Open in concert

The retail pharmaceutical sector is increasingly moving towards chains over stand-alone pharmacies.

Photo: Viet Tuan

Late one Sunday afternoon Ms. Ly Nguyen, a housewife in Ho Chi Minh City’s Tan Binh district, went to the local Phuc An Khang pharmacy to buy some cough drops for her son. When she got there she was surprised to see its doors closed for renovations and that the signage had changed to An Khang pharmacy, with the familiar logo of Mobile World. “I’m used to buying medicine and medical supplies for my family there because it’s near my house and its prices are reasonable,” she said. Despite the change in ownership, “I’ll still shop there if they have the same products and prices,” she added.

Competitive space

A raft of new pharmacy chains has appeared in Vietnam’s major cities over recent years, especially in Ho Chi Minh City, sparking competition among pharmaceutical retailers. Two giant mobile retailers - Mobile World (MWG) and FPT Retail - have officially set foot in the pharma sector recently by acquiring the Phuc An Khang and Long Chau pharmacy chains, respectively, with the latter apparently being a private investment by FPT Retail’s CEO Ms. Nguyen Bach Diep.

Indonesia’s leading retail pharmacy chain and healthcare provider Century Pharma, a subsidiary of the Pharos Indonesia Group, has also penetrated into Vietnam by quietly expanding its Century retail brand in Ho Chi Minh City. After the first outlet opened at Bitexco Tower in District 1 in early 2017, the brand now has a number of outlets in prime buildings and strategic locations. Century Pharma Vietnam refused to comment when approached by VET but said in an internal announcement that it will create a retail revolution in beauty and healthcare products in the southern city.

A long-standing local chain, Phano Pharmacy, now has nearly 60 outlets in Vietnam and was the first brand to reach GPP standards, in 2007. Its pharmacies are primarily in hospitals and supermarkets. Along with its development plan for Ho Chi Minh City, Phano has also appeared in major provinces in the Mekong Delta and central region, and Chairman Truong Viet Vu said it will open more drug stores, initially focusing on the southern market.

Pharmacity, meanwhile, has 39 drug stores in its chain, covering different districts in Ho Chi Minh City. Mr. Chris Blank, Founder and CEO of Pharmacity, said the Vietnamese market has space for the development of pharmacies and it will therefore expand its chain to 200 outlets by 2020 in Ho Chi Minh City and then reach out into other provinces in Vietnam, to increase its brand identity. Yet another pharmacy chain is My Chau Pharmacy, which received investment from Saigon Asset Management (SAM) in 2016 and targets opening more than 80 pharmacies nationwide over the next three years.

The boom in pharmaceutical retail has created a high level of competition between chains. Not only do they plan to expand but also pay greater attention to improving quality and adopting special strategies. The Vistar medical services chain is a vivid example. A late arriver on the scene, it has combined healthcare and beauty services. It operates like a convenience store chain, opening 24/7, and cooperates with foreign partners such as Boots, Watsons, Sasa, and Mannings to bring international brands to Vietnam.

With a different strategy to Vistar, Eco Pharmacy has opened in handy locations, near major hospitals. Ms. Pham Thu Phuong, who works at the Vietnam Payment Solution JSC (VNPAY), said she always buys medicine at Eco Pharmacy. “After having a health check at hospital, I usually buy prescription medicine at the Eco Pharmacy store as it saves time because it’s nearby and has reasonable prices.”

Different to Eco Pharmacy, Pharmacity has outlets in residential areas. Given that most people are in a rush, convenience is prioritized over nearly everything. It has also expanded its online pharmacy and manufactures its own face mask brand.

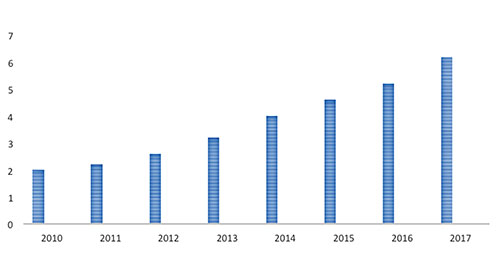

Source: BMI. Unit: $ billion

Room for growth

Vietnam’s pharmaceutical retail industry is expected to move towards chains because of ever-tightening regulations for the health sector. Consumers are also more conscious of their health and want to buy the right medicine at the best pharmacies. Mr. Vu believes that modern chains will be welcomed by consumers as they seek a higher quality of life. “Changes will create challenges for traditional drugstores, and modern chains will eventually replace them,” he said.

Associate Professor Truong Van Tuan, Chairman of the Ho Chi Minh City Pharmacists Association and lecturer at the Pharmacy Faculty at the Ho Chi Minh City University of Medicine and Pharmacy, said that pharmacies account for 70-80 per cent of all pharmaceutical sales in developed markets. There are now many more in Ho Chi Minh City, such as Phano Pharmacy, with 60, Medicare 45, and Vistar 21.

He said that investors see great potential in the pharmaceutical market, and the Ministry of Health also encourages investment in chains, as long as they meet the ministry’s conditions. “The trend of private pharmacies will develop in two directions in the time to come: investing in order to meet the requirements of the health sector and meet market demand, and participating in the pharmacy chains of famous brands,” he added.

Recent research reveals the potential of Vietnam’s pharmaceutical market. Revenue in 2016 was $4.7 billion, according to BMI’s Pharmaceutical and Health Care in Vietnam report, a 13 per cent increase over 2015 and double-digit growth was forecast over the following five years.

BMI estimates the pharmaceutical market will see annual revenue of $7.27 billion by 2019, for average annual growth of 13.4 per cent. The country’s young population, rising middle class, and higher per capita income are all key factors in the market’s development.

Issues to address

As a market of great potential, many pharmaceutical companies are keen to gain a foothold in Vietnam but there are certain risks involved. Regardless, “Thirty-four of the world’s largest pharmaceutical companies are in Vietnam, which indicate the potential the country possesses,” according to Mr. Robert Tran, CEO of the Robenny Corporation in the US, Canada and Asia Pacific. Technology retailers, he went on, can take advantage of their experience in retail chains but must address three main risks: the dominance in wholesale channels, managing entire supply chains, and human resources. Despite thousands of medical students graduating each year, their skills remain lacking.

Besides, “there are some pharmaceutical chains applying international models, such as combining convenience stores and pharmacies,” he added. “The Medicare and Guardian chains are two examples but neither has achieved success so far.” Vietnamese people, he explained, like to shop at supermarkets and department stores but don’t normally linger in a pharmacy.

The challenge for pharmacy chains is that Vietnamese don’t generally follow their doctor’s instructions. A key factor in success is therefore changing the mindset of customers. When they need to buy the right medicine, convenience is not a factor. People will be willing to travel longer distances to get the right advice and the right pharmaceuticals.

Chains may be the latest trend in Vietnam but they need to be a more attractive option than a traditional pharmacy. Leaders must not only have a solid knowledge of pharmaceuticals but also professional management skills, to avoid any competition within the chain./.

VNF/VnEconomic Times

Most read

Recommended

Economy

Economy

Hanoi Is Among 100’s Smartest Cities In The World In 2024

Economy

Economy

IMF Expert: Vietnam Remains Attractive Destination for Foreign Investors

Economy

Economy

World Bank: Vietnam's Economy Recovers Gradually

Economy

Economy

ASEAN Future Forum and India's Role in Indo - Pacific Stability and Prosperity

Popular article

Economy

Economy