Experts: Vietnamese Government Provides Continuous Support for High-tech Companies

According to Indronil Sengupta, Chairman of Indian Business Chamber Hanoi (INCHAM), Vietnam is currently one of the world's most attractive places in terms of FDI.

|

| Indronil Sengupta, Chairman of Indian Business Chamber Hanoi (INCHAM) (Photo: Dinh Hoa/TĐ). |

"One of the biggest reasons is the stability of government policy. The government has done a great work in promoting FDIs and SMEs. The second reason is because of the "upwardly mobile" young population, meaning that consumer needs are constantly increasing. From an FDI perspective, who wants to cater to the Vietnamese market, this is a sign of good demand," said Sengupta.

Sengupta believes that beside the two big reasons above, the competitiveness of Vietnam's logistic industry also positively affects the impression of foreign investors.

"Vietnam, having signed so many Free Trade Agreements (FTAs) with different countries and different regional blocks, has become a very attractive destination for a global export base," said the Indian expert.

Also, thanks to the operation and the policy regarding its industrial parks, Vietnam allows foreign investors to quickly set up and start producing.

"In other countries, there are similar industrial park models to those of Vietnam. However, Vietnam was able to create the demand and the supply together. This helps make Vietnam an attractive destination for investors both before and after the global pandemic," he explained.

According to Sengupta, foreign investors will also consider the fact that Vietnam is only one of the few countries which did not have a negative growth during the coronavirus outbreak.

"Looking at year-on-year GDP growth, because Vietnam did not have any negative growth, maybe 2-3% growth, so the year-on-year GDP growth will show less. Whereas in many other countries it went down negative or zero, so the GDP growth [in Vietnam] will look much higher," Sengupta said.

|

| Marc Kramer, Senior Lecturer at College of Business and Management (VinUniversity) (Photo: VinUniversity Website). |

Meanwhile, according to Marc Kramer, Senior Lecturer at College of Business and Management (VinUniversity), the amount of investment capital mobilized by technology startups in Vietnam will rise as "companies see Vietnam as stable with high potential".

"The government is doing everything it can to support entrepreneurship. In other words, American companies see Vietnam as stable with high potential because of its rapid current and projected growth of the economy," said Kramer

He stressed that Vietnam, of all of the Asian countries, because of its size and natural beauty has the best chance of being Silicon Valley of Asia because it is affordable and appeals to people who love what California has to offer. An investment of US $5 million in a startup in Vietnam is worth between US $10 to US $15 million.

The need for reducing pollution and support of semiconductors, Kramer stressed, makes the healthcare industry become particularly attractive.

"The population is getting more advanced in terms of healthcare needs. Thereby, Vietnam is the best launchpad for new drugs and medical devices and technology, which will attract more people with technical degrees and the reason for college graduates leaving Vietnam will diminish. The industry will grow, leading to individuals working in these [technology] companies to develop spinoff businesses," said Kramer.

US $4.5 million in the seed capital round for Vietnamese technology startups in Q1 2024A report by Tracxn Technologies - Market data platform for venture capital, shows that in the first quarter of 2024 (as of March 15, 2024) technology startups in Southeast Asia successfully raised US $816 million. This number is down 40% compared to the total capital of US $1.36 billion mobilized in the first quarter of 2023 and down 13% compared to US $935 million raised in the last quarter of 2023. However, the amount of capital mobilized by Vietnamese technology startups this quarter has increased by 467% compared to the US $6.3 million raised in the fourth quarter of 2023. Overall, in the first quarter of 2024, Vietnam ranked third in the region in terms of the amount of investment capital mobilized by startups, after Singapore and Indonesia. This is a positive change compared to the fourth quarter of 2023, when Vietnam ranked 4th. Most of the capital was poured into Be Group, a startup that provides transportation booking and fast delivery services. With US $31.2 million in the series-B round, Be Group's capital-raising deal accounts for more than 87% of the capital mobilized in the whole market. This shows that investors still prioritize investing capital in startups that have had certain success in operations, proven that their business model and products are suitable for the market, and are in the process of expanding their team and scope of operation. Traxcn assessed in the report that Vietnam has become an emerging startup center in Southeast Asia. In the first quarter of 2024, foreign investors became more open to Vietnamese startups calling for capital in the early stages by pouring US $4.5 million in the seed capital round for Vietnamese technology startups. Previously, no early-stage capital rounds were recorded in the final quarter of 2023. |

| Asia's First Climate Entrepreneurship Hub Launched in Hanoi The launch of Coalition for Climate Entrepreneurship (CCE Hub) in Hanoi was build upon the momentum of the Comprehensive Strategic Partnership issued between Vietnam and ... |

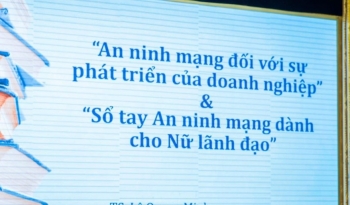

| Supporting Vietnamese Women Entrepreneurs in Cyberspace The "Cybersecurity Handbook for Women Leaders" was officially launched on June 15 in Hanoi. |

| HCMC's Businesses Strengthen Connections with Overseas Vietnamese Entrepreneurs It is necessary for Ho Chi Minh City to strengthen connections between businesses of the metropolis and overseas Vietnamese entrepreneurs and firms |