has moved from complete built – up (CBU) to complete – knocked down (CKD) for the best – selling SUV, Fortuner. However, after changing to CKD, the slightly higher price of Fortuner makes its competitiveness decrease.

TC MOTOR’s sale is slightly lower than TMV as 42,424 units was sold, less than TMV by 2000 units. The two main units of TC MOTOR are still Hyundai Grand i10 and Accent, accounting for 50% sold units of Hyundai.

These aforementioned are impressive figures of TC MOTOR in the first 7 months in 2019.

The total sale of Hyundai in 2018 in Vietnam market was 63000 units. After the first 7 months in 2019, TC MOTOR sold 70% the amount of 2018. Hyundai production growth is at the same level with the growth of VAMA.

The fourth giant car manufacturer Vinfast.

The complete - knocked down cars face challenge when ASEAN complete built - up car get free tariff

According to report of the Ministry of Industry and Trade, the average growth rate of complete knocked – down car manufacturing in 2015 – 2018 was 10%. In 2015, domestic car production were 200,000 units/year, 51% higher than 2014. In 2016, the amount continued increasing to 283,300 units/year, 38% higher than 2015. In 2017, the output were 258,700 units/year, 9% lower than 2016. In 2018, the number was 250,000 units, 3% lower than in 2017.

As estimated by management agencies, it will take the Vietnamese automobile market at least 10 years to put into use around 2 million cars. Moreover, according to the expert’s calculation, the car productions must be estimated 2 million cars/year to attract the foreign investors.

Vietnamese National Assembly and Government ratifies and implements many favorable policies on investment, import and export duties, profit tax, land lease charges… to support the automotive industry to develop which is a positive sign for car manufacturers such as THACO, TC MOTOR and VinFast to believe in their strong investment in the next time./.

( Translated by Van Nguyen )