Tax refunds to boost foreign tourists’ spending in Vietnam

The number of foreign tourists to Vietnam has increased significantly for the past years, however, their spending, especially for Vietnamese goods, has remained low mainly due to the unfamiliar value added tax (VAT) refunds for tourists.

According to the Vietnam Tourism Advisory Board Secretariat, average spending of Chinese tourists in Vietnam is estimated at USD 638 per person and that of tourists from other countries at about USD 943 per person.

Meanwhile, statistics of the Vietnam National Tourism Administrative showed that Vietnam received 11.6 million international tourists in the first 11 months of 2017, a rise of 27.8 per cent year-on-year. The figure is expected to hit 12.8 million at the end of the year, with visitors from Asia surging 45.6 per cent.

|

Average spending of foreign tourists in Vietnam is estimated at less than USD 1,000 per person. (Photo: Internet)

Experts said the reason for the low spending is that international tourists do not get VAT refunds when buying goods in Vietnam because most of domestic businesses are not willing to participate in the refund policy.

Only 649 stores of 80 enterprises had taken part in the refund program as of the end of last month, according to the Ho Chi Minh City Department of Tourism.

Economist Dinh The Hien said the current VAT refund for tourists was still not prevalent in Vietnam, with only nine tax border gates, mostly in Ho Chi Minh City. Meanwhile, it is more common and more easily secured in Singapore, Hong Kong, South Korea and Japan, among other countries. Many foreigners were unaware of Vietnam’s VAT refund policy, he said.

To increase foreign tourists’ spending in Vietnam, experts have urged simplifying the procedures to ease foreign tourists in receiving the refunds.

Pham Trung Luong, Vice Chairman of the Vietnam Tourism Education Association, said that VAT refunds encourage tourism and boost visitors’ spending, but the procedures to receive refunds in Vietnam was unclear and inconsistent.

As a result, many tourists at border gates and airports do not receive VAT refunds, he added.

Phan Dinh Hue, director of Vong Tron Viet Travel Company, said the purpose of VAT tax refunds was to encourage tourism and the purchase of goods made in Vietnam.

“It should never be considered a favor we do for tourists,” he said. “Our survey shows that most foreign visitors are primarily concerned about fake or counterfeit goods, instead of the price. Some European customers have complained about the quality of lacquer items purchased in Vietnam.”

Vietnam is also not considered a major shopping destination, so visitors are not particularly interested in VAT refunds, he said.

According to the customs pision at Ho Chi Minh City’s Tan Son Nhat International Airport, the amount of VAT refunds so far this year was VND 35.5 billion (USD 1.56 million) compared to VND 44 billion (USD 1.94 million) last year.

Le Tuan Binh, Deputy Director of the customs department of Tan Son Nhat airport, said around 40,000 people arrive and depart from the airport every day, with half of that figure representing departures.

However, the total number of VAT refunds being processed daily at Tan Son Nhat airport are worth a total of only VND 100 million (USD 4,400), which shows the low demand for such refunds. Most VAT refund items include sunglasses, cosmetics, handbags, clothes, footwear, cell phones and watches./.

VNF/Hanoitimes

Most read

Recommended

National

National

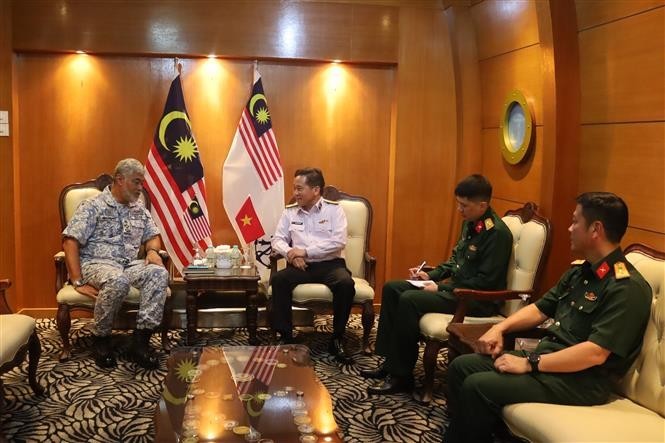

Vietnam, Malaysia Look Forward to New Era of Development

National

National

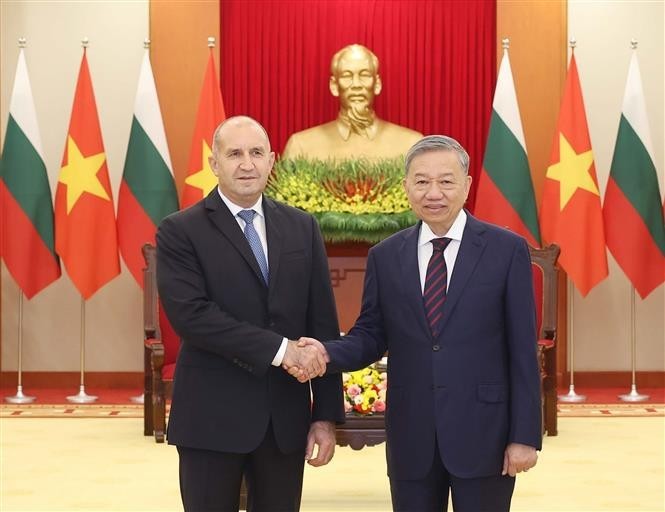

Vietnam News Today (Nov. 26): Party Leader Receives Bulgarian President

National

National

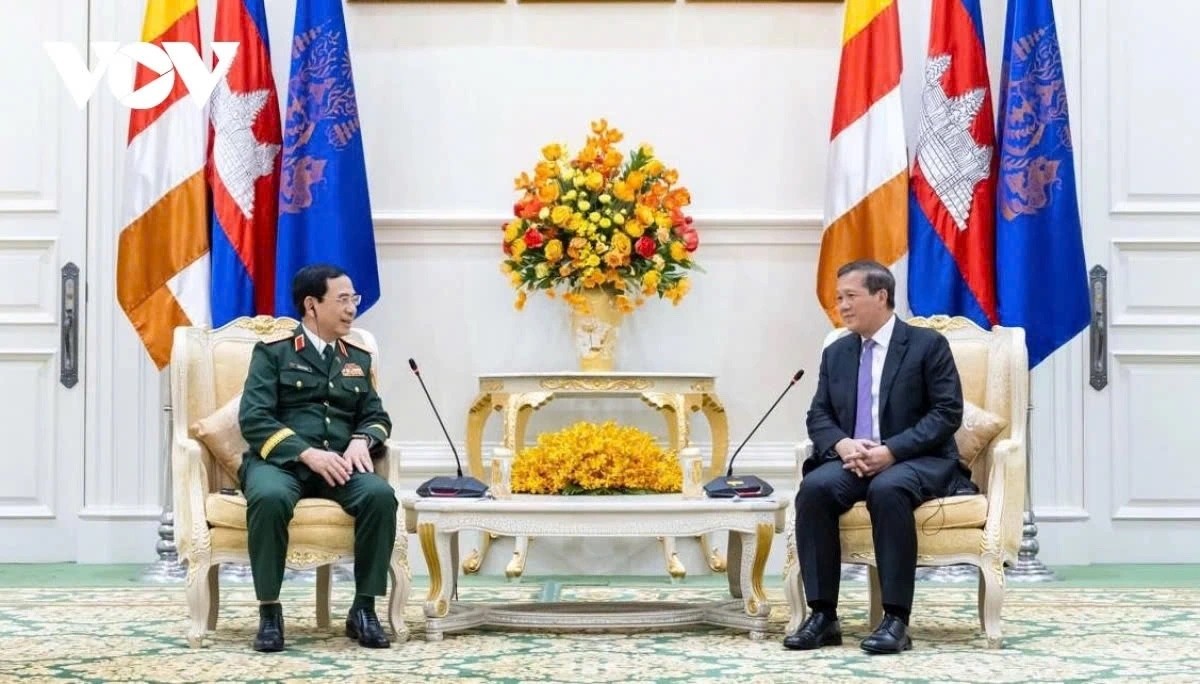

Vietnam News Today (Nov. 25): Cambodia Attaches Importance to Defense Cooperation With Vietnam

National

National

General Secretary To Lam Meets Vietnamese Community During Embassy Visit in Malaysia

Popular article

National

National

Vietnam News Today (Nov. 24): India, Vietnam Strengthen Coordination Capability in UN Peacekeeping Operations

National

National

President of Vietnam Luong Cuong Proposes Direction for Promoting APEC's Role

National

National

Vietnam News Today (Nov. 23): South Korean Firms Eye Joint Ventures With Vietnamese SMEs

National

National