Malaysia: the highest E-Wallet usage In Southeast Asia

|

| Malaysia leads mobile wallet usage in South-East Asia. Photo: Rojak Daily |

According to Mastercard Impact Study 2020, Malaysia leads its neighbors in Southeast Asia in the usage of mobile and digital wallets. Based on the results, the usage in Malaysia is at 40% followed by the Philippines at 36%, and Thailand at 27%. Surprisingly, the high-tech country of Singapore only came in fourth, with only 26% of their citizens prefer paying with e-wallets. The study was based on inputs gathered from 10,000 consumers and business professionals across 10 markets in the Asia Pacific.

As the Malaysia market edition results showed, COVID-19 that led to wide movement restrictions had driven momentum in Southeast Asia towards the digital economy by necessitating rapid adoption of e-commerce, digital payments and preference for online activities, reported The Star.

The report indicated that, although most countries in the region have started to lift restrictions, it is likely that some of these trends and habits would remain in the new normal.

|

| Digital is the way to go. Photo: Rojak Daily |

According to SoyaCincau, one of the most influential tech sites in Malaysia, it was reported that nearly half of consumers surveyed in Malaysia have increased their online shopping activities. Other activities that saw an increase include surfing the internet for news and entertainment (75%), online video streaming (57%), social networking (55%), and home delivery for food or groceries (50%).

64% of Malaysians that participated in the survey have said that they will continue to shop online in the same frequency even after restrictions are lifted. 54% would continue to go for home deliveries and 45% have said that they would continue to work from home.

Apart from eWallets, Malaysians have also shifted to contactless debit cards (26%) and contactless credit cards (22%) for payments. Cash usage has declined by 64% since the beginning of the COVID-19 pandemic and other neighboring countries are also experiencing the same trend. Cash usage has declined by 67% in Singapore, 64% in the Philippines, and 59% in Thailand.

|

| In a recent study, Mastercard identified a rise in online shopping in the region. Photo: kr-asia.com |

The survey has found that Malaysia’s digital activities such as online shopping and usage of digital payments were also higher than other markets in Southeast Asia. For the month of April, Malaysians were doing 18% more cashless payments including mobile and QR payments compared to 16% in the Philippines and 15% in both Singapore and Thailand. 24% of consumers in both Malaysia and Singapore have also said that they were using contactless payments more.

Malaysia’s digital activities especially online shopping and usage of digital payments, were also higher in comparison to other markets in Southeast Asia. In April, consumers in Malaysia were doing 18% more cashless payments including mobile and QR payments, as compared to 16% in the Philippines, 15% in Singapore, and 15% in Thailand.

On the contactless cards (both debit and credit), Malaysia tied with Singapore with approximately 24% of consumers in both markets saying they were using contactless payments more.

eanwhile, Southeast Asia Emerging Markets, Mastercard division president Safdar Khan said the company was committed to using the power of data to enable businesses of all sizes to adapt and evolve alongside consumers’ changing needs, preferences and behaviors through e-commerce tools, increasing contactless payment limits, and spearheading the shift to contactless across the region.

"By putting consumer sentiment and concerns at the core of all decisions, businesses and governments will be able to move with greater confidence from this current situation, and mitigate the adverse impact of future crises,” he said to The Star.

|

| With a population of 600 million and good mobile saturation, Southeast Asia is becoming a battleground for e-wallet companies. Photo: The Star |

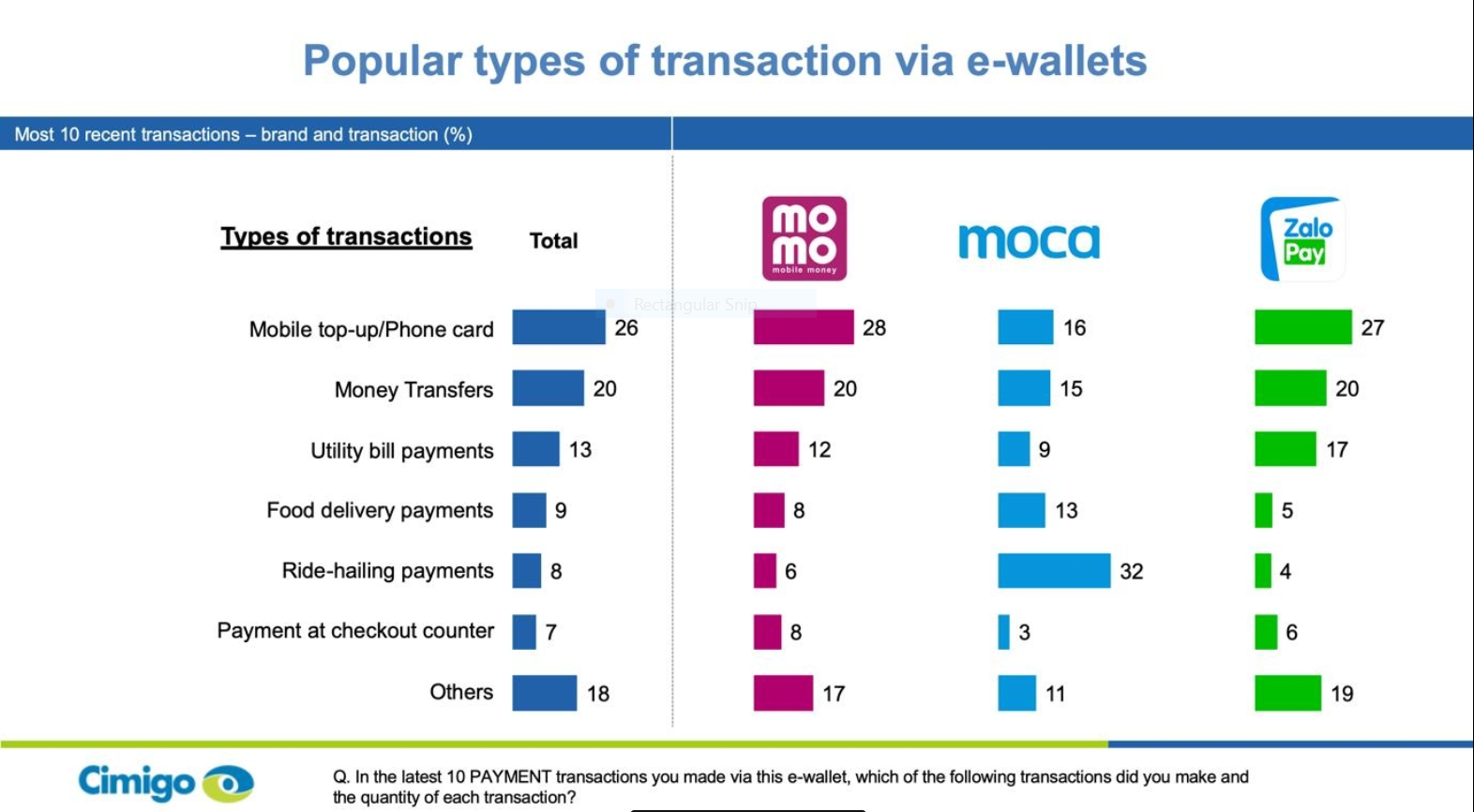

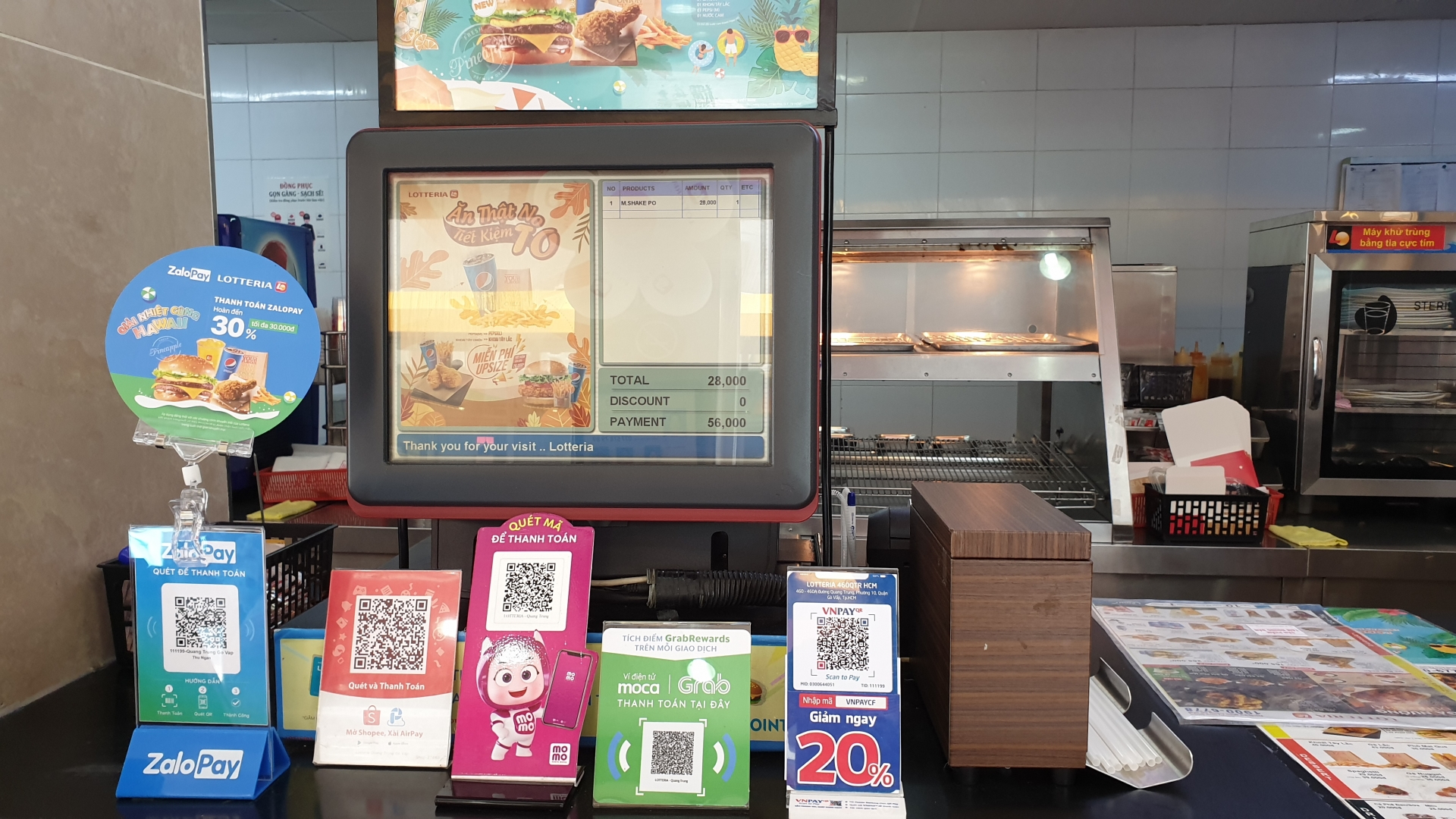

| In 2019, research on e-wallet users’ perception and behavior towards popular e-wallet brands in Vietnam conducted by Cimigo Market Research shows that Momo, Moca, and ZaloPay are the three most popular e-wallets in the two main cities of Vietnam. These three e-wallets account for more than 90% of e-wallet users. The result also shows that e-wallets are mostly used for mobile top-up, money transfer, utility bill payments, food delivery, and ride-hailing payments. Momo and ZaloPay are mostly used for mobile top-up, money transfer, and utility bill payments. Moca is mostly used for ride-hailing payments, mobile top-up, money transfer, and food delivery payments.

Based on the results, there are six key factors driving the choice of an e-wallet brand, including user-friendly interface; different and regular promotions; safety and security; ability to be linked to various banks; ability to use in many places; and diversity in payment services. In Vietnam, the ratio of cashless payments to the total means of payment has only reached 14%, according to the Government and the State Bank of Vietnam. This context provides e-wallet brands a potential environment to grow and gradually change the cash payment habits of the population, which helps contribute to the government's direction of developing cashless payments in Vietnam. With the on-going COVID-19 outbreak, the State Bank of Vietnam has also advised people to limit cash usage and increase the use of digital payments in order to reduce the risk of infection. Cashless payment, including e-wallets, are becoming increasingly popular and are welcomed by more users. (Source: VIR)

|

| E-commerce becomes the key factor in Vietnam retail industry As sales decline under the impact of Covid-19, e-commerce and online shopping grew sharply, supporting the trading activities of many stores during the outbreak. |

| Ha Noi encourages cashless payment, e-commerce Ha Noi plans to encourage the use of cashless payments as part of efforts to further develop e-commerce in the city. |

| Vietnam’s e-commerce market to surpass US$17bn in 2023: GlobalData Vietnam's e-commerce market is projected to hit US$17.3 billion in 2023, from US$9.4 billion in 2019, according to a forecast from data and analytics company ... |