Vietnam to Impose Global Minimum Tax from 2024

The applicable tax rate is 15% for multinational enterprises with total consolidated revenue of EUR 750 million (about USD 800 million) or more in two of the four most consecutive years. Taxable investors are required to pay the global minimum tax in Vietnam.

Through a review by the General Department of Taxation, there are about 122 foreign corporations investing in Vietnam that are affected by the imposition of global minimum tax. If orginated countries of these companies all impose taxes from 2024, they will collect an additional tax difference of about more than VND 14,600 billion next year.

However, the imposition of the global minimum tax will directly affect the benefits of foreign investment enterprises during the period of tax exemption incentives, with an effective tax rate lower than 15%. That means Vietnam's tax incentives for foreign businesses will no longer be effective, which could affect the investment environment in general.

|

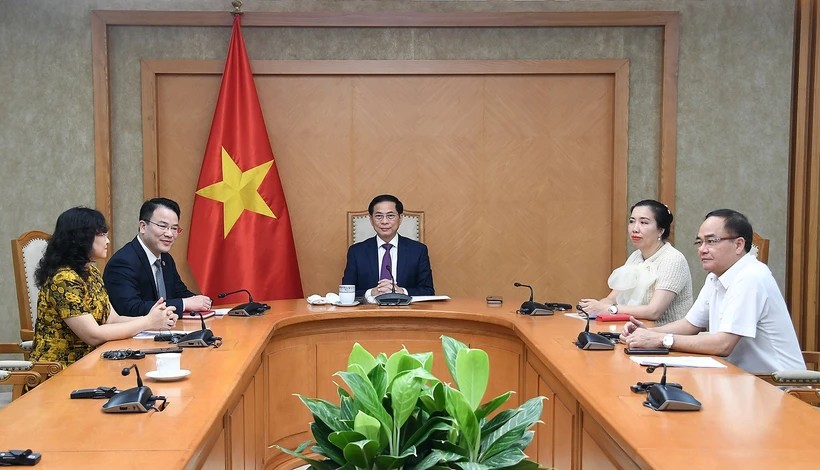

| Illustration photo. (Source: Thoi Dai). |

Previously, on the morning of November 29, 2023, with over 93.5% of delegates in favor, the Vietnamese National Assembly voted to pass a Resolution applying additional corporate income tax according to regulations to prevent global anti-base erosion (global minimum tax).

The global minimum tax is an agreement reached by G7 countries in June 2021 to combat multinational corporations from shifting profits to countries with low tax rates to avoid taxes.

To date, 142/142 member countries, including Vietnam, have agreed with this tax policy. Large corporations and companies with global consolidated revenue of EUR 750 million or more must pay a minimum tax of 15%. UK, Japan, Korea, and EU are expected to impose taxes in 2024.

| Vietnam's New Position on World Investment Map Vietnam attracted foreign direct investment (FDI) for more than 35 years and has become an attractive destination for investors around the world. |

| Vietnam promotes automobile industry by changing tax & customs policies With a view to turning Vietnam into a modern and industrialized country by 2030, the country takes action to encourage the automobile industry. |

| Vietnam Applies Special Preferential Taxes for Countries Under the RCEP Agreement The Government of Vietnam announces the Decree on Vietnam's Special Preferential Import Tariff to implement the Regional Comprehensive Economic Partnership (RCEP), also known as Decree ... |