Vietnamese businesses borrow 65% of its equity?

During the first period of 2020, there are contradicting opinions among Economists about the statistics and conclusion from a report of an independent group of experts, stating that the Annual GDP (of Vietnam) is insolvent for the country to pay off its interests.

|

| According to Mr Nguyen Quang Thuan, this ratio was composed using over a thousand listed companies on the Vietnamese Stock Exchanges, and it is relatively safe... |

To clarify the point, Chairman and General Director of FiinGroup Nguyen Quang Thuan has shared his consultation with VnEconomy.

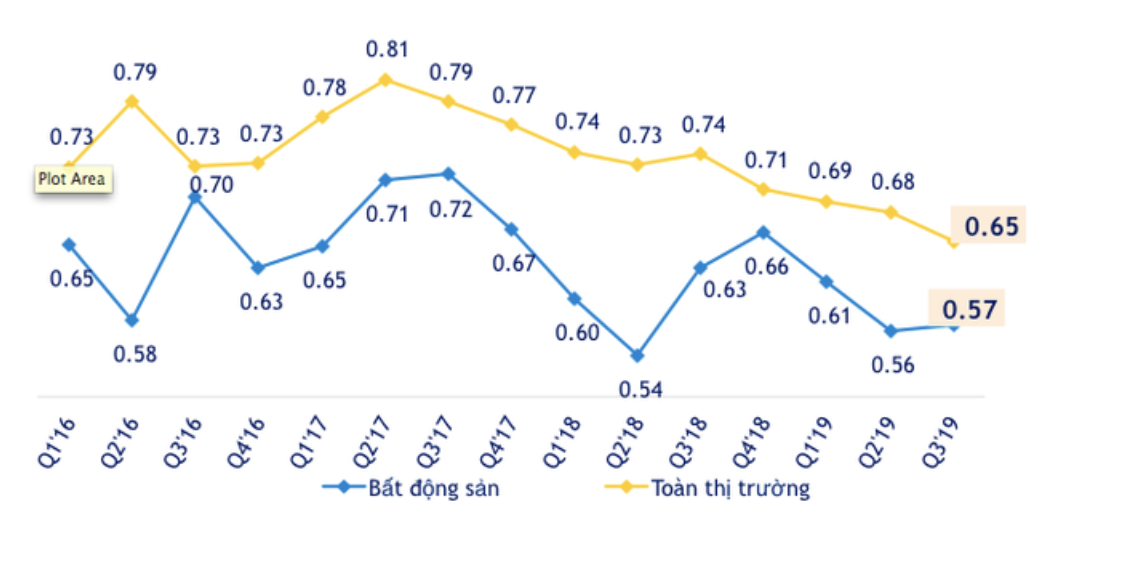

The extend of this leverage, on theory, is within the "green zone" - under 1x. However, in order to provide a more in-depth analysis, it depends on the characteristics of the industry and many other variances. For instance, the ratio for the real estate industry is in decline and currently at 0.57 mark by the end of the 3rd quarter of 2019 (the data consists of 110 real estate firms including big names like VinGroup, Sun Group, Novaland, Nam Long, etc.).

The reason for this phenomenon is because the developers are actively reducing their Debt ratio and encourage customers to take the mortgage via the 3-party integration: Developers, Banks, and Customers. Over the last 5 years, mortgages have raised dramatically to 13.14% of all loans. Meanwhile, loans taken by developers and real estate firms are merely 6.1%. Therefore, in order to define the embedded risk of the real estate industry, not only firms and developers but the mortgage loans for hundreds of thousands of customers are to be taken into account.

The financial leverage should be viewed via “interests bearing loans” instead of the total account payable. Because a typical account payable consists of many other parts that are not essentially “loans”. For instance, credit terms, deposit from the customer or upfront payments from retailers, etc.

The use of total debts in order to calculate the financial costs of a company or of an economy is not a valid method. In fact, if the cumulated equity of non-financial enterprises in Vietnam - 8.5 quadrillion dong (US $365b) - by the end of 2017 was correct, then the total debt of listed firms would be 5.5 quadrillion dong (US $236.2b), not 13.8 quadrillion dong, given the D/E of 0.65 is applied.

Our “back of the napkin” numbers were based on the D/E ratio of listed companies. However, in reality, due to their superior stability and credit ratings, listed enterprises tend to borrow more. Meanwhile, unlisted firms have the tendency of using lower leverage.

If the Government loans are taken into account (about 3.4 quadrillion dong), then the total debts is around 8.9 quadrillion dong, approximately $380b.

In order to analyze the solvency of a nation, one should consider the correlation between the total cost of interests – about US $34b ($380 * 9%) - and the announced GDP – US $277b. Our GDP/total costs of interest is currently at 8.1 times.

Utilize the 7% GDP to calculate the total cost of interests for the economy is not reliable. Because the GDP in its embedded characteristics has contained growth, undeterred by the composed method.

For the matter of fact, according to our understandings, among the total debts of enterprises and Government, many of them are non-interest-bearing loans. For example, internal loans within big corporations, or Government loans – which accounted for 52% of the GDP – parts of them are non-interest-bearing and grace loans.

| Vietnam's positive GDP growth amidst the pandemic Covid-19 certainly slowed down the Vietnamese economy growth. However, by the end of the day, the little South East Asia country still came out on ... |

| "Hanoi Civic Commitment" website officially launched Deputy Director of Hanoi Department of Natural Resources and Environment Le Tuan Dinh said that the website includes 25 solutions in 5 fields: Energy - ... |

| Southern key economic localities showed signs of recovery in the context of COVID-19 Despite COVID-19's negative impacts upon all aspects of the country's economy, Vietnam's southern provinces' economy continues to show signs of recovery. |

Recommended

Economy

Economy