Research and advisory firm, Chartis, classifies GBG as a Category Leader with strong market potential and completeness of offering for enterprise fraud solutions among a broad array of global enterprise fraud solutions providers

GBG Recognised as Enterprise Fraud Category Leader in Chartis’ RiskTech Quadrant® 2021

SINGAPORE - Media OutReach - 15 April 2021 - GBG (AIM:GBG), the global technology specialist in fraud and compliance management, identity verification and location data intelligence, has been recognised by Chartis as a Category Leader in their latest RiskTech Quadrant® for enterprise fraud solutions, 2021.

The Chartis report, "Financial Crime Risk Management Systems: Enterprise Fraud", provides a market update and vendor landscape analysis for 2021. It highlights specific factors and attitudes unique to each region in digital and cash transactions that are impacting financial institutions (FIs), and that need to be taken into consideration when making enterprise fraud investments. For instance, e-payments in emerging markets, such as India and China have increased significantly by as much as 700% since 2012, while Malaysia and Indonesia continue to be heavily dependent on cash payments.

Throughout the last year, the COVID-19 pandemic has driven a surge in identity crimes on mobile channels, synthetic identity fraud, and bot attacks, and catapulted financial inclusion initiatives, propelling FIs to extend financial services to 'unbanked' populations. As the world's fastest growing non-cash transaction market, coupled with the growing need to access new-to-bank consumers, Asia Pacific has experienced spikes in criminal and fraudulent behaviour in the last year. This shift in the fraud landscape calls for stronger readiness among FIs in local data intelligence, analytics capabilities and having KYC and authentication integrated as a single customer journey.

With fraud remaining a key challenge for FIs across Asia Pacific, GBG's solutions were rated as having 'Advanced Capabilities' in 'Advanced/proprietary fraud-detection techniques' and 'Case management and workflow'.

As a Category Leader for enterprise fraud, GBG was recognised for combining depth and breadth of functionality, technology and content with the required organisational characteristics to capture significant market share, and for demonstrating a clear strategy for sustainable and profitable growth, matched with best-in-class solutions.

Together with the enterprise fraud category leader recognition, GBG has now been classified by Chartis as a category leader across three of the RiskTech Quadrant® reports for financial crime risk management system:

- KYC, 2020

- AML, 2020

- Enterprise fraud, 2021

Dev Dhiman, APAC Managing Director of GBG, commented, "The Chartis report clearly reflects the dichotomy that FIs face today in managing a rise in more complex and varied fraud typologies, higher false positives, and their reduced ability to perform manual investigations with remote working. Financial crimes have their regional specificity and uniqueness, which means that financial service providers across Asia Pacific require enterprise fraud and compliance solutions with the most effective automation, enhanced modelling, and data processing and management capabilities, tailored to their market."

Sidhartha Dash, Research Director at Chartis Research, said, "GBG's focus on Asian datasets from a financial crime risk management perspective is relatively unique and is one of the factors driving their strong positioning. GBG has combined a solid and broad technology framework with a focus on emerging Asia, leading to a position in the leadership pack."

Dhiman continues, "Today, GBG is serving established banks and fintechs in APAC, including nine out of ten top tier banks in Malaysia, such as AmBank, four out of the seven BUKU 4 banks in Indonesia, global banks such as Citibank and HSBC, regional banks such as DBS, and new Buy Now Pay Later (BNPL) operators such as the hummgroup in Australia. We are proud to be recognised as a Category Leader in enterprise fraud management by Chartis, which attests to the innovation, performance and fit of our solutions to a highly complex and diverse market in APAC."

For more information about GBG's enterprise financial crime solutions. To review GBG recent awards and achievements, visit here: www.gbgplc.com/apac/awards/

About GBG:

GBG offers a range of solutions that help organisations quickly validate and verify the identity and location of their customers.

Our market-leading technology, data and expertise help our customers improve digital access, deliver a seamless experience and establish trust so that they can transact quickly, safely and securely with their customers online.

Headquartered in the UK and with over 1,000 team members across 16 countries, we work with 20,000 customers in over 70 countries. Some of the world's best-known businesses rely on GBG to provide digital services and keep the economy moving, from US e-commerce giants to Asia's biggest banks and European household brands.

To find out more about how we help our clients establish trust with their customers, visit www.gbgplc.com/apac, follow us on Twitter @gbgplc or ![]() LinkedIn.

LinkedIn.

Recommended

Economy

Economy

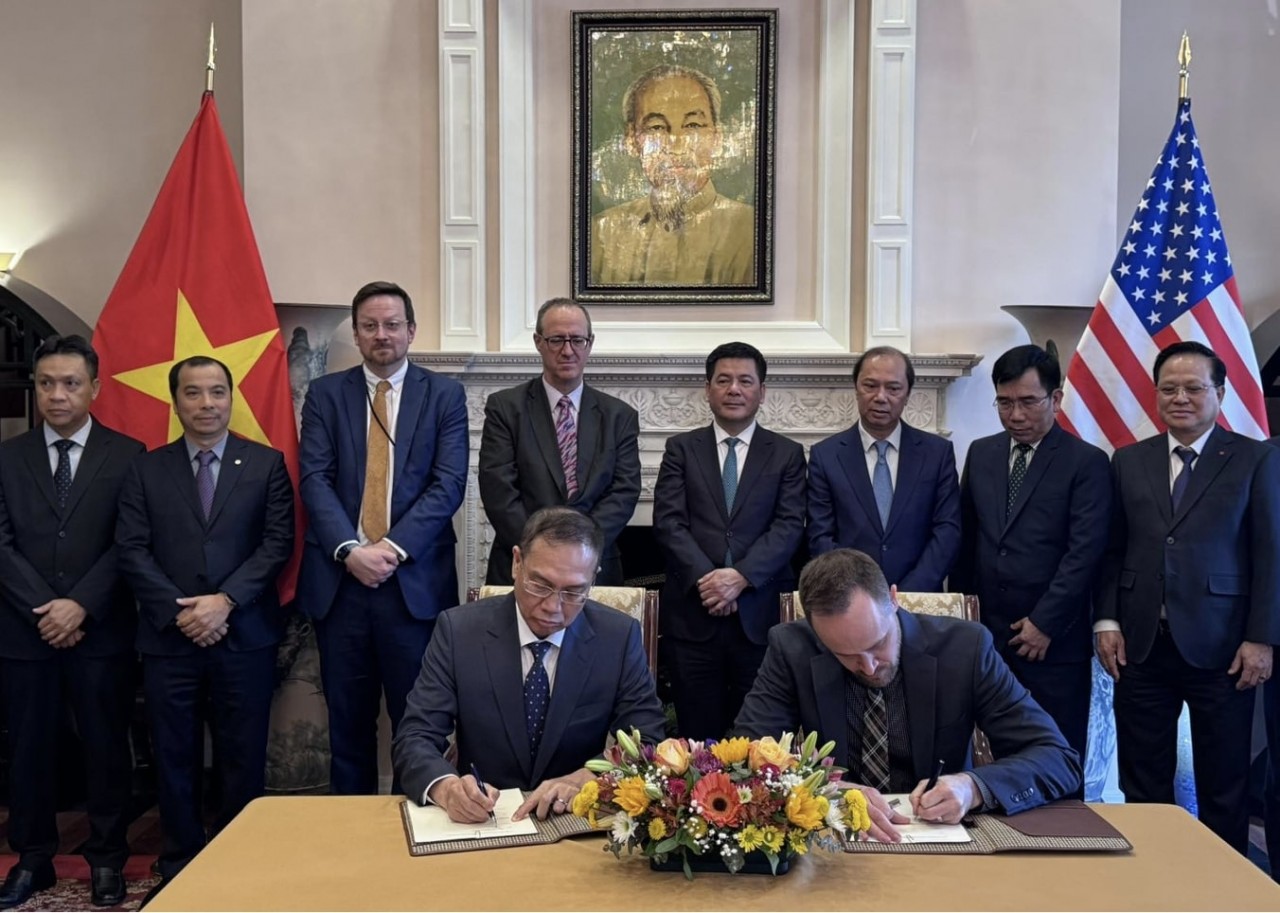

Greenfield & Associates, LLP - Professional partners in tax and financial accounting for Vietnamese businesses in the U.S. market

Economy

Economy

Roots of Enlightenment: India’s Timeless Buddhist Journey

Economy

Economy

India's Connect with Global South: A Bridge of Shared Heritage

Economy

Economy

Jaishankar, UN Special Envoy on Myanmar Julie Bishop Discuss Stability and, Refugee Situation

Economy

Economy

A diplomatic energy balance in a contested energy space

Economy

Economy

Strengthening Nalanda Buddhism: IHCNBT’s Historic First General Assembly

Economy

Economy

Rejecting Khalistan Separatism: Former Australian PM Tony Abbott’s Vision for Indo-Pacific Harmony

Economy

Economy