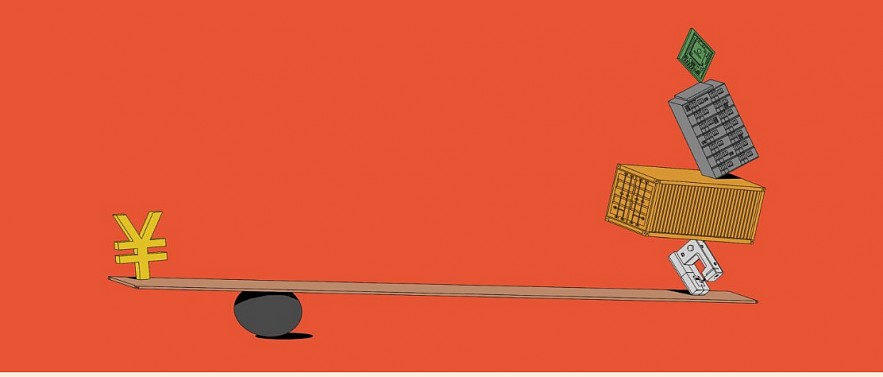

IMF on powers - China’ growth: falling and impacting others

|

IMF has forecasted China’s growth rate to be at 4.5% in 2025 even when there are good number of measures taken such as increased net exports and more funds released to support country’s growth, according to the financial post.

China’s woes don’t end here as its constant trade war with the United States has resulted in new tariffs being imposed by both the countries on each other and these trade tariffs have their own economic consequences for countries around the world. IMF’s Deputy Director Gita Gopinath has highlighted US-China escalations and its global impact for others. “We are seeing geopolitically driven trade around the world, which is why when you look at overall trade to GDP that’s holding up fine, but who’s trading with whom is certainly changing,” she said during a media brief.

The 2024 has seen an increase in number of trade tariffs between China, EU and the US. Both EU and the US have highlighted unfair trade practices and over manufacturing by China as the reasons for heightened tariffs as the local players of the industry feel cheated. China too in its response implemented some new and higher temporary tariffs on some US and EU imports as its tug-of-war with America continues.

IMF’s Gopinath pointing at the increased tariffs by these countries suggested it would be costly for everybody. On the US-China trade relations and its global impact she said, “Output is going to be much lower than what we are projecting for all countries in the world, there’s going to be pressure on inflation, so that’s not the direction in which we should be going.”

Gopinath’s comments came closely after IMF Managing Director Kristalina Georgieva expressed concern over how global trade is no longer relies on good trade practices and is now majorly driven by retaliatory trade measures a country takes against its rivals.

Tim Adams, CEO of the Institute of International Finance, also warned against tariff proposals coming from the U.S. presidential candidate Donald Trump as it pave way for disinflation and finally leading to sky rocketing interest rates.

The IMF’s Gopinath indicated that the world economic stability depends on good US-China relations and nothing would be better if a sense of sanity prevails among the top-notch countries. “It is in everyone’s self interest that these relationships are maintained,” she said.

The IMF while presenting its 2024 World Economic Outlook report that continual use of protectionist policies by countries will trigger a dip in economic growth globally. Although, as per IMF report the U.S. economy has been the major driving force for global growth through the balance of this year and in 2025, but it is the derailed Chinese economy that is battling inflation and the counter offensives by both these countries have led to high interest rates globally.

The IMF report further suggests that the emerging markets such as India and Brazil have stood out on the upside of the IMF forecasts, but the world’s number two economy China has fared below expectations in 2024 with a below-trend growth rate of 4.5% and expected to be derailed in 2025 as well.

IMF report also warned against possible risks of armed conflicts, potential new trade wars and the hangover from the tight monetary policy employed by the US Federal Reserve and other central banks to rein in inflation.

“Today, the IMF reported that the United States is leading the advanced economies on growth for the second year in a row,” Lael Brainard, the Director of the White House’s National Economic Council, said in a statement.

The IMF report conclusively states, “A broad-based retreat from a rules-based global trading system is prompting many countries to take unilateral actions. Not only would an intensification of protectionist policies exacerbate global trade tensions and disrupt global supply chains, but it could also weigh down medium-term growth prospects.”

The IMF wants the world to sit up and take notice of trade war between China and the US and how it is impacting the rest of the world.