Package of over VND30 trillion to support Vietnamese enterprises amid coronavirus outbeak

| |

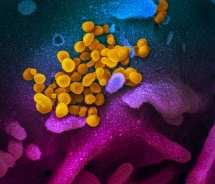

| Many enterprises are facing difficulties due to lack of production materials. Photo: collected. |

Identify three specific support objects

According to Mr. Pham DinhThi, Director of Tax Policy Department, Ministry of Finance, the Covid-19 epidemic has a direct impact on the activities of many production sectors and fields of our country.

The most visible sectors are tourism, hotels, restaurants; and services such as education and healthcare.Some manufacturing industries will start to face difficulties due to temporary shortage of labor force and the loss of raw materials, leading to difficulties inoutput.

Recognizing this situation,after the Lunar New Year, the Minister of Finance actively reported to the Government and approved the issuance of Decision No. 155/QD-BTC dated February 7, 2020 onthe list of goods eligible for import tax exemption for the prevention and control of Covid-19.

However, up to now, the disease has been unpredictable. At the Government's regular meeting on March 3, the Minister of Finance proposed a package of solutions to support enterprises to overcome difficulties in order to boost production and business, support the market, and create motivation and growth for the economy.

According to the Director of the Tax Policy Department, this proposal is based on the research and evaluation from ministries and branches, as well as reference to the practice of business sectors and the opinions of international organizations and experts. So far, this package of solutions has been concretized by the draft decree to extend the time limit for paying taxes and land rents, which were officially submitted for public comment before the Ministry of Financesubmitted to the Government for promulgation.

Accordingly, the extension will apply to enterprises, organizations, inpiduals, groups of inpiduals, production and business households directly and severely affected by the Covid-19 epidemic.

Specifically, there are three groups. Firstly, enterprises, organizations, inpiduals, groups of inpiduals, and households engaged in production activities in agriculture, forestry and fishery sectors; production and processing of food; weaving; producing costumes; producing shoes; producing products from rubber; producing electronic products, computers; manufacturing and assembling cars (except for manufacturing and assembling cars with 9 seats or less).

Secondly, enterprises,organizations, inpiduals, groups of inpiduals, households doing business in railway transport; road transport; water transport; air transport; warehousing and support activities for transportation; accommodation services, catering services; activities of travel agents, tour business and support services, related to tour promotion and organization.

Thirdly, small and micro enterprises defined under the Law on Support for Small and Medium Enterprises No. 04/2017 / QH14 and Decree No. 39/2018/ND-CP dated March 11, 2018 of the Government detailing on some articles of the Law on Supporting Small and Medium Enterprises.

Not affect budget revenue of 2020

The tax amount and extension time are also clearly proposed by the Ministry of Finance. In particular, with value-added tax (VAT), in order not to affect the State budget balance in 2020, the Ministry of Finance proposed an extension of five months.

Specifically, as follows: Extension of the tax payment limit for the arising payable VAT amounts in March, April, May and June 2020 of the above subjects who are making monthly VAT declaration. At the same time, extending the deadline for paying tax for the arising payableVAT amounts in the first quarter and second quarter of 2020 of the above-mentioned enterprises and organizations are making quarterly VAT declaration. If taxpayers make additional declarations of their tax declaration dossiers which increase the payable VAT amount and their additional declaration dossiers are sent to the Tax officesbefore the extendeddeadline, the extended tax amounts will includethe arisingpayable tax amountsdue to additional declaration.

For extending the 5-month VAT payment deadline for the payable VAT amounts from March to June 2020 (paying taxes in April to July), the State budget revenues of those months shall decrease by about VND22,600 billion. However, the State budget revenue in 2020 will not decrease because enterprises must make payment to the State budget before December 31, 2020.

The Ministry of Finance also proposes to extend the deadline for payment of VAT and personal income tax on the payable tax amounts of 2020 of inpiduals, groups of business inpiduals, and households operating in economic sectors under the draft. Inpiduals, groups of business inpiduals and households shall pay the extended tax amount in this Clause before December 15, 2020. Thus, the extended tax amount is about VND3,000 billion, but the State budget revenue in 2020 will not decrease because business households and inpiduals must pay to the State budget before December 15, 2020.

For land rent, the Ministry of Finance requests the Government to extend the land rental payment deadline for the amount of payable land rent in the first period of 2020 of enterprises, organizations and inpiduals that are leased land by the State directly under decisions and contracts of competent State agencies in the form of annual land rent payment and usingland for production and business purposes of the support objects. Extendedland rental is expectedabout VND4,500 billion. However, the State budget revenue in 2020 will not decrease because businesshousehold and inpiduals must pay to the State budget before October 31, 2020.

With regard to multi-sector business enterprises, in fact, there are the enterprises engaged in multi-sector production and business (not only doing business in extendedsectors)and in accordance with the Tax administrationLaw, organizations and inpiduals shall declare VAT and PIT on the same declaration (not declare tax according to business sectors).

Therefore, in order to simplify the management as well as tax declaration of enterprises, the Ministry of Finance proposes to extend the whole payable VAT amount for enterprises, organizationsextend all payableVAT and personal income tax amounts for inpiduals, groups of inpiduals and households in case that enterprises, organizations, inpiduals, groups of businessinpiduals and householdsengaging in production and business activities of many different economic sectors including economic sectors being subject to support under the guidance in this Decree.

Particularly, the extend land rentshall be determined according to each decision or contract with the purpose of using land for production and business of economic sectors supported in this stage.

| Basic protective measures against the new coronavirus Coronavirus disease (COVID-19) advice for the public: Basic protective measures against the new coronavirus. |

| NIH: New coronavirus can persist in air for hours and on surfaces for days New research finds that the virus that causes coronavirus disease 2019 (COVID-19) is stable for several hours to days in aerosols and on surfaces. |

| SCMP: Honeysuckle flower can help treat flu virus Coronavirus treatment: Recently, the Hong Kong-based SCMP newspaper published an article announcing Chinese scientists’ work showing that traditional medicines, including Jin Yin Hua (honeysuckle flower), ... |