Vietnam Ranked Third in ASEAN for Fintech Funding

|

| Financial technology funding in the ASEAN region report. Photo: UOB |

Financial technology funding in the ASEAN region more than tripled from last year to hit a record US$3.5 billion (US$4.7 billion) in the first nine months of 2021.

“This trend signals a shift in the strategy of investors across several Asean markets as they fund mature firms that are seen as standing a higher chance of emerging stronger from the pandemic,” said the report.

Accordingly, growth in the region’s number of fintech firms slowed as the industry continues to mature.

The number of funding deals grew by 32% compared to 2020, up to now the number reported to be 167 deals, with almost half the deals going to Singapore-based FinTech firms.

Vietnam ranked third

The annual report by UOB, PwC Singapore and the Singapore FinTech Association on Nov. 10 shared the ranks of fintech funding attraction in the ASEAN region. Vietnam rebounded sharply to US$375 million in funding (11%), ranked 3rd as a result of two mega-rounds.

Singapore retained its top spot in the ASEAN region for the number of deals made by financial technology firms to secure funding, with firms securing a total of US$ 1.6 billion in investments.

Indonesia stayed in second place, raking in US$904 million in funding (26%)

VNPay deal contributed to sharp rebound

Among the fintech firms from payment sector, VNPay received the second biggest investment valued at US$ 250 million by parent firm VNLife. At top spot was Grab Financial Group (Singapore) with US$300 million funding.

Both of these parent firms take higher risk than the market average. Specifically, VNLife goes against the trend where investors go for more mature and resilient FinTech, which stands a higher chance of emerging stronger from the pandemic.

VNPay is an early-stage fintech company, yet Niraan de Silva - Managing Director of VNPay has high hope that this deal will be the key digital banking enabler in Vietnam.

VNPay currently gained comprehensive relationships with over 40 banks offering multiple services such as SMS banking, digital banking platforms and distribution services and QR payment.

Momo, late-stage fintech company in Vietnam from payment sector, received US$ 100 million investment.

The rebound in fintech investments comes after total funding dipped from US$1.6 billion in 2019 to US$1.1 billion last year – when the Covid-19 outbreak likely dampened investor confidence.

Other key survey results

There were 188 Fintech firms in Vietnam by the end of Q3 2021. There were only seven new Vietnam fintech companies set up this year, compared with 12 last year and 25 in 2019.

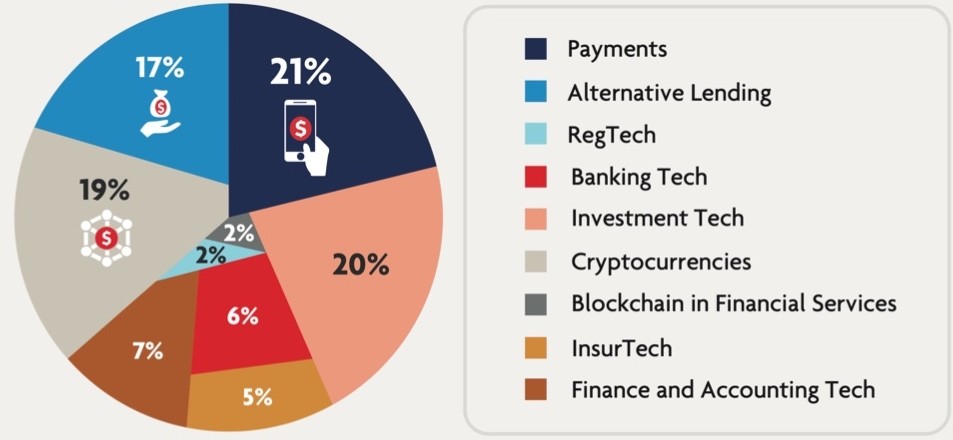

Besides the biggest distribution of payments firms (21%), there are several types of Fintech firms in Vietnam such as investment type (20%), cryptocurrencies type (19%) and alternative lending type (17%).

|

| Distribution of Vietnam Fintech firms in YTD 2021 by category. Photo: Tracxn |

According to Tracxn, the majority of Fintech funding in Vietnam also goes to payment businesses with the amount of US$ 348 million, while alternative lending, blockchain in financial services and crypto firms share small portions.

Vietnam had 33% respondents prefer branches and ATM over digital banking, the survey suggests that access to physical cash is still important for the population.

It ranked the highest and most willing to consider digital-only banks, with 68% of respondents saying yes when asked if they would choose digital-only banks.

The survey also found that 13% of Vietnamese respondents have already used cryptocurrencies, 33% will use and 46% might consider, while 8% don't plan on using.

Hence, the majority are happy to ‘wait and see’ but encouraged by the growing acceptance of digital currency by established corporations. Another reason is because crypto exchanges are yet to be accepted by regulators.

Fintech in ASEAN 2021 Report: Key Findings1) In the first nine months of 2021, ASEAN’s FinTech firms received a record-breaking US$3.5 billion in funding, three times the amount raised last year. 2) Singapore continues to lead funding numbers and deals within ASEAN. 3) Payments, investment tech and cryptocurrency firms saw the most funding. 4) E-wallets have emerged as a key payment method, second only to cash. 5) One in two respondents are aware of 'green' investment products, of which 55 per cent have invested in such products. 6) Almost nine in 10 respondents across ASEAN are currently using or are open to using digital currencies in the future. |

| Singapore Leads Foreign Investment in Vietnam in 10 Months Singapore has taken the lead among 97 countries and territories investing in Vietnam in the first 10 months of this year. |

| Singapore-based Cryptocurrency Platform Selects Duco To Automate Core Controls & Support Growth Global provider of cloud-based data automation and reconciliation services, Duco, announced today that leading Singapore-based cryptocurrency platform, Coinhako, has adopted Duco's services to automate and ... |

| Experts: Vietnamese economy set to rebound in 2021 Thanks to the promotion in private investment and exports, the Vietnamese economyis set to bounce back in 2021, experts said at a forum in Ho ... |