Vietnam News Today (Jun 20): Vietnamese Goods Gain Larger Share on Domestic Market

| Vietnam News Today (Jun 20) notable headlines Optimizing UNCLOS 1982 to transform Vietnam into a powerful maritime country Vietnamese goods gain a larger share on domestic market Big countries set new tax rules, Vietnam has to weigh pros and cons Quang Ninh hopes for stronger investment, tourism links with Mozambique The press always one of frontline forces: PM Vietnam listed among countries with highest growth forecasts in 2022 Large room for Vietnam’s dairy farming industry to flourish Da Lat attracts tourists with colorful flowers Tourism promotes forest protection in Ba Be National Park |

|

| Offshore fishing fleet of Ninh Thuan province. Photo: Nguyen Thanh/VNA |

Optimizing UNCLOS 1982 to transform Vietnam into a powerful maritime country

A seminar running theme "Việt Nam – Đất nước nhìn từ biển” (Vietnam - the country seen from the sea) was held recently to celebrate the 40th anniversary of the signing of the 1982 UN Convention on the Law of the Sea (UNCLOS) and ten years of the enforcement of the Law of the Sea of Vietnam.

The event was co-hosted by the Commission for Information and Education of the Communist Party of Vietnam (CPV) Central Committee and Vietnam National Assembly Television.

At the seminar, the participants affirmed that December 10, 1982 marked an important legal event in the development of international law, with the birth of a legal document which is considered as the Constitution of the Seas and Oceans- the United Nations Convention on the Law of the Sea 1982 (UNCLOS).

The UNCLOS 1982 came into force on November 16, 1994. Four decades after its birth, the Convention is still valid. To date 167 countries have joined the Convention, of which 164 are members of the United Nations.

The UNCLOS 1982 laid the foundation for establishing a new international order at sea and balancing the interests of all developed and developing nations. It was the first Convention to define all territorial waters in the world.

The Convention is also seen as the charter for the establishment of all major international organizations on the sea such as the International Tribunal for the Law of the Sea (ITLOS), and the Commission on the Limits of the Continental Shelf (CLCS).

In particular, the Convention also provides a mechanism for the settlement of maritime disputes.

According to Professor Carl Thayer, an expert from Australia’s New South Wales University, the unique feature of UNCLOS is that it has established a compulsory mechanism for dispute settlement.

Emphasizing that Vietnam is a maritime country, with a coastline of more than 3,260 km, and 4,000 large and small islands, including Hoang Sa (Paracel) Truong Sa (Spratly) archipelagos, Associate Professor. Dr. and Ambassador Nguyen Hong Thao, right after national reunification in 1975, only two years later, Vietnam had dispatched a delegation of officials to attend United Nations conferences on the Law of the Sea and absorb the spirit of the draft document of the UNCLOS 1982.

This has contributed to the fact that on May 12, 1977, Vietnam became the first Southeast Asian nation to issue a declaration on the territorial sea, contiguous zone, exclusive economic zone, and continental shelf. Then, when the nation promulgated the Law of the Sea in 2012, it had more than 500 legal documents at the central and local levels related to State management of seas and islands, Thao said.

After the UNCLOS 1982 was ratified, Vietnam was one of the first 107 countries to sign and soon carry out ratification procedures, cited VOV.

On June 23, 1994, the National Assembly of the Socialist Republic of Vietnam issued a resolution on the ratification of the UNCLOS 1982.

By ratifying the Convention, Vietnam has demonstrated its will to exercise its rights within the limits permitted by the Convention, while taking into account the freedoms of other states.

Regarding the Law of the Sea of Vietnam, the delegates affirmed that becoming a member of the UNCLOS 1982 requires the country to have a separate and comprehensive law on the sea.

In that context, on June 21, 2012, the Law of the Sea of Vietnam was approved by the National Assembly of Vietnam and it took effect from January 1, 2013.

The Law of the Sea of Vietnam is built on the basis of the provisions of UNCLOS and international law. This is viewed as an important milestone in the development of Vietnam's legal system in general, as well as in the process of building and fine-tuning legal regulations related to seas and islands.

During the course of the seminar, the delegates gave their opinions and suggestions for Vietnam to promote the value of the UNCLOS 1982), and the 2012 Law of the Sea of Vietnam in order to realize the goals set by the Eighth Conference of the 12th Party Central Committee on sustainable development of Vietnam's marine economy to 2030, with a vision to 2045.

Vietnamese goods gain a larger share on the domestic market

Vietnamese goods are benefitting from better quality, diverse designs and competitive prices to establish their place on the domestic and global markets.

Textile and garment makers are among those succeeding in conquering the domestic market. Firms such as Garment 10, Viettien, Duc Giang, Nha Be, Hoa Tho, Hanosimex and TNG have gained a firm foothold, and each recorded annual domestic revenues in hundreds of billions of VND.

Cao Huu Hieu, General Director of the Vietnam National Textile and Garment Group (Vinatex), said 10 years ago, Vietnamese consumers preferred foreign garment products due to their cheap prices, but now many people have selected domestically produced clothing with better quality.

Vinatex, apart from Hanoi, has opened more fashion shopping centers in other localities like Ho Chi Minh City in the south and Da Nang in the central region to give consumers easier access to quality domestic products, he noted.

A recent study by market research company Nielsen revealed that after the Covid-19 pandemic, 76 percent of Vietnamese consumers showed a preference for local products, especially branded, quality and healthy items.

This trend is partly attributed to the fact that Vietnamese goods now have higher competitiveness thanks to better quality and reasonable prices. As a result, they are enjoying increasing presence in different distribution channels, according to VNA.

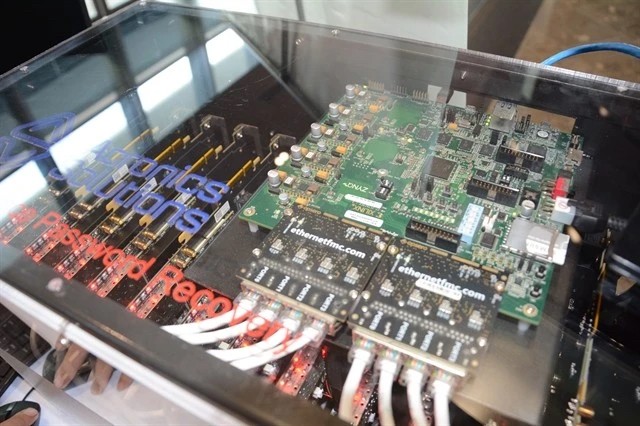

|

| Vietnamese goods are making up a big proportion at supermarkets. Photo: VNA |

According to the Ministry of Industry and Trade (MoIT), Vietnamese goods make up at least 90 percent of the products sold in supermarkets, for example 90-93 percent at Co.opmart, 90-95 percent at Satra, and 95 percent at Vissan. The rate stands at 60 percent and above at traditional markets and convenience stores.

Le Viet Nga, Deputy Director of the MoIT’s Domestic Market Department, said businesses are now aware that to win consumer trust, they have to improve product quality, boost sci-tech application, and use advanced management measures to reduce production costs, with better quality, designs, and after-sale services.

Many enterprises which have long focused on exports are now paying more attention to the domestic market and offer products that meet high standards for local buyers. They have also managed to develop their own domestic distribution networks in Vietnam.

Businesses are also aware of the need to build and protect their brands, and actively take part in major events promoting Vietnamese goods among domestic consumers and overseas Vietnamese, Nga said.

She noted that to help enterprises expand their domestic presence, relevant agencies will continue to effectively carry out different programs and plans to promote trade, develop supporting industries, and assist firms to step up sci-tech application, thereby raising their productivity and competitiveness.

In particular, one of the focuses is encouraging companies to conduct digital transformation by utilizing e-commerce, e-payments, and modern logistics methods so they can further engage in domestic and foreign distribution chains. Besides, high-quality Vietnamese goods and services favored by consumers will also be promoted as national brands, the official added.

Big countries set new tax rules, Vietnam has to weigh pros and cons

The fact that rich countries want to impose a global minimum tax of 15 percent has put Vietnam in an awkward situation. Vietnam would be able to collect bigger taxes but this could discourage multi-national enterprises.

New rules aim at eliminating tax havens

On October 8, 2021, the global cooperation forum on Base Erosion and Profit Shifting (BEPS) program, of which Vietnam is a member, issued a statement on the two-pillar framework to address challenges arising from the digital economy with the consensus of 136 member countries.

Of the two pillars, Pillar 2, which sets the global minimum tax rate of 15 percent, is expected to be applied from 2023.

The principle allows investing countries to levy a 15 percent minimum tax rate on income that enjoy tax reductions or exemption in the investment receiving countries.

The General Department of Taxation (GDT) said this would have a big impact on developing countries like Vietnam.

According to GDT Deputy General Director Dang Ngoc Minh, the principles have been figured out, but many issues remain questionable - for example, which fields would be excluded and which fields would apply the principle.

Many large corporations register their investments in Vietnam through companies established in “tax shelters” such as Hong Kong, Singapore and British Virgin Islands, where the tax rate is zero percent.

With the new policy, Vietnam will have to be sure that the corporate income tax is equal or higher than the minimum tax rate of 15 percent applied all over the globe.

Analysts say that the new rule targets these tax havens.

American enterprises invest in Vietnam, but they make the investment from tax havens such as British Virgin Islands. When the rule is applied, if Vietnam offers tax remissions for investors, the US will impose a tax of 15 percent on projects of this kind.

Possible impact

According to GDT, of 36,500 foreign invested projects in Vietnam, 3 percent of the projects/enterprises enjoy tax incentives. They are mostly large projects located in industrial zones (IZs) and economic zones (EZs). As such, the 15 percent minimum tax rate would only target 3 percent of enterprises in Vietnam.

The general corporate income tax (CIT) in Vietnam is 20 percent, while the real CIT that foreign invested enterprises (FIEs) have to pay is 12.3 percent. Meanwhile, large foreign corporations bear tax rates of between 2.75 percent and 5.95 percent (many foreign invested projects can apply the preferential CIT rate of 10 percent only for the whole life of projects, and enjoy tax exemption for 4 years and 50 percent reduction in the next nine years).

As such, the tax rates applied to them are very low if compared with the 15 percent minimum tax rate that countries plan to apply,” Minh explained.

The global minimum tax policy would reduce the efficiency of Vietnam’s tax incentives offered to FIEs. The representative of GDT warned that if Vietnam continues to offer tax incentives, it would directly “sponsor” developed countries such as the EU and US.

The new policy would also affect existing FDI (foreign direct investment) projects in Vietnam and reduce the power of new investors.

“When considering a new project, investors would consider many factors, including tax incentives. They will thoroughly consider the minimum tax policy,” he said.

The attraction of large-scale hi-tech FDI projects would face challenges, which would affect Vietnam’s export and international payment balance, reported VNN.

“Large corporations like Samsung make products for export. When exporting products, their forex reserves are left in Vietnam. If there is no such item, this will immediately affect the payment balance,” he explained.

However, challenges always come with opportunities. If the global minimum tax rate policy is applied, Vietnam would be able to collect higher taxes from Vietnamese outward investment projects as well as investment projects in Vietnam.

In the long term, Vietnam, as a member of BEPS, will have to raise the CIT rate to 15 percent at minimum and this would bring higher collections.

The current tax collection from FIEs is VND206 trillion with an average tax of 12.3 percent. If the tax rate is raised to 15 percent, Vietnam would collect hundreds of trillions of dong from the removal of tax incentives.

Nguyen Mai, chair of the Vietnam Association of Foreign Invested Enterprises (VAFIEs), also said that the global minimum tax policy would bring both challenges and opportunities and that Vietnam needs to take initiative in joining the new mechanism and take full advantage of the new opportunity to accelerate its reform and create a new driving force to attract higher-quality FDI.

Quang Ninh hopes for stronger investment, tourism links with Mozambique

Nguyen Xuan Ky, member of the Party Central Committee and Secretary of the Quang Ninh Provincial Party Committee, hosted a reception on June 18 for President of the Assembly of Mozambique Esperanca Laurinda Francisco Nhiuane Bias, who has been paying an official visit to Vietnam.

The visiting leader said she is greatly impressed with Quang Ninh, a province known for its outstanding socio-economic achievements in Vietnam in the recent past.

She noted Mozambique currently ranks 11th among the 72 countries and territories Vietnam is investing in. Meanwhile, bilateral cooperation in agriculture is being promoted with many joint projects carried out to share experience and provide training in agriculture and aquaculture, cited VNA.

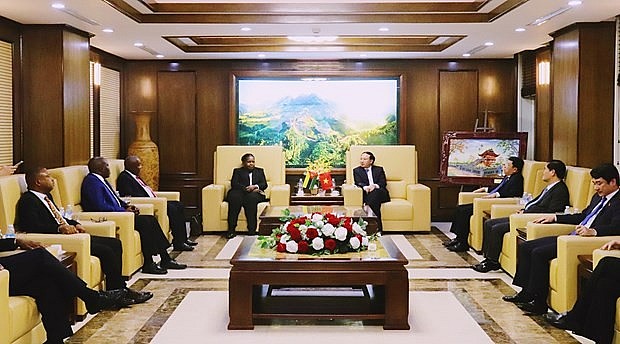

|

| The meeting between Secretary of the Quang Ninh Party Committee Nguyen Xuan Ky (right) and President of the Assembly of Mozambique Esperanca Laurinda Francisco Nhiuane Bias on June 18. Photo: VNA |

With the long-standing friendship and multifaceted cooperation, the leader expressed her hope that the trip will help further enhance Mozambique’s relations with Vietnam in general and Quang Ninh in particular, especially in agriculture and telecommunications technology.

The President added that she hopes more Vietnamese enterprises will come to invest and do business in Mozambique.

Welcoming the parliamentary delegation from Mozambique, Ky provided his guests with a brief introduction of Quang Ninh’s potential, advantages, and socio-economic situation, highlighting that the province now owns many conditions for attracting and bringing success to foreign investors.

He also voiced his hope that after the visit, the President of the Mozambican Assembly will help encourage many businesses, investors, and people from her country to invest and travel in Vietnam, including Quang Ninh.

On this occasion, the host official invited the Mozambican delegation to visit Ha Long Bay, a renowned world natural heritage site in the province.

The press is always one of the frontline forces: PM

The press is always one of the frontline forces and has helped people to know, understand, follow, believe and do, Prime Minister Pham Minh Chinh said.

He made the statement when chairing a meeting on Friday between standing Government members and leaders of press agencies on the occasion of the 97th Vietnam Revolutionary Press Day (June 21).

PM Chinh said that in the context of complicated developments in the region and the world, as well as the Covid-19 pandemic, Vietnam has still gained many important achievements; protecting its independence, sovereignty and territorial integrity; ensuring political security and social order and safety; and stabilized the macro-economy.

The achievement of these results has seen the contributions by press agencies, and journalists, PM Chinh said.

He used the occasion to express his thanks to journalists nationwide and extend his best wishes to all of them who are working at home or abroad, VNS reported.

|

| Prime Minister Pham Minh Chinh meets with leaders of press agencies. Photo: VNS |

The Government leader said he hoped that Vietnamese journalists will exert efforts to contribute more to the Party’s cause and people’s happiness and to build a government that has integrity and discipline, and take drastic and effective actions, and build more and more powerful and prosperous nation.

He also asked the press to continue being a ‘sharp weapon’ in the fight against corruption, negative phenomena and wastefulness which has been carried out drastically, concertedly, and effectively by the Party under the leadership of General Secretary Nguyen Phu Trong.

The PM shared with the difficulties facing the press and journalists nationwide, such as regimes and policies for journalists, and facilities and equipment for press operations.

“The Government supports and makes efforts to strengthen the potential of the press in accordance with its competence, the guidelines of the Party, policies and laws of the State; in line with the practical requirements and the capacity of the country, within the general development of the professions", the leader said.

| Vietnam News Today (Jun 19): Vietnam logs 699 new Covid-19 infections on June 18; Vietnam, Cambodia continue efforts in border demarcation and marker planting; Eureka ... |

| Vietnam News Today (Jun 18): Hundreds Covid-19 Vaccination Points Set Up for Booster Doses Vietnam News Today (Jun 18): Vietnam confirms 723 new Covid-19 infections; Hundreds Covid-19 vaccination points set up for booster doses; Vietnam stays active in epidemic ... |

| Vietnam News Today (Jun 17): Apple’s iPhones Likely to be Assembled in Vietnam Vietnam News Today (Jun 17): Covid-19: 774 cases added to national caseload on June 16; Apple’s iPhones likely to be assembled in Vietnam; Hanoi targets ... |

Recommended

National

National

Shangri-La Dialogue 22: Vietnam Highlights Some Issues of Ensuring Stability in a Competitive World

National

National

Vietnam News Today (Jun. 2): Vietnamese Trade Mission Sounds Out Business Opportunities in United States

National

National

Vietnam News Today (Jun. 1): Vietnamese, Japanese Firms Foster Partnership

National

National

Vietnam News Today (May 31): Vietnam Strongly Supports Laos’s National Development

National

National

Vietnam News Today (Jun. 4): Vietnam - Promising Candidate for Southeast Asia’s Next Powerhouse

National

National

Vietnam News Today (Jun. 3): PM Pham Minh Chinh to Attend UN Ocean Conference, Visit Estonia, Sweden

National

National

Vietnam News Today (May 30): Vietnam, Venezuela Reinforce Ties Through People-to-people Diplomacy

National

National