India best among top economies in taming inflation and maintaining growth on high road

The world economy had not recovered from the daunting impact of coronavirus, the geo-political headwinds such as Russia-Ukraine war impacted the recovery process in 2022 and before this war settled, Israel-Gaza conflict deepened the geo-politics and geo-political fragmentation. The geo-political disturbances and geo-political fragmentations caused price escalations in the international commodity prices.

The prices of international commodities products had become skyrocketing with the exorbitant costs of production in 2022. This also added to the scarcity in availability of products and higher costs of imports for the countries which were heavily dependent on international commodity raw materials. Such developments led to the inflationary pressure around the globe.

The inflation trajectory in US had gone up to 9.1% in June 2022 , in UK 11.1% in October 2022, in France 6.2% in October 2022, in Italy 11.8% in October 2022, in Canada 8.1% in June 2022, in and in Brazil 12.1% in April 2022 and in India (CPI) at 7.8% in April 2022. However, inflation in China remained below the tolerance level of 3% during the period of 1st March 2022 to 14th May 2024.

Such a high inflation trajectory was worrisome for every government and central bank across the countries where there inflation was skyrocketing. The calibrated measures undertaken by the Government of India and Reserve Bank of India have had a significant effect on the escalation in inflation trajectory. The effective measures helped to maintain high growth trajectory while simultaneously containing price escalations.

India taming inflation and maintaining growth

CPI inflation in India peaked in April 2022 at 7.8%, majorly stoked by upward pressure created by crude oil prices, and other international commodity prices. The CPI inflation eased thereon, but it remained above the RBI's upper band for many months. CPI has been, however, shown a major improvement in the recent months, decelerated to 5% in February 2024, 4.85% in March 2024 and 4.83% in April 2024.

The Wholesale Price Index (WPI) inflation reached its highest point at 16.6% in May 2022, gradually decreasing to 10.7% in September 2022, 1.3% in March 2023, and further decelerating to -0.5% in October 2023. Subsequently, it showed minor fluctuations, registering at 0.2% in February 2024, 0.5% in March 2024, and 1.2% in April 2024.

Inflation trends in India (WPI and CPI)

Source: Compiled from Reserve Bank of India

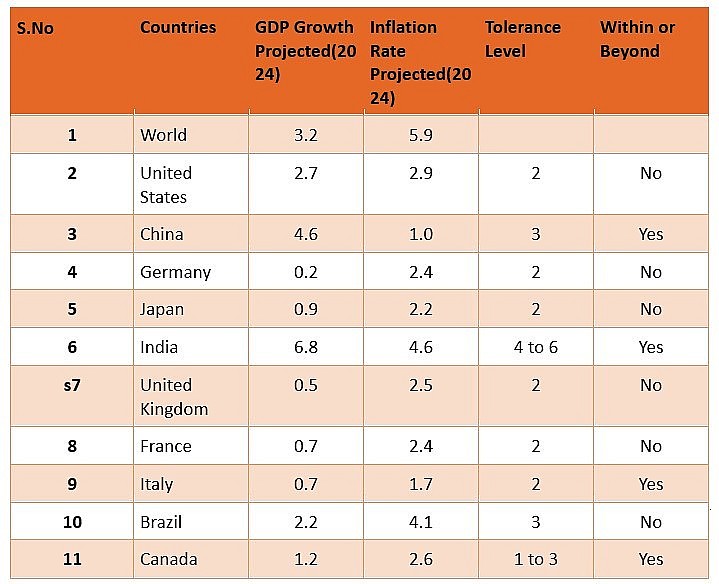

India has greatly managed the inflation trajectory to soften significantly simultaneously maintaining growth consistently at high road. India’s inflation at 4.8% is within the target band of RBI at 4-6% and GDP growing fastest among the top ten economies. India is projected to grow fastest at 6.8% in 2024 followed by China at 4.6% and the US at 2.7%. India's projected inflation rate for 2024 stands at 4.6% by IMF.

Among the top leading economies, China's projected inflation rate is 1%, also within its tolerance band of 3%, Canada’s inflation at 2.6% is projected in the tolerance band of 1-3%, while the US inflation at 2.9% is projected out of its tolerance band of 2%. This robust economic performance underscores India's resilience and potential, showcasing its ability to sustain growth and the fastest rate while maintaining stability in inflation.

GDP growth and inflation rates among the top 10 economies

|

| Source: Compiled from WEO April 2024, IMF. Yes indicates that the inflation is within the tolerance level and No indicates that inflation is outside the tolerance level. |

In the recent months, CPI inflation in India has come down significantly due to continuous softening in housing inflation from 3.2% in January 2024 to 2.6 in April 2024, fuel and light from -0.6% in January 2024 to -4.2 % in April 2024, clothing and footwear categories from 3.3% in January 2024 to 2.8% in April 2024 and pan, tobacco and intoxicants from 3.2% in January 2024 to 2.9% April 2024. However, inflation is still sticky in food and beverages at 7.8 in April 2024.

Proactive measures by the Government to strengthen the supply chains are leading to softening of inflation in many items. Going forward, inflation trajectory in India is expected to become normal by September/October 2024 as many of the kharif crops in the country will be entering the food grain markets and supplementing the existing supplies. The consciously softening inflation trajectory and solid fiscal consolidation path will further strengthen India’s attractiveness towards global investors.