SOEs to divest from banks on positive market outlook

(VNF) - Many State-owned enterprises are seeking to pest from commercial banks this year, as local stock is forecast to remain positive.

The Vietnam Posts and Telecommunications Group (VNPT) and Vietnam Bank of Agriculture and Rural Development (Agribank) are planning to auction their holdings in Maritime Bank and Ocean Bank (OCB) in March.

VNPT to offload its entire holding of 71.6 million shares in Maritime Bank (source: cafef.vn)

VNPT has registered to offload its entire holding of 71.6 million shares in Maritime Bank (equivalent to 6.09 per cent of the bank’s capital) at the starting price of VND11,900 (US$0.52) per share, , in an auction scheduled on March 10.

The move is in line with the call from Prime Minister Vuong Dinh Hue, urging the telecommunication group to pest from its listed member companies.

On a smaller sale, Agribank will sell out 390,665 shares in Ocean Bank in an auction in mid-March. The starting price is set at VND10,200 per share.

Agribank to sell its shares in Ocean Bank (source: cafef.vn)

Mobifone, one of the three largest mobile network providers in Vietnam, also plans to pest from Southeast Asia Commercial Bank (SeABank) and Tien Phong Bank (TPBank) this year, after the failure in 2016.

Last year April, Mobifone made an announcement to sell its entire holding of 33.4 million shares in SeABank (equivalent to 6.12 per cent of the bank’s capital) at the initial price of VND9,600 per share, but there was no response of willingess to purchase.

In same month, it also announced the sale of 14.28 million shares of TPBank’s capital, and ended up selling 61 per cent of this amount.

According to VP Bank Securities Company (VPS), banks could be among top best performers on the securities market this year, driven by the intense restructuring process in the financial system, as well as the Government’s support policy of easing foreign ownership limits in commercial banks.

In addition, many small banks have plans of debuting shares on the stock market this year, and this would facilitate pestment from these banks./.

( VNF/VNA )

Recommended

National

National

Deep Affection of International Friends

National

National

Vietnam News Today (May 20): Hanoi Named Top Cultural, Artistic Destination in Asia

National

National

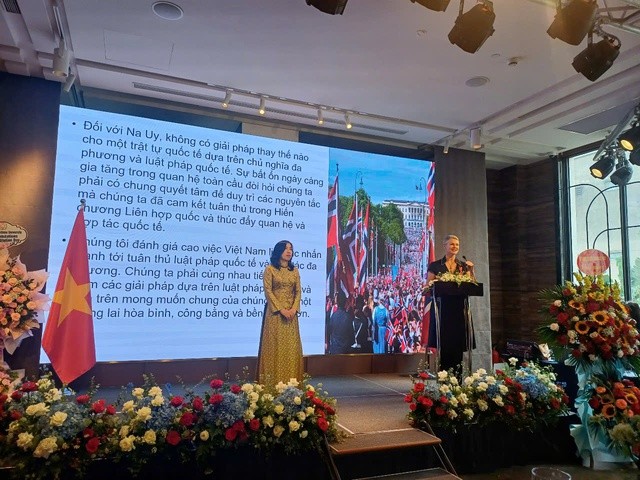

Vietnam News Today (May 19): Norway Hails Vietnam’s Continued Emphasis on Upholding International Law

National

National

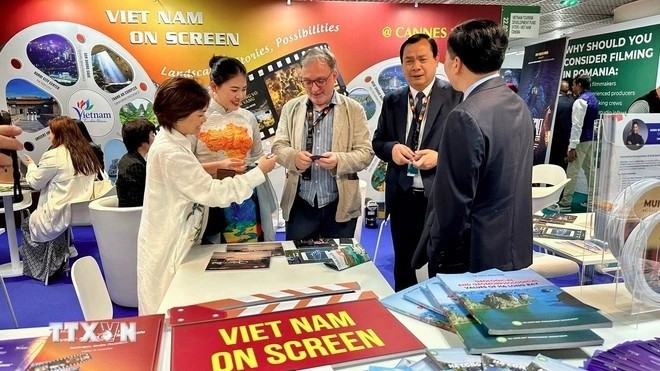

Vietnam News Today (May 18): Cannes 2025: Vietnam Rising as New Destination for International Filmmakers

National

National

Vietnam News Today (May 17): Vietnam and United States Boost Financial Cooperation

National

National

Strengthening Vietnam-Thailand Relations: Toward Greater Substance and Effectiveness

National

National

Vietnam News Today (May 16): Nha Trang Listed Among Top 15 Global Summer Destination in 2025

National

National