Carmakers eye expanding assembly operations in Vietnam over tightened imports

Many automobile makers have announced plans to increase investment for vehicles manufactured or assembled in Vietnam as stricter import rules continue to prevent them from shipping completely built-up products to the Southeast Asian country.

An employee is seen at a car assembling plant in Vietnam. Photo: Tuoi Tre

Vietnam’s car imports have dropped significantly since the government’s Decree 116, which requires all models of imported vehicles to obtain a Vehicle Type Approval certification issued by authorities in the exporting country, took effect on January 1.

Few shipments have since been eligible for customs clearance to Vietnam as most countries that sell cars to the nation do not use such a document and it will take time for exporters to enact measures to meet those requirements.

In the week ending February 1, only 23 automobiles, including 20 tractor trucks and three cars with fewer than nine seats, were imported into Vietnam, a clear example of Decree 116 impacts.

In the same period, Vietnam imported nearly US$15.2 million worth of automobile parts and components, compared to the mere $1.66 million value of the 23 car shipments.

While automobile producers have announced that they would cease exports to Vietnam for good and called on relaxing the regulations, they have also silently prepared to boost their assembly operations in the country as a temporary solution to the issue.

Carmakers eye expanding assembly operations in Vietnam over tightened imports

Workers are seen at a car assembling plant in Vietnam. Photo: Tuoi Tre

‘Last resort’

Toyota Vietnam is considering a plan to assemble several product lines, particularly the Fortuner, in Vietnam instead of Indonesia if the situation in the wake of Decree 116 remains unchanged.

The automaker has had to resort to this option as it is cheaper to sell imported products than the domestically assembled ones, Pham Anh Tuan, head of strategy planning with Toyota Vietnam, admitted to Tuoi Tre (Youth) newspaper on Sunday.

“We are still watching market development and will only start assembling domestically if we can no longer import the products,” he said.

In January, Mitsubishi Motors notified different local regulatory agencies of their plan to build the second automobile plant in Vietnam.

Last year the existing Mitsubishi Motors factory sold 6,672 units, making up nine percent of Vietnam’s market share.

The second $250 million facility, with a total capacity of 50,000 units a year, is expected to start production by 2020 and generate some 1,000 jobs.

Carmakers eye expanding assembly operations in Vietnam over tightened imports

Workers are seen at a car assembling plant in Vietnam. Photo: Tuoi Tre

During the introduction of its Ford Ecosport 2018 model earlier this month, Ford Vietnam also confirmed that it is studying the market to start manufacturing and assembling two new product lines in the country.

Even the Ford Ecosport may be assembled in Vietnam so the automobile can enjoy a zero tariff for imported spare parts as per Decree 125.

A carmaker must have a total production of 16,000 units, including 6,000 cars with nine seats and fewer, to be eligible for the zero percent tax.

Vietnam’s automaker Truong Hai is also speeding up construction for a $528.63 million facility to make Mazda-branded cars.

Planned for commission late next month, the plant is capable of producing 50,000 units a year during its first phase, and is said to be Mazda’s most modern facility in Southeast Asia./.

VNF/TTO

Most read

Recommended

Economy

Economy

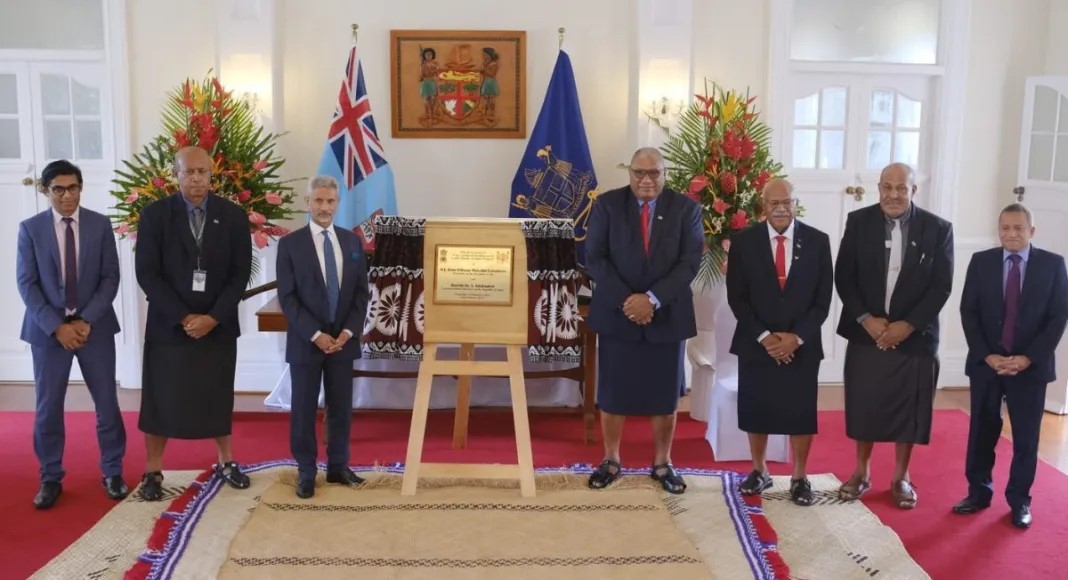

FIPIC at 10: India’s strategic engagement with the Pacific Island countries

Economy

Economy

UKVFTA Opens up New Opportunities for Vietnamese Coffee Exports

Economy

Economy

Fostering Digital Economic Growth and Technological Innovation in Vietnam

Economy

Economy

Ho Chi Minh City Hosts Forum to Boost Vietnam-Laos Economic Cooperation

Popular article

Economy

Economy

Vietnamese Farm Produce Makes Strong Inroads into Malaysian Markets

Economy

Economy

Forum Discusses Way to Expand Vietnam-Cambodia Cooperation in Digital Economy

Economy

Economy

Vietnam Achieves Highest Export Growth to Singapore in 11 Months

Economy

Economy