India Tops Singapore, Indonesia, Vietnam in Fintech Study

|

Robocash is a fintech company with offices in Asia and Europe that specialise in providing technological finance solutions for the underserved by the traditional banking system in emerging markets. The South Asian nation came up in first place in several categories including the most amount of funds raised and total revenue.

From 2000 to 2022, the years included in the study, in the four sectors in the survey, a total of USD 25.6 billion was raised which is 48 per cent of all funding received in the region. India also emerged as the leading county in Robocash Southeast Asia Fintech Index.

The Index aggregates scores using the following measurements - share of total funding, share of total revenue, and share of total active companies. Singapore was second and Indonesia came in third. The purpose of the Robocash report is to gain an understanding of financial technologies development in mature and emerging countries of the South and Southeast Asian region, namely India, Indonesia, Singapore, the Philippines, Vietnam, Malaysia, Bangladesh, Pakistan and Sri Lanka.

The following four fintech sectors were chosen for the survey - Payments and Transfers, Alternative Lending, E-wallets and Digital Banking. For the purpose of the study, only those companies that are based in the territory of a particular country were selected, while foreign entities were excluded.

As of the end of 2022, there are 1,254 active fintech companies in the nine countries and four sectors studied. This represents a rise of almost 45 times from the 28 companies that existed before the year 2000. The growth of such firms accelerated between 2015 to 2020, when over 62 percent of the companies in the study were founded.

India has the greatest number of such companies operating, at 541, representing 43.1 per cent of the total, followed by Indonesia 165 (13.2 per cent), Singapore with 162 (12.9 per cent), Philippines 125 (10 per cent), Malaysia 84 (6.7 per cent), and Vietnam 78 (6.2 per cent). Pakistan, Sri Lanka and Bangladesh have the fewest fintech companies among the countries surveyed with 51, 27 and 21 companies respectively.

Therefore, it is unsurprising that Alternative Lending which includes such services as online microcredit, peer-to-peer lending, and point-of-sale financing (for example, installment loans for shoppers at checkout), experienced the highest growth among the four sectors between the years 2000 to 2022.

Robocash noted that the four sectors studied are by no means the major fintech sectors in the region. Although they represent 54.3 per cent of all fintech businesses in the Philippines, the other countries in the survey have more diversified fintech sectors with these four sectors representing just 19.4 per cent of all fintech companies in Indonesia and only 10.5 per cent in India which the Robocash report says has 5,176 fintech firms.

India received a total of USD 25.6 billion (48 per cent of the total funds), followed by Singapore with USD 14.7 billion (27.6 per cent), Indonesia USD 7.5 billion (14.1 per cent), Philippines USD 2.4 billion (3.4 per cent), and Vietnam USD 1.8 billion (3.4 per cent).

Hemant Gala, Head of Head of Financial Services & Banking at Indian digital payment giant, PhonePe, was quoted in 2021 as saying, "Digital payments have become a way of life in India and we have seen 10-15 million new customers coming on to the digital bandwagon over the last 12 months. Two factors that led to this change were demonetisation and Covid-19 pandemic."

Digital lending, InsurTech and WealthTech are amongst the subsectors set to witness the strongest growth, the report says, driven by greater customisation of segment-specific solutions, rising awareness and ease of policy purchase and claims processes, and booming demand for investment solutions.

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

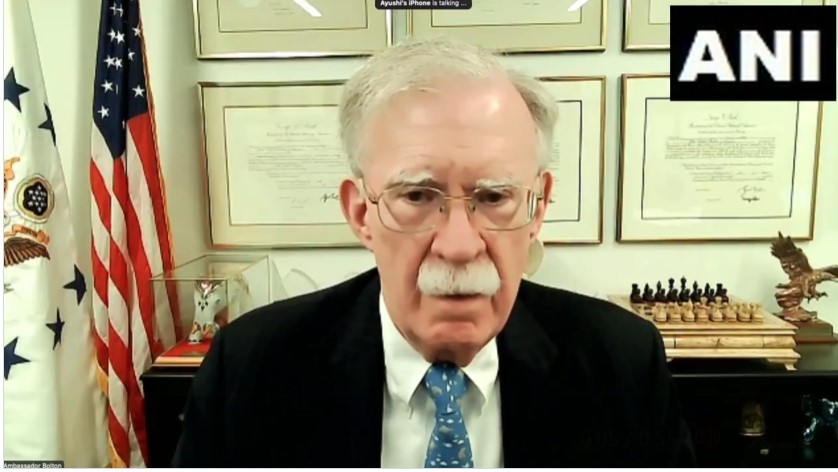

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

Popular article

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World