India and ASEAN facilitate instantaneous cross-border retail payments

The Reserve Bank of India (RBI) has taken a significant step in enhancing cross-border retail payments by joining Project Nexus, a multilateral initiative aimed at interlinking domestic fast payment systems (FPS). This collaborative effort, led by the Innovation Hub of the Bank for International Settlements (BIS), aims to connect the FPSs of four ASEAN countries - Malaysia, the Philippines, Singapore, and Thailand - with India as the founding members. This platform is expected to go live by 2026, streamlining cross-border payments to make them more efficient, faster, and cost-effective.

The Association of Southeast Asian Nations, or ASEAN, is a composite made up of numerous economies with different economic systems and growth stages. Brunei's economy, despite its tiny size, is highly dependent on exports of petrol and oil. The economies of Cambodia and Laos are expanding, with an emphasis on clothing manufacture and agriculture. As the biggest economy in ASEAN, Indonesia has a wide range of exports, such as textiles, coal, and palm oil. Oil, gas, and electronics all make major contributions to Malaysia's varied economy. Myanmar's economy is growing, and its natural resources and agricultural sector have promise.

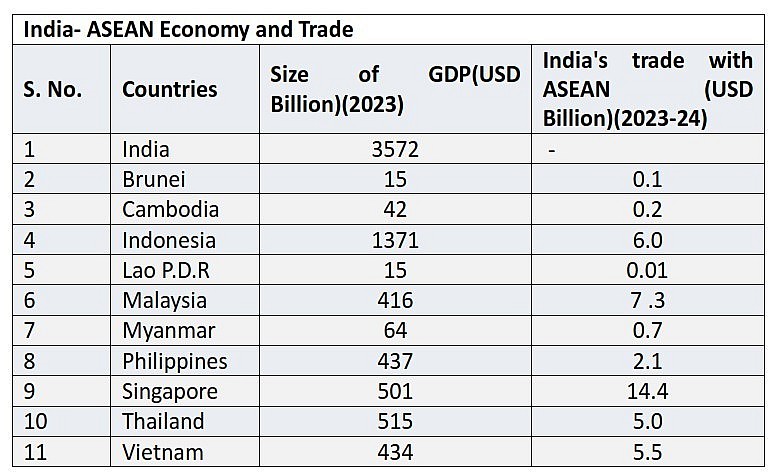

India's trade with ASEAN countries demonstrates the economic interdependencies and mutual benefits of these partnerships. The following table provides a snapshot of the GDP of selected ASEAN countries and their trade with India in the fiscal year 2023-24:

|

The service industry in the Philippines is strong, especially in business process outsourcing. As a financial hub, Singapore is strong in exporting technology, banking, and finance. Thailand boasts a robust tourism, automobile, and electronics sector, contributing to its well-rounded economy. Vietnam's industrialization is accelerating, and electronics and garments being key exports.

Project Nexus's multilateral strategy broadens the scope of international cooperation while also improving the bilateral advantages of India's Unified Payments Interface (UPI) with each of the ASEAN member states. This project aims to promote commercial and economic relations by enabling rapid cross-border retail payments. Through the use of this platform, nations inside and outside of ASEAN can get access to more effective and frictionless financial transactions, fostering more global economic cooperation and integration. The Nexus platform brings several key benefits to the table:

1. Efficiency: The platform ensures speedy cross-border payment processing by linking domestic FPSs, cutting down on the time usually required for international transactions. For companies that depend on timely payments for goods and services, this efficiency is essential.

2. Cost Saving: High transaction fees are a common feature of traditional cross-border payment systems. By lowering these expenses, the Nexus platform seeks to lessen the financial burden on consumers and increase the affordability of international trade for small and medium-sized businesses (SMEs).

3. Enhanced Trade Relations: The platform will probably encourage more companies to participate in international trade by making payments simpler and faster, which will boost economic relations between India and the ASEAN nations. Stronger economic relationships and higher trade volumes may result from this.

4. Financial Inclusion: By offering a simple and convenient means of making international payments, the Nexus platform has the potential to attract a greater number of individuals into the official financial system. This inclusiveness can promote economic growth in underdeveloped areas.

India's Trade with ASEAN

India's trade ties with ASEAN nations reached significant levels in the fiscal year 2023–2024, indicating close economic relations. For example, commerce between India and Singapore was valued at USD 14.4 billion, placing it among the top trading partners. Malaysia came in second with USD 7.3 billion in trade. Significant commerce with India was also conducted by Thailand and Indonesia, totaling USD 5.0 billion and USD 6.0 billion, respectively.

India is a major exporter of petroleum products, engineering items, jewellery and gems, organic chemicals, and pharmaceuticals to ASEAN nations. India's industrial and manufacturing sectors depend heavily on these exports. On the other hand, ASEAN nations provide India with a substantial amount of technology, machinery, mineral fuels, and edible

oils for import. Not only does this import-export dynamic promote economic interdependence, but it also propels technological and industrial progress in India.

Being a prominent financial hub, Singapore imports large amounts of machinery, pharmaceuticals, and petroleum goods from India. In addition, it exports equipment, electronics, and organic chemicals to India, underscoring the mutually beneficial relationship between the two economies. Malaysia is a significant partner that imports pharmaceuticals, machinery, and refined petroleum from India and exports natural rubber, electronic equipment, and palm oil to India.

Indonesia and Thailand, with their substantial trade volumes, play pivotal roles in India's trade landscape. Indonesia's exports to India include coal, palm oil, and organic chemicals, while India exports refined petroleum, automobiles, and cereals to Indonesia. Thailand's exports to India consist of machinery, electronics, and rubber, whereas India exports pharmaceuticals, textiles, and chemicals to Thailand.

Vietnam has been a major trading partner, purchasing chemicals, steel, and machinery from India and exporting electronics, textiles, and footwear. Despite their lower trade quantities in comparison to other ASEAN nations, the Philippines and Myanmar nevertheless add to the varied commercial landscape by importing and exporting minerals, machinery, and agricultural items.

It is anticipated that the Nexus platform launch will further strengthen these commercial ties. The platform aims to enhance the efficiency and affordability of cross-border payments, hence stimulating increased trade with ASEAN nations by enterprises. Higher trade volumes and a more integrated economic environment will result from this. Better business conditions will draw in more capital and create an atmosphere that is favorable to economic expansion.

In broad strokes, the Nexus platform is a revolutionary move towards enhancing economic cooperation between India and ASEAN nations and modernizing cross-border financial systems. The platform tackles important cost and efficiency concerns by enabling instantaneous retail payments, which encourages stronger trade and economic ties. As a result of the ASEAN countries' varied economic systems and India's increasing economic might, there will be substantial benefits for both parties and increased economic integration.

In a nutshell, the Nexus platform's success will act as a template for other areas, showing how international trade and economic progress can be promoted by multilateral cooperation in financial technology. Monitoring the platform's effects on trade dynamics and economic development will be essential after it goes live in order to make sure that it keeps up with the changing needs of both consumers and enterprises.