UK newspaper: Vietnam’s stock market attracts more private investors

| Vietnam stock market ranked among the world's best performers | |

| Vietnam Index: Huge losses shown up in the first quarter of 2021 | |

| Foreign investors will soon return to Vietnam's stock market: HSBC |

|

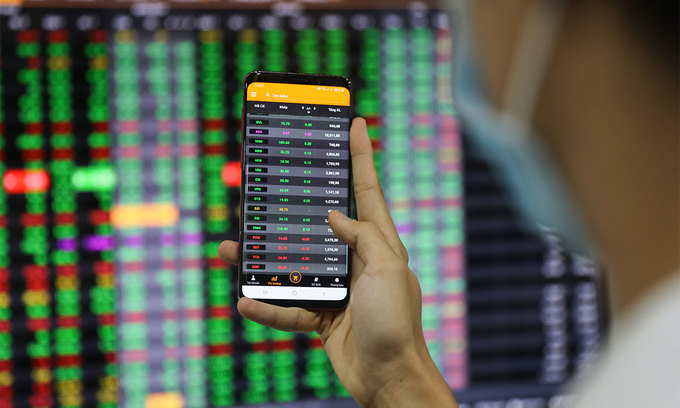

| An investor looks at stock prices on a smartphone at a brokerage in Ho Chi Minh City. Photo: VnExpress |

As Vietnam makes its anticipated progress from frontier status to a fully fledged emerging market, the stock market is now at the stage where more and more private investors are getting on board, said an article recently published on the UK newspaper Proactive.

According to the article, the country’s stock market recently topped the milestone of US$1billion of daily transactions, making it the second most liquid in Southeast Asia.

Its author, Oliver Hail, took Dragon Capital as an example, saying with the longest record of any independent asset manager in the country and the second biggest investor behind the government, Dragon Capital is first on the list for most overseas investors in Vietnam.

“When we started,” says Dragon Capital founder and chairman Dominic Scriven, “Vietnam's biggest export was scrap metal, and exports were US$2bn. After years in between where it emerged as one of the biggest agricultural exporters – of rice, of cashew nuts, of cinnamon, and several others – this year exports will be close on US$300bn and the biggest chunk of exports will be electronics and smartphones.”

“And what's guides that is a political system, political philosophy and a social structure that all combined to underlie consistency and stability.”

|

| Averaging 7% for the past six years, Vietnam's economic growth is expected to remain strong. Photo: Proactive |

Dragon is perhaps best known to UK investors as manager of the FTSE 250-listed Vietnam Enterprise Investments Ltd (LON:VEIL) investment trust, but also runs an open-ended UCITS fund.

With assets under management totalling around US$5.5bn, of which the VEIL trust is approximately 40% and the ETFs just under 20%, the firm is one of the biggest players in South-East Asia.

While Vietnam’s equity market is now turning over a healthy amount per day, Scriven pointed out that the market remains relatively immature and the Vietnamese economy still offers considerable catch-up opportunities with other local rivals.

He said about 95% of the Vietnamese daily stock market volume is private investors not institutions.

Ebullient is putting it modestly, with economic growth averaging 7% for the past six years and expected to remain one of the world’s fastest growing countries, according to the article.

Highest increase in the world

|

| An investor watches stock prices at a brokerage office in Hanoi. Photo: AFP |

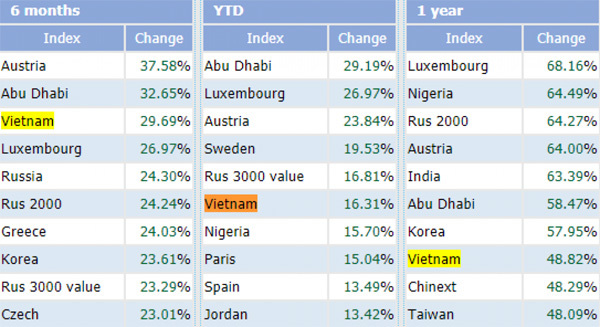

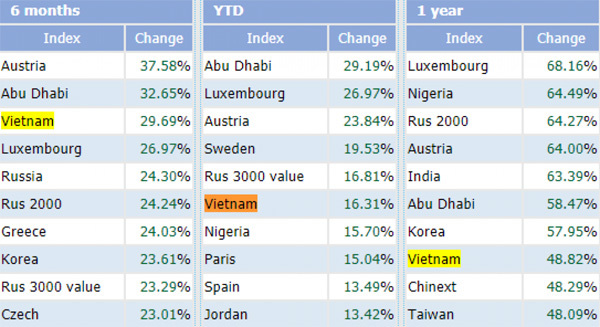

Vietnam’s benchmark VN-Index has increased 34.51% in the first half of this year, marking the highest rise in the world.

Abu Dhabi came second with its stock market rising 33.06%, followed by Austria with 32.65%, according to China-based stock database StockQ.

The number of new investors entering the stock market in May scaled a new monthly record, with over 113,000 new trading accounts opened, VnExpress said.

The VN-Index's continuous growth has broken most forecasts made by domestic securities companies.

The Viet Dragon Securities Company (VDSC) had forecast that the VN-Index could reach a high of 1,272 points, equivalent to a year-on-year increase of about 15 percent.

Vietcombank Securities (VCBS) and Viet Capital Securities (VCSC) made similar forecasts of the index reaching 1,250-1,280 points. Meanwhile, Ho Chi Minh Securities Corporation (HSC) said the VN-Index could reach 1,500 points by the end of the year.

The index has surged rapidly, pushing the price-earnings (P/E) ratio to 18.8. Although this figure is still much lower than other Southeast Asian countries, it shows Vietnam's stock market is coming of age.

VNDirect Securities said in its newly released strategy report that the market is no longer undervalued but also not too high, meaning that businesses need more time to improve their results and pull the valuation ground to a more attractive level.

Viet Nam News also cited FiinGroup statistics showing that in 2021, listed companies plan to increase their equity size by 3.8%, equivalent to VND102.6 trillion (US$4.5 billion) through share issuance, a record so far.

From the beginning of this year, they have successfully issued about VND20.3 trillion and are planning to issue more than VND82.3 trillion in the year-end period./.

| HSBC: foreign investors hard to ignore Vietnamese stock market for longer Vietnam is frontier equity market which has been interested in and liked, with its turnover now almost the same level as Singapore and far more ... |

| Vietnamese billionaires’ worth up by $500 mln as stock market scales new high The accumulative net worth of six billionaires in Vietnam expanded by nearly $500 million as the benchmark VN-Index hit a fresh peak on April 1. |

| Vietnam stock market paid attention internationally by surge of new investors with "record" jumps Vietnam, the region’s small frontier market, has seen a four-fold jump in share trading volumes in December as the benchmark VN-Index surpassed the 1,000-point mark, ... |