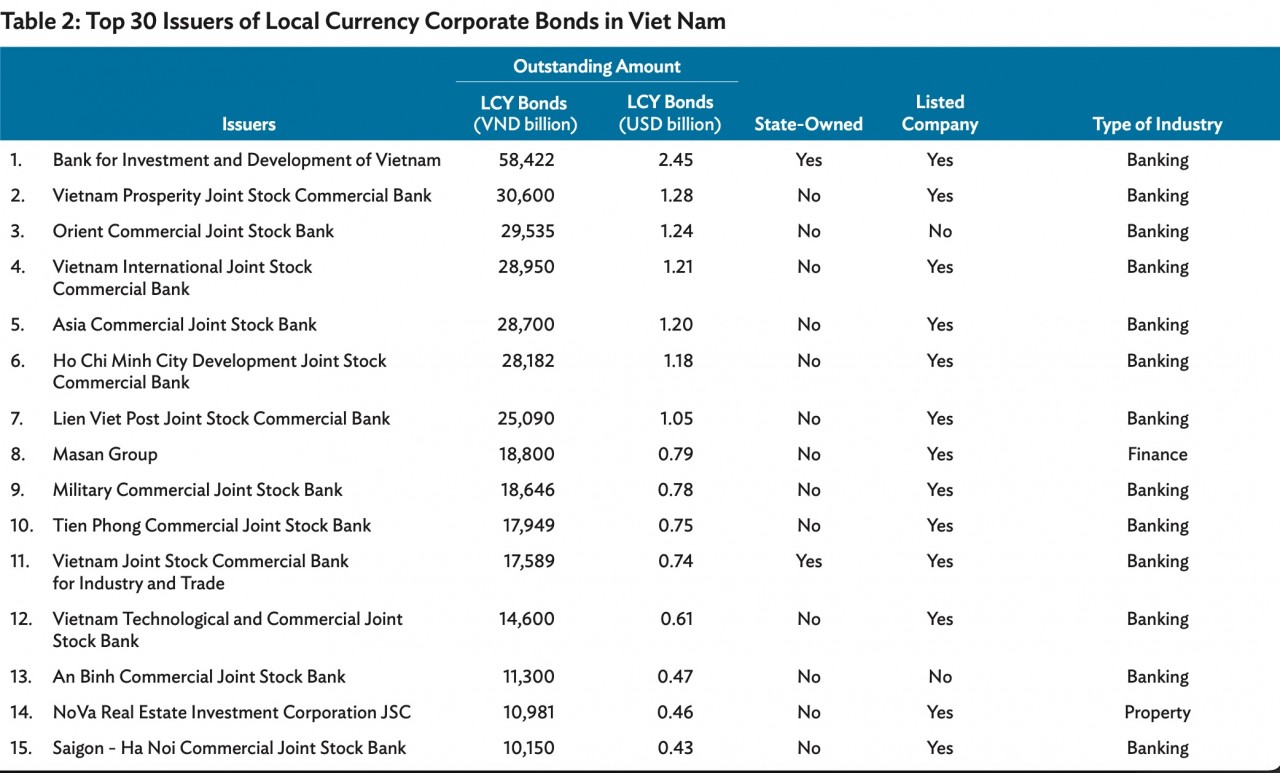

ADB: 27 out of 30 Top Issuers of Corporate Bonds in Vietnam Are Privately-Owned

|

| According to the ADB report, the markets of Vietnam and Singapore recorded the fastest year-on-year growth, while the markets of Thailand and the Republic of Korea showed the slowest year-on-year expansions over the same period (Photo: VNA). |

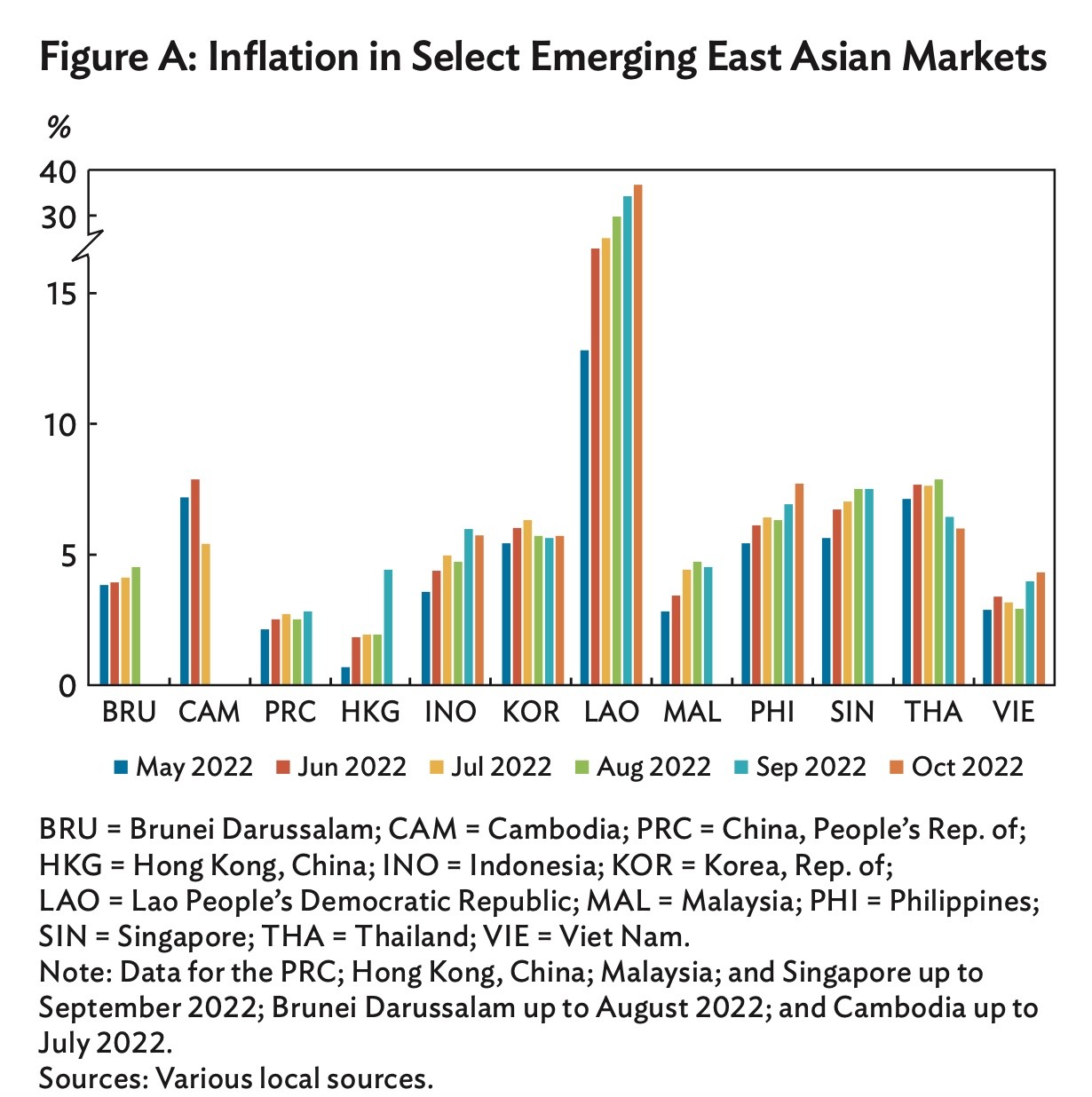

Emerging East Asia’s local currency (LCY) bond market reached a size of USD22.0 trillion at the end of September. Regional currencies fell against the US dollar, equities dropped, and risk premiums widened between August 31 and November 4, according to the latest update of Asia Bond Monitor, prepared by ADB’s Economic Research and Regional Cooperation Department.

On a year-on-year basis, growth in emerging East Asia’s LCY bond market also slowed to 12.5% in the third quarter of 2022 from 14.0% in the previous quarter. According to the ADB report, the markets of Vietnam and Singapore recorded the fastest year-on-year growth, while the markets of Thailand and the Republic of Korea showed the slowest year-on-year expansions over the same period.

Portfolio outflows in most markets

Portfolio outflows were also seen in most regional bond markets. Global inflation, slower growth in China, and economic fallout from the Russian 'military operation' in Ukraine continued to threaten the region's short-term prospects.

"Financial conditions in emerging East Asia weakened at a faster pace in September and October than in the first eight months of 2022, due to the aggressive tightening by the US Federal Reserve," said ADB Chief Economist Albert Park. "However, the region remains largely resilient so far, despite various headwinds."

Bond yields climbed in emerging East Asia between 31 August and 4 November, driven by higher bond yields in major advanced markets as well as higher interest rates due to domestic monetary tightening. In September and October, central banks in major member economies of the Association of Southeast Asian Nations, as well as the Bank of Korea, raised policy rates to quell elevated inflation and safeguard financial stability amid aggressive monetary tightening by the Federal Reserve.

Despite monetary tightening in the region, inflationary pressure persisted in most emerging East Asian markets on rising food and energy prices, and, to a lesser extent, pending supply chain disruptions. The dimming economic outlook in the region and tightening financial conditions weighed on investment sentiment across the region.

Vietnam has the sharpest rise overall in government bond yields

|

| Screenshot from ADB's Asia Bond Monitor November 2022 report. |

Among regional bond markets, Vietnam and the Philippines recorded the sharpest rise overall in government bond yields.

Vietnam’s 2-year and 10-year bond yields rose 172 bps and 139 bps, respectively, during the review period.

Expert's review concluded that the rise of bond yields in Vietnam was largely driven by the State Bank of Vietnam’s two consecutive 100 bps hike of the refinancing rate on 23 September and 25 October to keep inflation below the full-year target of 4.0%.

In particular, rear-to-date consumer price inflation in Viet Nam recorded 3.6% in August and further climbed to 4.0% in September and 4.2% in October.

All nine markets included in the report posted positive year-on-year growth, although five (China, South Korea, the Philippines, Singapore, and Vietnam) experienced slower year-on-year expansions in the third quarter of 2022 than in the second quarter.

Also in the third quarter, the markets of Hong Kong (China); Indonesia; and Malaysia experienced faster year-on-year growth than in the previous quarter while Thailand grew at the same pace. The report said that aggressive monetary tightening in advanced economies has pushed up bond yields and worsened the downturn of financial conditions in emerging East Asia, cited from VNA.

In the third quarter, the sole issuance of government-guaranteed bonds during the quarter came from the Vietnam Bank for Social Policies’ issuance of 3-year bonds amounting to VND500 billion (US $20 million).

Bond issuance activities from the corporate segment was dragged down by the implementation of tighter regulations for the issuance and trading of private placement issues (The majority of corporate bonds in Vietnam are issued via private placement).

|

| Screenshot from ADB's Asia Bond Monitor November 2022 report. |

Over the third quarter, ADB observed that the bond issuance activities from the corporate segment slowed, with total debt sales amounting to VND48.5 trillion. This represented a contraction of 29.8% quarter-on-quarter in Q3 2022, reversing the strong 120.5% gain posted in the preceding quarter.

| US Helps Improve Vietnam's Private Sector Competitiveness USAID just launched a project to improve private sector competitiveness in Vietnam |

| Aircraft and Weapons on Display at Kim Chinh Private Museum in Ninh Binh Kim Chinh Private Museum (Kim Son District, Ninh Binh Province), stores and displays thousands of artifacts such as planes, missiles, and many other weapons from ... |

| New Initiative Launched to Promote Private Sector-Driven Sustainable Growth By 2025, the initiative will deliver technical assistance packages to 300 businesses, of which 10 will receive additional assistance to pilot, implement or scale their ... |