Cashless payment rising in Vietnam and its growth prospects

| Ha Noi encourages cashless payment, e-commerce |

| Online payments flourish in Vietnam during COVID-19 |

| Ha Noi encourages cashless payment, e-commerce |

According to Visa, E-Commerce spending in Vietnam has increased by 40 percent over the past year. A Visa’s Consumer Payment Attitudes study found that the number of respondents in Việt Nam saying they have used in-app mobile payments increased to 44 percent last year. This study also found that those saying they had tried contactless card payments increased to 32 percent, and QR payments 19 percent.

|

|

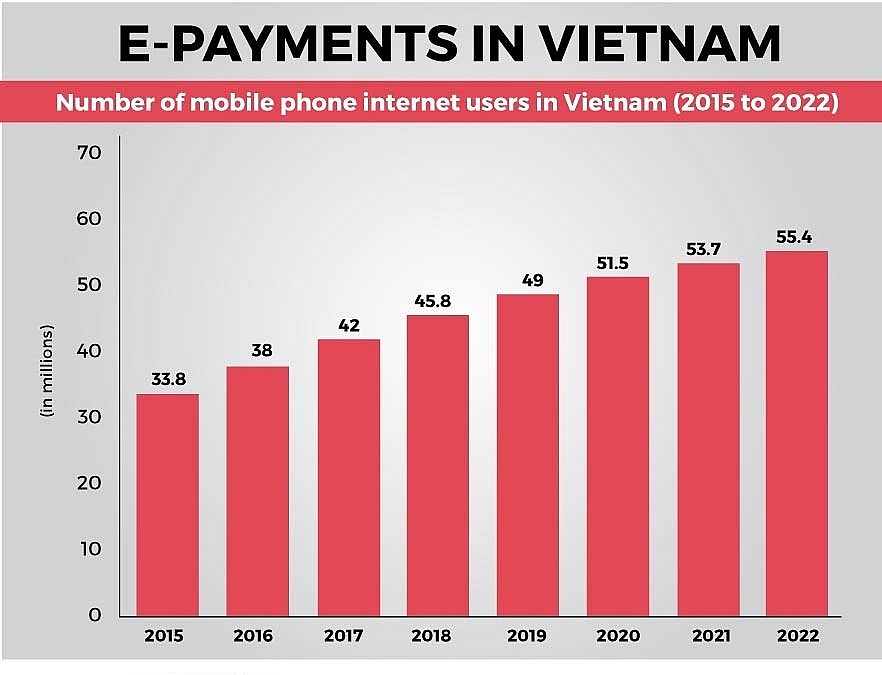

According to Statista, in 2017, the number of e-payments in Vietnam grew by 22 percent from the previous year and was valued at US$6.1 billion. This figure is forecasted to grow to US$12.3 billion by 2022, reports the Asian Post.

|

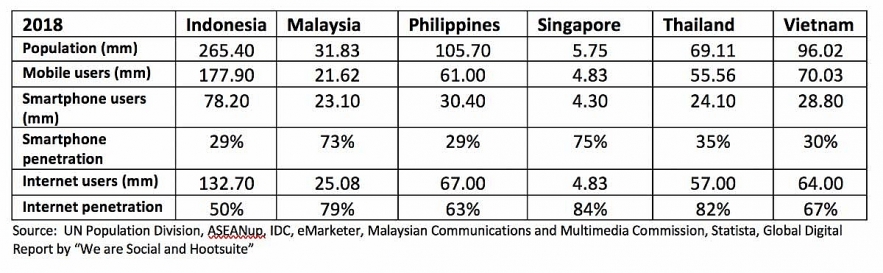

According to the Hanoi Times the increasing internet adoption, evident by Vietnam’s 140 telecommunication subscribers per 100 people, and the nearly 60 million subscribers of 3G and 4G. In fact, 99% of districts and wards have 4G coverage. As such, this number is expected to increase to 80 million subscribers in 2020.

The Deputy Prime Minister said this is an ideal environment to facilitate e-payment, as well as other financial and e-commerce services across the country, which brings benefits for enterprises and all Vietnamese while facilitating the way for a cashless society.

Earlier this year, the government approved a project on increasing the use of cashless payments for public services. By 2020, the government expects the ration for cashless payments for the following services to be:

· Social Welfare payments 20%

· Hospital fees (major cities) 50%

· Electricity & Water payments 70%

· University tuitions 70%

· Tax payments 80%

Bùi Sỹ Lợi, Vice Chairman of the National Assembly’s Committee on Social Affairs, said that the government is keen to promote cashless payments. By limiting the amount of cash in circulation, the government lowers its costs for the printing and management of cash, which in turn, makes the government more efficient.

With the encouragement of the Government along with the development of modern technology and the retail sector, digital payment growth is expected to be dramatically increased in the future.

| Vietnam is fastest growing market for m-payments |

| Vietnam intensifies non-cash payments for public services |

| FPT University acccepts Bitcoin payment |

Recommended

Economy

Economy