Indian investment in Australia show steady growth but room for expansion

|

| Image: Prime Minister Anthony Albanese with Gopal Baglay, High Commissioner of India to Australia (Source: X) |

A new PwC report, Bridging Continents: Inbound Investment from India to Australia, highlights how Indian companies have increasingly looked to Australia for mergers and acquisitions (M&A), particularly in technology, industrials, retail, consumer goods, and healthcare. While these investments have driven growth and innovation, the overall scale remains modest compared to other destinations, suggesting untapped potential.

|

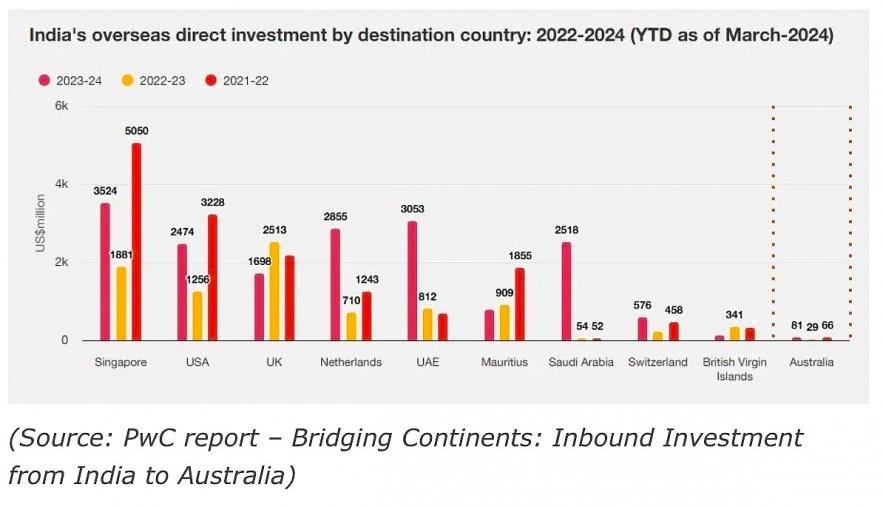

India’s outbound investments have grown significantly, with businesses seeking international expansion through M&A to access new markets and advanced technologies. Between 2022 and 2024, Singapore emerged as the top destination, attracting US$4.8 billion, followed by the UAE (US$3.4 billion) and the Netherlands (US$3 billion).

|

Australia, however, ranked only 22nd, receiving just US$0.1 billion in Indian investments. This shift in overseas investment destinations highlights India’s increasing preference for locations offering tax incentives and regulatory ease, such as Mauritius, Singapore, and the British Virgin Islands, over traditional resource-rich markets like Australia.

|

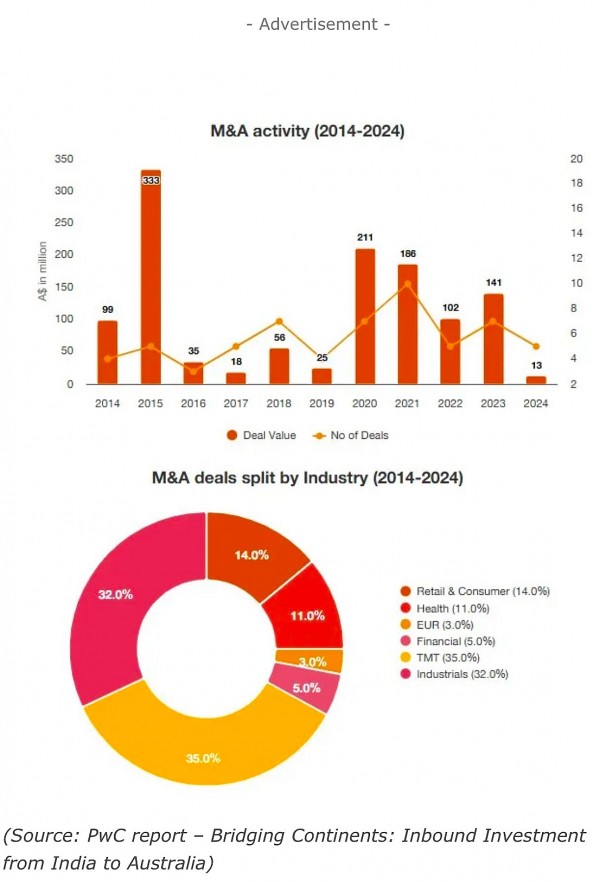

Despite this, Indian investment in Australia has seen notable peaks in certain years, driven by key acquisitions. The largest deal occurred in 2015, when Strides Arcolab acquired Arrow Pharmaceuticals for A$265 million, contributing to a total Indian investment of A$333 million that year. Other major transactions include HCL’s A$182.8 million acquisition of DWS Ltd in 2020 and Wipro’s A$153.7 million purchase of Ampion in 2021. Over the past decade, India has completed 63 inbound M&A transactions in Australia, with deal activity peaking in 2018, 2020, and 2021. However, investment levels have fluctuated, with a sharp decline in 2016 and lower activity in recent years.

India currently ranks 15th among foreign investors in Australia, indicating steady but limited engagement compared to larger players. The technology, media, and telecommunications (TMT) sector has been the primary focus of Indian investment, accounting for 35% of deals and a total deal value of A$408 million over the past decade. The sector’s strong performance aligns with Australia’s growing digital economy and the increasing demand for advanced technology solutions.

With India’s economic and strategic ambitions on the rise, its investment relationship with Australia is expected to grow, supported by stable market conditions and government initiatives to ease overseas investment restrictions. By fostering stronger business-to-business and government-to-government ties, both nations stand to benefit from a more dynamic and mutually rewarding investment partnership in the years ahead.

Recommended

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

Popular article

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World

India strikes back at terrorists with Operation Sindoor

World

World

India sending Holy Relics of Lord Buddha to Vietnam a special gesture, has generated tremendous spiritual faith: Kiren Rijiju

World

World