Vietnam’s Economic Recovery Remains Strong Despite Global Uncertainties: WB

|

| Vietnam's industrial production continued a robust expansion of 10.4% year-on-year. Photo: doanhnhantrevietnam.vn |

Industrial production continued a robust expansion of 10.4% year-on-year while retail sales rebounded with growth of 4.2% month-on-month and 22.6% year-on-year, suggesting strong recovery of private consumption.

About 173,000 international visitors arrived in May, about 70% higher than in April and the highest figure since April 2020, yet still less than 16% of pre-pandemic levels.

Sales of consumer services, which were hit harder than the sales of goods last year, experienced a stronger rebound (41% year on year compared to 18.3% year on year, respectively).

The rebound was due to the booming accommodation and catering services, which increased by nearly 70% and were 12.4% higher its pre-pandemic level three years ago. Travelling also tripled compared to a year ago although it was about 60% lower than its pre-pandemic level.

Amid heightened global uncertainties, export growth slowed and imports growth plateaued.

FDI commitments were $879 million in May, the lowest level since September 2020, and nearly 50% lower than a year ago. This is the fourth consecutive month of decline, reflecting the heightened economic uncertainties caused by the protracted war in Ukraine and the health-related lockdowns in China.

|

| Thanks to strengthening domestic demand, total revenue collection increased by an estimated 29.4% in May. Photo: VietnamPlus |

On the other hand, FDI disbursement remained strong in May, up 8.5% year on year, marking a six-month expanding streak.

CPI inflation edged up from 2.6% in April to 2.9% in May driven by a rise in gasoline and diesel prices, which were 54.5% higher in May than a year ago. Producer price inflation showed signs of easing in May, with both input costs and output prices rising at the slowest rates in three months.

Credit growth remained strong at 16.9% year on year while overnight interbank interest rates dropped sharply from 1.73% in April to 0.33% as of the end of May.

Thanks to strengthening domestic demand, total revenue collection increased by an estimated 29.4% year on year in May, keeping the budget in surplus for the fifth consecutive month.

The WB recommended that Vietnamese authorities should be vigilant about inflation risks associated with continuing rise in prices of fuels and imports, which may dampen the ongoing recovery of domestic demand. Temporary support including targeted transfers should be considered to help poor households weather the price surge.

As the commodity price shock appears to be mainly affecting oil and fuels, with passthrough to transport costs, temporary targeted subsidy for main gasoline and fuel users (such as truckers) could also be considered to alleviate hardship and blunt the inflationary pressures.

Investing in alternative energy production would reduce the economy’s dependence on imported fuels in the medium term and promote greener growth.

HSBC lowers Vietnam’s inflation forecast to 3.5%

|

| It is likely that inflation will sometimes surpass the State Bank of Vietnam’s ceiling rate of 4% in the second half of 2022 but only temporarily.. Photo: Ha Noi Moi |

HSBC has lowered its forecast on Vietnam’s inflation rate in 2022 to 3.5% from its earlier prediction of 3.7% due to the stable domestic food prices, which is expected to help curb the country’s headline inflation.

The bank explained that the inflation risk in ASEAN countries has increased since the beginning of 2022, leading to a high rise in both core and headline inflation rates compared to the period before Covid-19 broke out.

However, the impacts are different on each country, and inflation pressure in Singapore, Thailand and the Philippines has become heavier, while in Vietnam, Malaysia and Indonesia, inflation has been under good control.

But headline inflation is likely to increase sharply in the second group soon, especially in the context of rising energy prices, it predicted, adding that although the world oil price has "cooled down" compared to the peak in March, it is still at a high level, while the price of natural gas continues to increase gradually.

In Vietnam, energy price inflation has also persisted for long. Transport prices hit a record high, surpassing food inflation to become the main driver of Vietnam's headline inflation, it said. Despite rising energy prices, food inflation has remained moderate, helping control the overall increase in headline inflation so far, it added.

HSBC also increased its inflation forecast for Thailand, Singapore, Indonesia, and the Philippines.

After considering both inflation and growth, HSBC also revised its forecast for Vietnam's operating interest rates in 2022.

While the current inflation rate remains below the 4% target, the bank expects persistent high energy prices will continue to push overall prices up. It is likely that inflation will sometimes surpass the State Bank of Vietnam’s ceiling rate of 4% in the second half of 2022 but only temporarily. That situation will likely cause the bank to adjust interest rates by 50 basis points in the third quarter of 2022 before raising the rates three times, 25 basis points each time in 2023, the bank said/.

| Vietnam's Economy After One Year Journey of UKVFTA Opportunities for Vietnamese export businesses are huge in the context that the UK economy will recover quickly after the pandemic, demand for consumer goods increases, ... |

| WB: Vietnam's Economy Continues to Show Resilience The World Bank (WB) on March 11 released its brief updating Vietnam’s economic development in March, stating that the economy continues to show resilience and ... |

| Business Times: Vietnam – A New Asian Tiger Vietnam is expected to accelerate its economic recovery from the pandemic this year after having recorded a 2.6% increase in gross domestic products (GDP) in ... |

Recommended

National

National

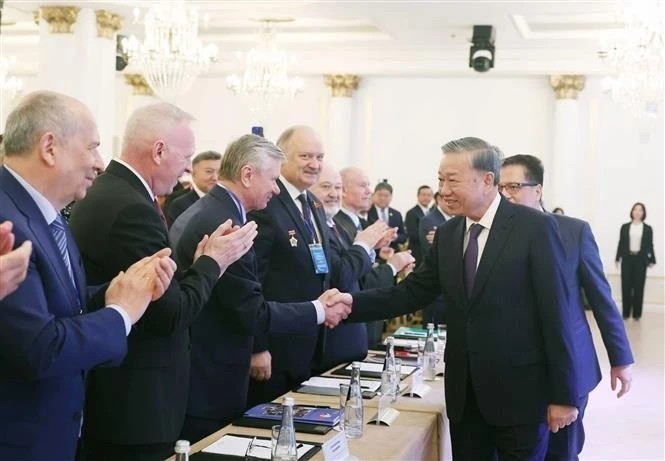

Vietnam News Today (May 12): Party General Secretary Meets With Russian Experts, Intellectuals

National

National

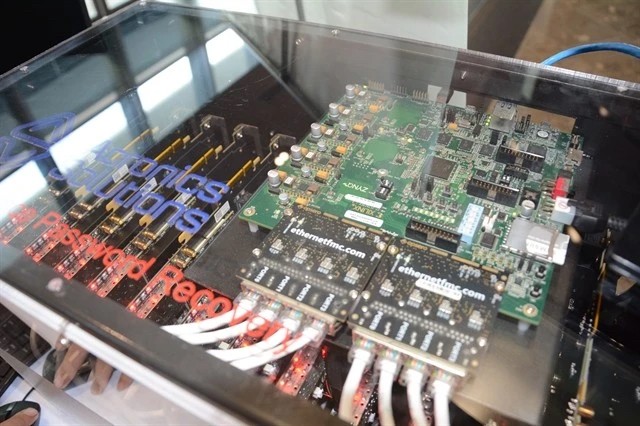

Vietnam News Today (May 11): Vietnam, Austria to Boost Cooperation in High-Tech Development, Innovation

National

National

Vietnam News Today (May 10): Vietnamese Peacekeepers Honored with UN Medal in South Sudan

National

National

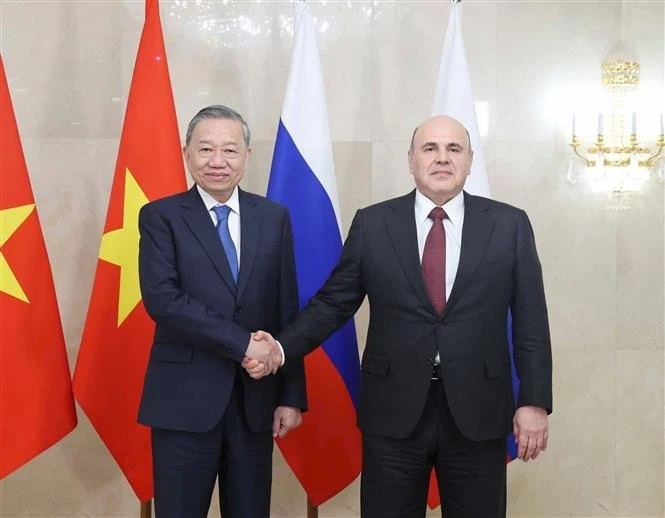

Vietnam News Today (May 9): Vietnam Ready to Work With Russia to Elevate Relations

National

National

Vietnam News Today (May 8): Vietnam Remains Committed to UNCLOS

National

National

Vietnam News Today (May 7): Vietnam Hosts Over 7.67 Million International Visitors in First 4 Months

National

National

Vietnam News Today (May 6): Party Leader To Lam Meets Vietnamese Expatriates in Kazakhstan

National

National