Investors in high-end residential sector can earn profits at the rate of 15 to 20 per cent this year

Investors can expect a minimum profit rate of 7 to 8 per cent and a maximum profit rate of 15 to 20 per cent, depending on each segment of the city property market, he added.

Experts said , owing to the impending rebound in the sector.

Nguyen Khai Hoan, chairman of the Khai Hoan Land Company, said the HCM City property market would enter a new sales cycle this year after recovering from a crisis over past few years.

Hoan further pointed out that the minimum profit rate of 7 to 8 per cent a year would be applicable to medium and high-end apartments, due to a slight increase in prices by little less than 10 per cent for these products during the last quarter of 2014.

|

Experts from Savill property company expect real estate market in Ha Noi to recover strongly this year. — Photo soha

Meanwhile, land in the suburban areas of HCM City, such as in District 9, District 12, Nha Be and the Binh Chanh districts, was expected to report an annual profit rate of 15 to 20 per cent at the most during the next few years.

There was a big gap in the profit rate between the two segments because investors in HCM City often give priority to land as an asset, Hoan stated. Apartments offer high liquidity for a short period, but in the long term, land is a safer investment channel so the property segment's benefits increase as per the sales cycle in the sector.

The local property market this year would be brighter than last year, Hoan said, but would not be able to match the strength seen in the market eight years ago. Therefore, the expected profit rate of 15 to 20 per cent was still very attractive.

"High-end residential properties and resorts will prosper," Hoang Phuong, Associate Director and Head of Residential Sales at Savills Ha Noi, reiterated.

"In 2014, the mid and high-end residential sectors witnessed some recovery, which has been confirmed since the recent approval of the new property title."

"When foreigners are allowed to own property in Viet Nam, Savills will be able to offer the best conditions for consulting to these potential clients and connect them with investors. In 2015, the market continuously targeted property products with great quality and location, guaranteed construction progress, and professional management. Also, resorts seem promising for investment in the recovering market," Phuong said.

Huynh Phuoc Nghia, senior consulting expert at the Global Integration Business Consultants Company (GIBC), predicted that investment in the property market would see strong recovery this year because of positive factors affecting the market, including macro-economic indices, support policies, external sources and the psychology of the market.

For the macro economy, indices of inflation and interest rates for banking loans had reduced, creating a stable foundation for the local economy, while the amended law on Housing and Law on Property Trading would become effective from July and would create favourable conditions for development in the local property market in the future, Nghia said.

Foreign direct investment for the property market had surged, said Nghia, adding that the psychology of investors had improved further, reflecting a strong surge in property transactions in numerous market segments.

Additionally, instability in the financial markets due to the effects of the global market and lower interest rates had transformed the property market into the best investment channel at present, he said.

The GIBC expert expected cheaper apartments to continue attracting more customers due to lower interest rates, payments stretched over a longer period and more investments getting loans from the VND30 trillion (US$1.43 billion) credit package.

High-end apartments would also lure more investors, but renting an apartment would be better this year, he said, while land in industrial zones would see a greater likelihood for development, online newspaper vnexpress.net reported.

Since the first quarter of this year, property speculators returned to the local market because of growing speculation, said Marc Townsend, CBRE Viet Nam's managing director. During the seven years of the local property market crisis, the market lacked positive news and investors had to wait for a longer period of time to come back.

High-end apartments would be in vogue this year, but other segments in the property market would also improve, he said. If banks continue to support buyers with attractive and reasonable interest rates, the market for apartments on sale would see more positive development during the next two to three years./.

Complied by VNF

Recommended

National

National

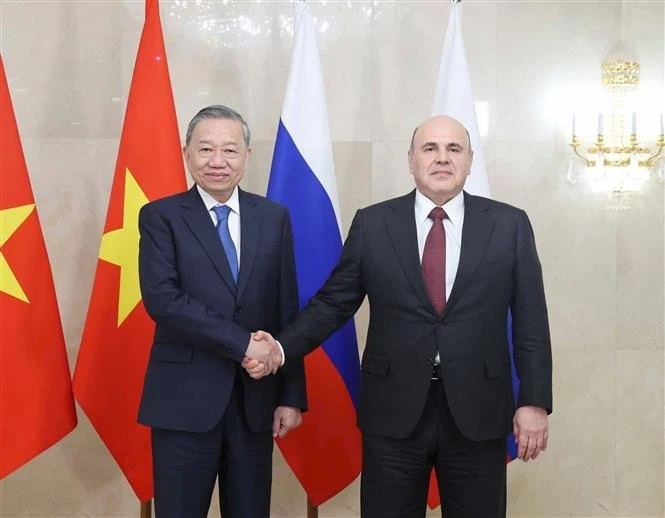

Vietnam News Today (May 9): Vietnam Ready to Work With Russia to Elevate Relations

National

National

Vietnam News Today (May 8): Vietnam Remains Committed to UNCLOS

National

National

Vietnam News Today (May 7): Vietnam Hosts Over 7.67 Million International Visitors in First 4 Months

National

National

Vietnam News Today (May 6): Party Leader To Lam Meets Vietnamese Expatriates in Kazakhstan

Popular article

National

National

Boarding Kindergarten Children Supported with VND360.000/Month

National

National

Vietnam News Today (May 5): Party Chief To Lam’s Trip to Russia Carries Special Strategic Significance

National

National

Vietnam News Today (May 4): Vietnam, Sri Lanka Deepen Traditional Friendship, Comprehensive Cooperation

National

National