Vietnamese enterprises amidst industry 4.0: Comprehensive strategy needed to retain talents

It’s never been more important for enterprises to adopt a comprehensive people strategy.

Vietnam was ranked 86th out of 118 countries in the latest Global Talent Competitiveness Index (GTCI), released in early 2017 by INSEAD, one of the world’s leading business schools, the Human Capital Leadership Institute of Singapore (HCLI), and the Switzerland-based workforce solutions provider Adecco Group, which measures how countries grow, attract, and retain talent and provides a resource for decision-makers to develop strategies for boosting their talent competitiveness.

According to the report, Vietnam scored relatively better in global knowledge skills but is struggling in terms of attracting talent and developing a pool of vocational and technical skills.

The country still possesses a workforce of prime age at low cost, with a young population and a rapidly-rising middle class willing to spend.

In the context of the trend towards automation, that there are still millions of low-skilled workers in the country’s key export sectors is a concern for enterprises as well as the government.

However, “most enterprises in Vietnam still have a huge need for talent, especially at senior levels,” said Tieu Yen Trinh, CEO of Talentnet. A comprehensive people strategy is therefore more important than ever, because young talent are now expecting fast career progression and there’s a big gap between supply and demand at the top management level, the latest Mercer Total Remuneration Survey found.

Automation threat

The Global Industry 4.0 Survey, the largest research of its kind and conducted last year by PwC on over 2,000 companies in nine major industrial sectors from 26 leading countries, revealed that companies expect the fourth industrial revolution (Industry 4.0) to reduce operational costs by 3.6 per cent per year while increasing efficiency by 4.1 per cent. Major corporations in Vietnam have been looking at applying advanced technologies and replacing their human workforce with machinery and robots in certain industries, to raise productivity, reduce production time, and optimize labor costs.

|

Photo for illustration (source: VET)

Similarly, Mercer’s “Insights from Current Asian Labor Market Trends 2017” report found that global industries will start to be disrupted by 2020, in which around 4.9 million jobs will be added in business and financial operations and 4.2 million in management. More than 4.8 million jobs, however, will be lost in office and administration, along with 1.6 million in manufacturing and production.

At the Vietnam HR Awards 2017 held in August, Hoang Nam Tien, Chairman of FPT Software, agreed that robotics will replace the human workforce in the near future, so Vietnamese companies should be aware of the increasing effects of Industry 4.0 on their employment.

When technology takes over to effectively support organizational operations, it consequently begins replacing people positions. Thus, the importance of human resources (HR) management, including people strategy and talent retention policies, should be the top priority in any business strategy.

Not only does it help increase efficiency and simplify and automate processes, technology also helps in gathering the necessary data for assessments and analyses, from which better decisions can be drawn for better direction in business development. HR management is therefore considered vital for businesses and technology is a contributing factor in talent management and leadership development. Furthermore, taking into consideration that HR management is the backbone of any enterprise, technology is having a major impact on many talent strategies.

At the same time, the technological era is creating both opportunities and challenges for businesses in the process of enhancing and managing resources. “Technology improvements require an increasing demand for a creative workforce with the strategic thinking and analytical acumen to meet needs in this challenging day and age,” said Trinh. “Expectations of employers regarding the required skills that potential talent and leadership need are entirely different from those of previous years, together with the pressure of having a workforce management strategy to keep up with the global workforce.”

Limited changes

Factors affecting employee retention and long-term commitment vary from company to company, but primarily include working environment and culture, relations with colleagues and especially leadership teams, career development opportunities, and, of course, compensation.

Focusing on these not only helps to promote a company’s image but also enhances employees’ commitment to the organization. Compensation, in particular, though not the one and only driver of an employee retention strategy, is considered the most common top-of-mind concern for employees when considering whether to remain at a company. Many local enterprises, however, aren’t keen on strategically investing in their total rewards policy.

|

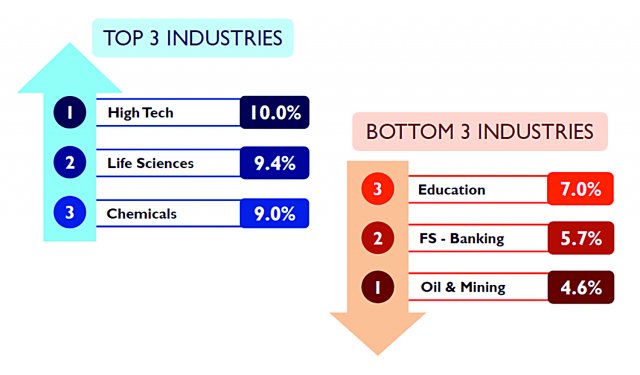

2017 salary increase trends, by industry - Top 3 & Bottom 3 (Source: Mercer - Talentnet Total Remuneration Survey 2017)

|

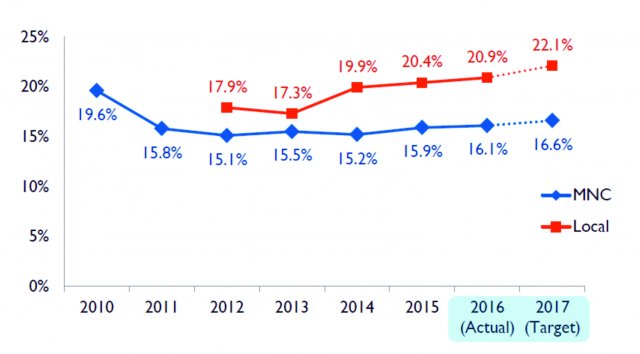

Variable bonus as % of base salary (Source: Mercer - Talentnet Total Remuneration Survey 2017)

According to the 2017 Vietnam Salary report conducted by Mercer and Talentnet on 592 well-established multinational companies (MNCs) and leading domestic companies from 16 industries and with remuneration data on 289,236 employees, the number of participating companies increased by 6 per cent while the among of employee data increased by 19 per cent in all industries. “The significant increase in the number of data points from leading companies joining this survey indicates the growing need of organizations for official and trustworthy market data to benchmark their current compensation and benefits with the market, maximize the use of their HR budget, and build an effective rewards system in order to attract and retain talent,” said Hoa Nguyen, Senior Director of Mercer Salary Surveys and HR Consulting Services at Talentnet.

A deeper look into the survey reveals increasing awareness among companies about the importance of people management and investment. Amid globalization, one positive sign is that there were more enterprises, both large and medium-sized, joining the survey in 2017, allowing HR experts and business leaders to have access to more insightful data on building their rewards strategies.

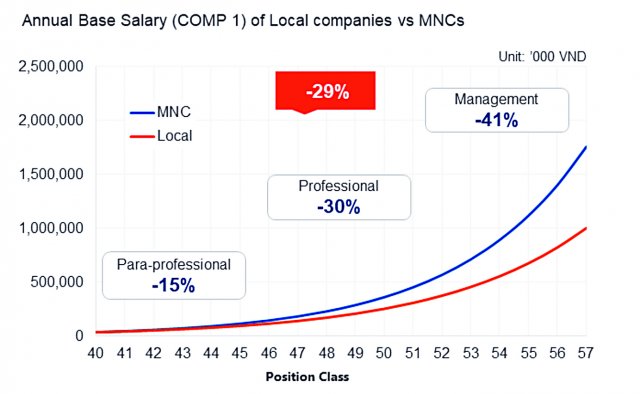

MNCs overall pay higher salaries than local companies, by an average of 29 per cent; down slightly from last year’s 31 per cent. The pay difference in annual base salaries is 30 per cent at the professional level and up to 41 per cent at the management level, as MNCs have been focusing on offering higher salaries for management positions to compensate such staff for their greater contributions and scope of work.

Local companies, meanwhile, are now willing to be more flexible in pay so they can compete with MNCs for key talent, leading to their variable bonuses accounting for a higher percentage of base salary than at MNCs.

Conversely, the average voluntary staff turnover rate at local companies is higher than at MNCs (10.5 per cent versus 7.4 per cent). For MNCs, the Top 3 industries with the highest turnover rates are retail (32.2 per cent), real estate (18.8 per cent), and consumer goods (17.3 per cent), whereas chemicals and the oil and mining industry have low turnover rates, at 9.9 and 5.3 per cent, respectively.

|

Pay difference between local companies & mncs (Source: Mercer - Talentnet Total Remuneration Survey 2017)

The average salary increase in 2017 at MNCs and local companies was 8.5 per cent and 8.9 per cent, respectively, compared to 8.6 per cent and 8.7 per cent last year.

However, Vietnam remains among the Top 3 regional countries with the highest salary increases, following only Myanmar and India. High-tech and life sciences were the Top 2 in terms of highest salary increases, at around 10 per cent, thanks to their positive business performance. Though paying in the top range in Vietnam, the oil and mining industry recorded the lowest salary increase, of 4.6 per cent, even lower than last year’s 7.5 per cent, due to falling oil prices.

Salary and benefits have always been considered the most important factors in attracting and retaining talent in Vietnam over the years, according to Ms. Nguyen Thi Hong Thuy, HR Director at the Vietnam Fan JSC. In the context of global integration and Industry 4.0, Vietnamese talent will have better job options, so “local companies should pay much more attention to their total rewards strategy and optimize it wisely, to not only retain high performers but also enhance competitiveness in the regional market,” she said.

She added that, at the senior management level, salaries in Vietnam are quite high regionally due to the fact that the country lacks talent at this level, but if local companies don’t proactively invest in their strategy they will find it difficult to secure good talent, especially when the labor market become fiercely competitive nationally and regionally under global integration./.

( VNF/VET )