India’s Foreign Exchange Reserves Grow Strength to Strength

Forex reserves are crucial for ensuring economic stability and resilience in a globalized world. These reserves provide a vital buffer against external shocks, enabling central banks to intervene in currency markets to stabilize exchange rates and maintain confidence in the domestic currency. FOREX support balance of payments dynamics, ensuring a country can meet its international obligations without resorting to drastic measures. Additionally, robust reserves enhance a nation’s credibility in the eyes of investors and lenders, lowering borrowing costs and attracting foreign investments. Moreover, forex reserves serve as a tool for implementing effective monetary policy, allowing central banks to regulate liquidity, manage exchange rates, and control inflation. Forex reserves play a multifaceted role in safeguarding economic well-being, underlining their importance in today’s interconnected financial landscape.

The components of forex reserves represent a diversified portfolio that provides stability and flexibility to a nation’s monetary authorities. Foreign currency assets form the primary component, consisting of holdings in currencies such as the US dollar, euro, yen, and others, which serve as liquid reserves to facilitate international transactions and maintain exchange rate stability. Gold reserves, a traditional store of value, offer additional security and confidence in times of economic uncertainty. Special Drawing Rights (SDRs), created by the IMF, supplement reserves by providing a supplementary international reserve asset that can be exchanged for freely usable currencies. The reserve position in the IMF represents a country’s holding of its own currency in the IMF’s pool of resources, providing additional liquidity and access to IMF financing in times of need. Together, these components form a robust framework for managing currency risks, supporting trade and investment flows, and ensuring stability in the global financial system.

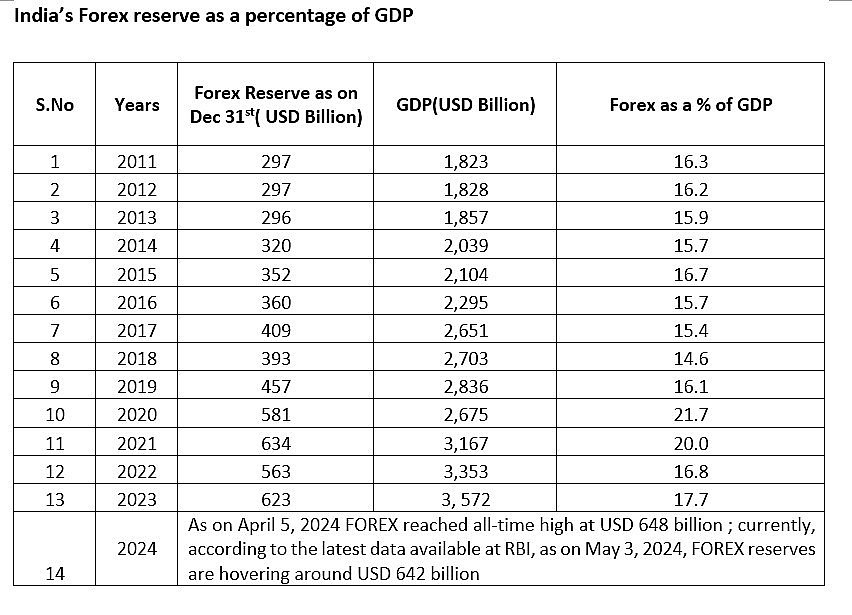

Over the last decade, India has seen a significant increase in its forex reserves. FOREX as a percentage of GDP has risen from 15.7% in 2014 to 17.4% by 2023. During the COVID-19 pandemic, these reserves peaked at 21.7%, the significant increase in India’s forex reserves during the COVID-19 pandemic highlights the prudent monetary and fiscal management undertaken by the country. Despite the unprecedented economic disruptions caused by the pandemic, India demonstrated resilience and stability in its financial management. This growth signifies India’s improved resilience against global economic volatility, offering stability to the rupee and bolstering investor confidence. The surge in forex reserves underscores India’s proactive approach to economic stability and its growing significance in the global economy.

In a recent development, India's forex reserves surged to a remarkable milestone, surpassing the total forex kitty. As of March 29, 2024, the reserves reached USD 645 billion, marking a significant achievement for the nation's economic stability. Continuing this upward trajectory, Also, India's foreign exchange reserves soared by USD 2.98 billion in the first week of the new financial year, reaching an unprecedented high of USD 648 billion as of April 5, 2024. This surge underscores India's robust financial management and highlights its growing strength in the global economic landscape.

Continuously implemented prudent policy reforms and strategic monetary policy measures are steadily enhancing India's Foreign Exchange Reserves. With foreign reserves now fortified at USD 641 billion(as on 3rd May 2024), India is poised to strengthen its position within the global economic framework. The robust FOREX reserves will offer the Reserve Bank increased flexibility in currency management, particularly amidst geopolitical challenges and fluctuations in global commodity prices.

The recent surge in forex reserves can be attributed to proactive measures undertaken by the Reserve Bank of India (RBI) amidst challenging economic conditions. In particular, the decision to increase gold reserves reflects a strategic move to diversify and strengthen the country's forex holdings, thereby enhancing resilience against external shocks. This surge in reserves has had a positive impact on investor sentiment, leading to increased confidence in the Indian economy. The rise in FDI, inflows from FIIs, and NRI remittances are indicative of this growing investor optimism and interest in India's economic potential.

In the aftermath of the COVID-19 pandemic, there has been a significant upswing in economic and business activities. India recorded robust GDP growth rates of 9.1% in 2021–22, 7.2% in 2022–23, and 7.6% in 2023–24, accompanied by a remarkable surge in capital markets. Projections indicate that India is poised to achieve the milestone of becoming a USD 4 trillion economy by FY 2024-25, followed by reaching USD 5 trillion by FY 2026–27, and further scaling up to a USD 7 trillion economy by 2030, with an ambitious long-term target of reaching more than USD 30 trillion by 2047.

India's journey towards economic resilience and global prominence is underscored by its proactive management of forex reserves and robust financial policies. The significant increase in forex reserves, particularly during the COVID-19 pandemic, reflects the country's prudent financial management and resilience in the face of economic challenges. This surge not only stabilizes the rupee but also bolsters investor confidence, driving inflows of foreign investments and remittances. Furthermore, India's ambitious growth projections signal its emergence as a powerhouse in the global economy, with targets set for achieving trillion-dollar milestones in GDP and solidifying its position as a major player on the world stage. As the nation continues to navigate through evolving economic landscapes, its proactive approach towards financial stability and growth sets a growth-promising trajectory for the future.

|