Southeast Asia's Smartphone Market Sees Lowest Shipment Since 2014: Report

|

| The Southeast Asia smartphone market falls 15% year-on-year in the second quarter of this year. Photo: Ha Noi Moi |

This led to an increase in old stock, stifling new initiatives and inventory from vendors, and a lackluster festive season, the report said, noting the decline in shipments marked the sixth consecutive drop in growth in Southeast Asia.

Despite a year-on-year decline of 26%, Samsung maintained its lead in Southeast Asia, shipping 4.2 million units, gaining 20% market share, driven by its new A-series models.

OPPO maintained its second position by shipping 3.4 million units and capturing a 16% market share. OPPO invested in boosting its Find and Reno series' brand visibility and expanded its operator footprint in markets like Malaysia and Thailand.

Xiaomi and Transsion both shipped 2.9 million units, each gaining 14% market share respectively. Xiaomi leveraged the new launch of its Redmi Note 12 series as a key volume driver.

Transsion expanded its market share by expanding in Malaysia, Thailand and Indonesia while solidifying its market leader position in the Philippines.

|

| Vietnam witnesses a shipment decline of 24% as it was highly exposed to the global economic slowdown. Photo: Vietnamnet |

Realme reclaimed the fifth spot, shipping 2.6 million units and capturing a 12% market share as it saw success with its new C-series launches.

“In Q2 2023, increased 5G adoption in operator-centric markets like Thailand and Malaysia drove some momentum, as telco operators seek cost-effective 5G devices for promotions,” said Le Xuan Chiew, Analyst at Canalys.

“Shipments fell by 7% and 11% year-on-year respectively in these markets, but the growing telco channel softened the decline. Affordable 5G remains a key driver for maintaining long-term share in telco-driven markets.”

Vietnam, being an export-driven economy, witnessed a shipment decline of 24% as it was highly exposed to the global economic slowdown.

“The market is expected to gain momentum in H2 2023 as channel inventory returns to healthier levels,” said Sheng Win Chow, Analyst at Canalys.

“The ramp-up of incentive programs and new high-end launches should increase retail sales Q3 2023 onward. The long-term outlook for Southeast Asia is intact and Canalys expects mid-single-digit growth in 2024. Expansion of the online channel will contribute largely to future growth as investments from e-commerce operators improve infrastructure, and timely payment and logistics will enable e-retailers to scale more efficiently. Increased marketing expenditure will spur demand by enabling more aggressive discounting. In addition, the region’s increasing disposable income from an expanding middle-class and young population entering the workforce are strong reasons to expect an improved landscape.”

|

| Affordable 5G remains a key driver for maintaining long-term share in telco-driven markets. Photo: Pandaily |

Last year, Vietnam was ranked 10th in the list of 10 countries with the largest number of 5G smartphones in the world, according to a report of Speedtest (of Ookla).

The company did not provide specific machine numbers for each country but noted that the results were obtained in the third quarter of 2022 (from July to September). At that time, many smartphones with 5G such as Apple iPhone 14 series, Samsung Galaxy Z Fold4, and Google Pixel 7 were not listed in some markets.

The top 10 countries with the most 5G phones in the third quarter are ranked in the order of the US, China, Brazil, Germany, Japan, Philippines, Thailand, South Africa, UK, and Vietnam./.

| Vietnam Among 10 Countries with the Highest Number of 5G Smartphones 5G smartphones are becoming more and more popular in Vietnam despite this new generation of mobile network technology has not been commercially deployed in the ... |

| OnePlus Confirms Launch Date for its Next Flagship Products NEW DELHI, INDIA - Media OutReach - 19 December 2022 - Global technology brand OnePlus announced today that The OnePlus Cloud 11 launch event will ... |

| Smartphone Exports Top $2 Billion in First 2 Months of 2023 In the first two months of 2023, India's mobile phone exports exceeded $2 billion, equivalent to over Rs16,500 crore, due to increased production and shipments ... |

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

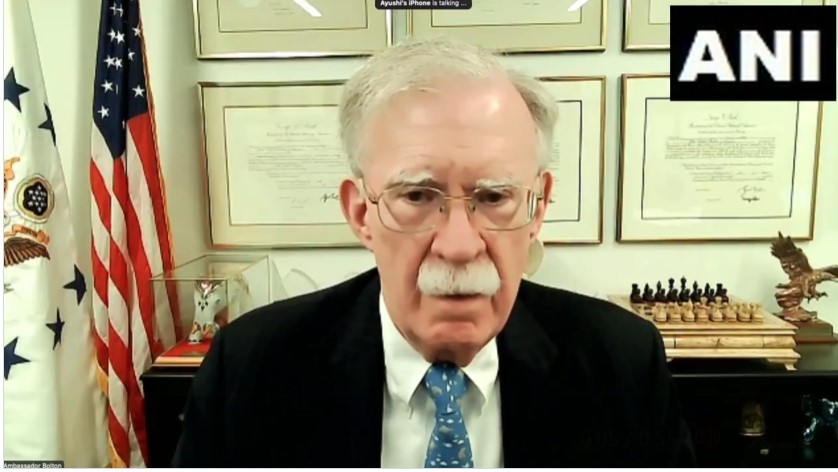

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World