Amendment of Law on Social Insurance: Employees Expect New Regulations on Debt Settlement and Social Insurance Evasion

|

| The workshop attracted many experts on social insurance policies. |

The Vietnam General Confederation of Labor (VGCL) and the Ministry of Labor, Invalids and Social Affairs on April 5, in Hanoi, held a workshop to collect opinions from trade union officials on the draft Law on Social Insurance.

The workshop also had the participation of trade union officials of the provincial and municipal Labor Confederation; Central Trade Union.

Spread to the grassroots trade union

Speaking at the opening ceremony, Vice President of the Vietnam General Confederation of Labor Ngo Duy Hieu appreciated the meaning and spread of the social insurance policy to people, including employees. Therefore, the workshop is an opportunity for trade union officials to share opinions and propose aspirations in adjusting policies of the law on social insurance, thereby contributing to improving the draft Law on Social Insurance (amended).

“On the basis of the draft, trade union officials are expected to provide suggestions and practical scientific ideas to develop a quality Law on Social Insurance (amended). Through the comments at the workshop, when returning to the locality, trade union officials need to fully inform the trade union officials, employers and employees, there”, said the Vice President of the Vietnam General Confederation of Labor.

Sharing the same view, Nguyen Ba Hoan, deputy minister of the Ministry of Labor, Invalids and Social Affairs, said that legal documents and project dossiers of the Law on Social Insurance (amended) have been drafted and sent to ministries, branches, localities and people for comments.

“Today's workshop is an important and meaningful activity. Through today's workshop, the Vietnam General Confederation of Labor and the Ministry of Labour, Invalids and Social Affairs will consider comments, and finalize the draft Law on Social Insurance before submitting it to the Government and the National Assembly”, said Deputy Minister Nguyen Ba Hoan.

Focus on “hot spots”

At the workshop, many delegates expressed their consensus with the draft of the amended Law on Social Insurance. Many delegates paid attention to the regulations related to debt status, and evasion of social insurance contributions - one of the current situations in the implementation of social insurance policies.

|

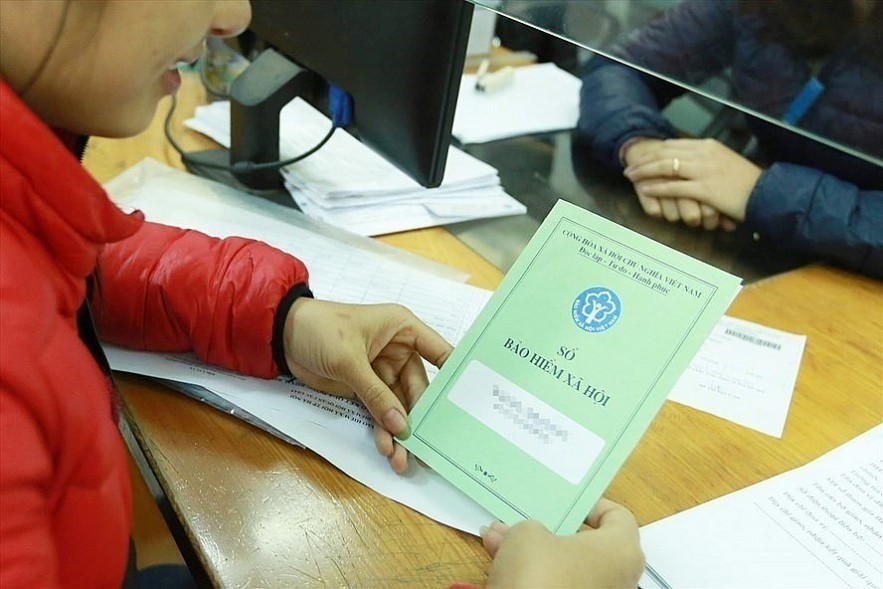

| Many workers expect a new policy in the coming revision of the Law on Social Insurance. |

Giving his opinion on handling the situation of enterprises evading social insurance contributions, Nguyen Manh Kha, vice president of the Oil and Gas Union, suggested that there should be more strict regulations and specific measures to handle this.

Nguyen Manh Kha cited the fact that many FDI business owners still owe social insurance and fled back to the country, even selling their machines. Therefore, even if the workers win the lawsuit to collect the social insurance, they cannot get back the money that the enterprise temporarily collects to pay the social insurance.

He also proposed regulations that businesses must provide a list of monthly social insurance contributions to the trade union to monitor and avoid the case of debts accumulating for many months.

Also related to the regulation on handling social insurance debts, Le Duc Tho, vice president of the Bac Giang Confederation of Labor, assessed that the draft Law on Social Insurance (amended) has added many strong measures. For example, the competent authority decides to stop using invoices for employers who have evaded social insurance contributions for 6 months or more.

“However, for businesses that owe social insurance many years ago, if this measure is applied, they will not be able to operate. One of the results is that the workers have to bear the consequences,” Le Duc Tho said.

Regarding the regulations on payment of social insurance, Duong Duc Khanh, president of the Ninh Binh Confederation of Labor, proposed to supplement the regulations. The regulation is that every month, the social insurance agency needs to confirm the information that the enterprise pays social insurance premiums and provide public information so that the employees can receive legitimate benefits.

| According to Nguyen Duy Cuong, deputy director general of the Department of Social Insurance (MOLISA), the draft Law on Social Insurance (amended) includes 9 chapters and 133 articles. The revised content focuses on large groups of policies, such as: supplementing social pension benefits in addition to basic social insurance; adding benefits to sickness and maternity benefits for people working in communes, wards and towns; supplementing the maternity regime in the voluntary social insurance policy; reducing the minimum number of years of social insurance payment to enjoy pension from 20 years to 15 years; new regulations on enjoying lump-sum social insurance. |

| Amendment of the Law on Social Insurance: New Regulations to Benefit Employees Adding subjects participating in social insurance (social insurance), adding maternity benefits in the voluntary social insurance policy, expanding the choice of one-time social insurance, and ... |

| World Bank Suggests Effective Framework for Vietnamese Banks At the seminar held by the Standing Economic Committee on Mar 21, interntional experts from the East Asia - Pacific Financial Region of the World ... |

| Amendment of the Law on Social Insurance to Increase Rights and Benefits for Employees According to Deputy Minister of Labor, Invalids and Social Affairs Nguyen Ba Hoan, the draft amended Law on Social Insurance is prepared to expand the ... |

Recommended

Viet's Home

Viet's Home

Lai Chau National Assembly, People's Council Delegates Hold Dialogue with Children

Viet's Home

Viet's Home

24 Children with Disabilities in Northern Provinces Received Free Surgery

Viet's Home

Viet's Home

World Vision Promotes Comprehensive Nutritional Care for Vietnamese Children

Viet's Home

Viet's Home

Hanoi, South Africa Strengthens People-to-people Exchanges, Expands Multi-sector Cooperation

Viet's Home

Viet's Home

Hue City to Raise Awareness on Mine Accident Prevention

Focus

Focus

Vietnam Leaves Imprints on the World Peacekeeping Map

Viet's Home

Viet's Home

“Global Vietnamese Singing 2025” - Connecting Hearts Longing for Homeland

Viet's Home

Viet's Home