Swift & Decisive Vietnam: Ready for massive influx of foreign investment

Positive recovery signs

The World Bank (WB) has recently published a report on Vietnam's macroeconomic situation. As reported, in May, domestic manufacturing and retail sales rebounded by approximately 10% compared to their April-levels but remained lower than during the same period last year.

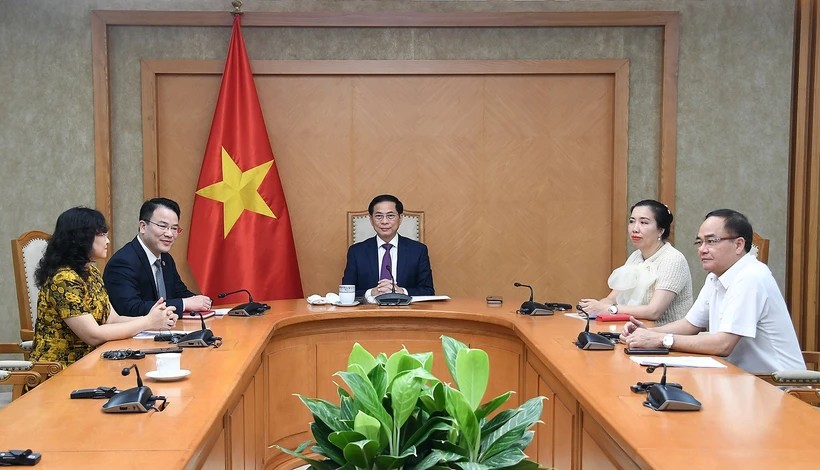

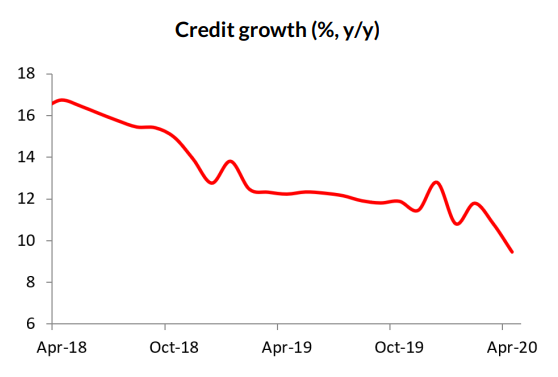

At about 10% (year-on-year), the expansion of the credit to the economy was approximately three times faster than the GDP growth rate during the four first months of 2020, in line with the gradual easing of monetary conditions by the State Bank of Vietnam.

|

| Photo: World Bank |

The index of industrial production (IPP) rebounded by 11% in May compared to April but still remained about 3% lower than the level recorded in May 2019. The index of industrial production in May witnessed an increase of 1% in general.

|

| Photo: World Bank |

As reported by WB, although the value of Vietnam’s merchandise exports increased by about 5% between April and May, it was 5.5% lower than a year ago due to weaker external demand and some possible disruptions of global supply chains. In May, imports fell by nearly 6% (y/y), reflecting lower oil prices and the slowdown in demand for foreign inputs by domestic firms.

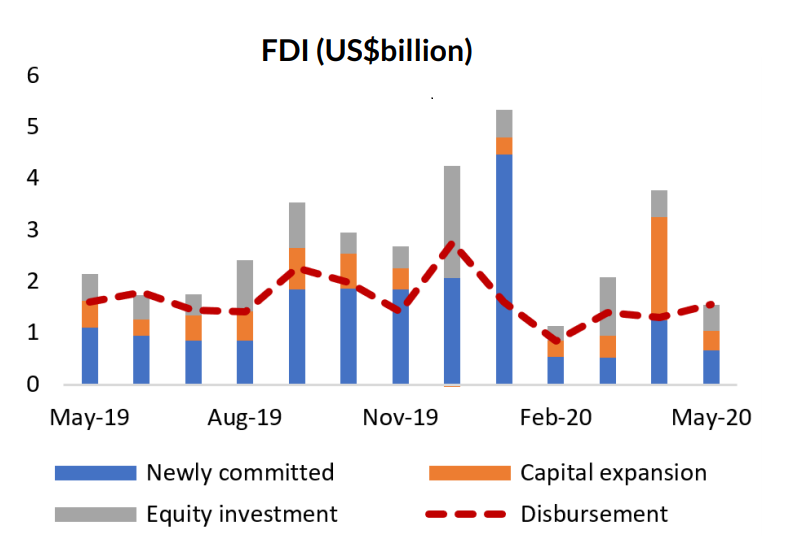

According to SSI Securities Corporation (SSI), it was such a positive sign when foreign direct investment (FDI) experienced a five- straight-month increase of 19,9% year-on-year, reaching up to $10,9bn.

Consumer price index (CPI) continued to decrease in four straight months; however, CPI in May showed an increase of 4,39% compared to the same period in 2019. Retail sales and profit from services also bounced back significantly in May compared to March and April due to the State's easing of domestic restrictions.

In terms of tourism, Bloomberg spoke highly of Vietnam as a role model in quick tourism recovery. Statistics from Apple suggested a promising scenario of a new wave of tourists to Vietnam.

As SSI suggested, the stock market carried on its robust recovery in May. VN-Index increased by 12,4% compared to the end of April, the average transaction value also experienced an increase of 30% compared to that last month.

All of the aforementioned figures have implied positive recovery signs for Vietnam's economy. Moreover, Vietnam is having the favorable conditions to achieve spectacular breakthrough after the remarkable success in handling the Covid-19 pandemic. The nation is therefore considered as the destination for foreign investment.

In addition to the State's boost of public investment, the provision of the 60-trillion-dong financial support package, efforts in attracting FDI as well as the opportunity of a part of global supply chains being shifted to Vietnam given the post-pandemic situation and the U.S.-China climbing tension, foreign indirect investment (FII) is considered as the key factor in spurring Vietnam's economic development.

The opportunity of acquiring the hefty investment

According to newly published research by VinaCapital, foreign investment is one of the key factors in helping Viet Nam’s economy grow in the aftermath of the pandemic.

The central banks all over the world are pumping a new amount of money in the market, with the total value up to $6.000bn, most of which will go to the capital market with the aim of supporting the global economy in the process of opening after the pandemic.

VinaCapital said a small part of this amount of money could accelerate the recovery of Vietnam's economy so that Vietnam could reach sustainable development in the future. Indeed, Vietnam is must be concerned about how to make its capital market more appealing to foreign investors so that it can approach this hefty capital source.

According to Andy Ho, Chief Investment Officer of VinaCapital, Vietnam needs to attract more capital to support the domestic capital market. This is a great opportunity for Vietnam to implement changes and reforms to attract more FII capital from the cash flow that the central banks all over the world use to support their economies.

The amount of money injected into the market this time has tripled compared to $2,000bn that central banks injected into economies after the 2008 financial crisis.

|

| Traders watch live stock quotes at the Ho Chi Minh Stock Exchange. (Photo bizlive.vn) |

Additionally, Ho also mentioned that Vietnam has stable political situation and business environment and so is the domestic currency. Moreover, Vietnam now has 97 million people, half of whom are under the age of 35 and the average income of ordinary people is about $3,000 per year. This is a great advantage to attract many businesses as well as domestic and foreign investors.

The key point, said Chief Investment Officer of VinaCapital, is that Vietnam needs reforms in the capital market to attract more FII capital flows. Foreign investors are interested in the development of enterprises, they want to see larger enterprises listed on the stock market and also want to see the acceleration of the equitization process of SOEs. The more equitized enterprises Vietnam has, the more opportunities for foreign investors.

In short, foreign investors want to see the diversification in Vietnam's stock market. Currently, there are only a few stocks that dominate the market, including stocks from banks and real estate sectors. Foreign investors want more options, like telecommunications, electricity, fertilizer, etc., and even health care services. Therefore, on the edge of the upcoming marvelous opportunity, Vietnam should be prepared, swift and decisive as it has been in the unprecedented situation of the Covid-19 pandemic.

| Vietnam adopts policies and measures to recover economy during, after COVID-19 Vietnam has adopted synchronous policies and measures to recover its economy both during and after the COVID-19 pandemic, Vice Foreign Ministry Spokesman Doan Khac Viet ... |

| Business areas expected to prosper after Covid-19 in Vietnam Biotechnology, online retail, fintech, and green real estate are expected to prosper during the post-COVID period. |

| Foreign investment on rise in Vietnam The reports from the Foreign Investment Agency (FIA) showed that foreign investors had registered to invest 23.36 billion USD into Vietnam since the beginning of ... |

Recommended

National

National

Vietnam News Today (Jun. 2): Vietnamese Trade Mission Sounds Out Business Opportunities in United States

National

National

Vietnam News Today (Jun. 1): Vietnamese, Japanese Firms Foster Partnership

National

National

Vietnam News Today (May 31): Vietnam Strongly Supports Laos’s National Development

National

National

Vietnam News Today (May 30): Vietnam, Venezuela Reinforce Ties Through People-to-people Diplomacy

Popular article

National

National

Vietnam News Today (May 29): Vietnam and Hungary to Expand Cooperation into New Areas

National

National

Vietnam News Today (May 28): Vietnam and China Discuss Strategic Cooperation Orientations

National

National

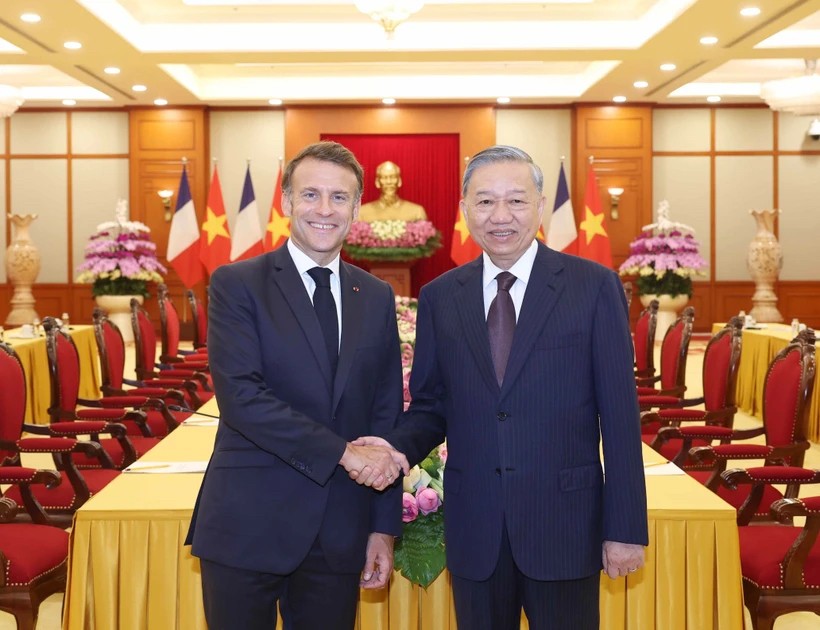

Vietnam News Today (May 27): Vietnam Treasures Multifaceted Collaboration with France

National

National