Oil price today: Cheaper than bottled water, below zero for first time in history

|

| Oil price today: Cheaper than bottled water, below zero for first time in history |

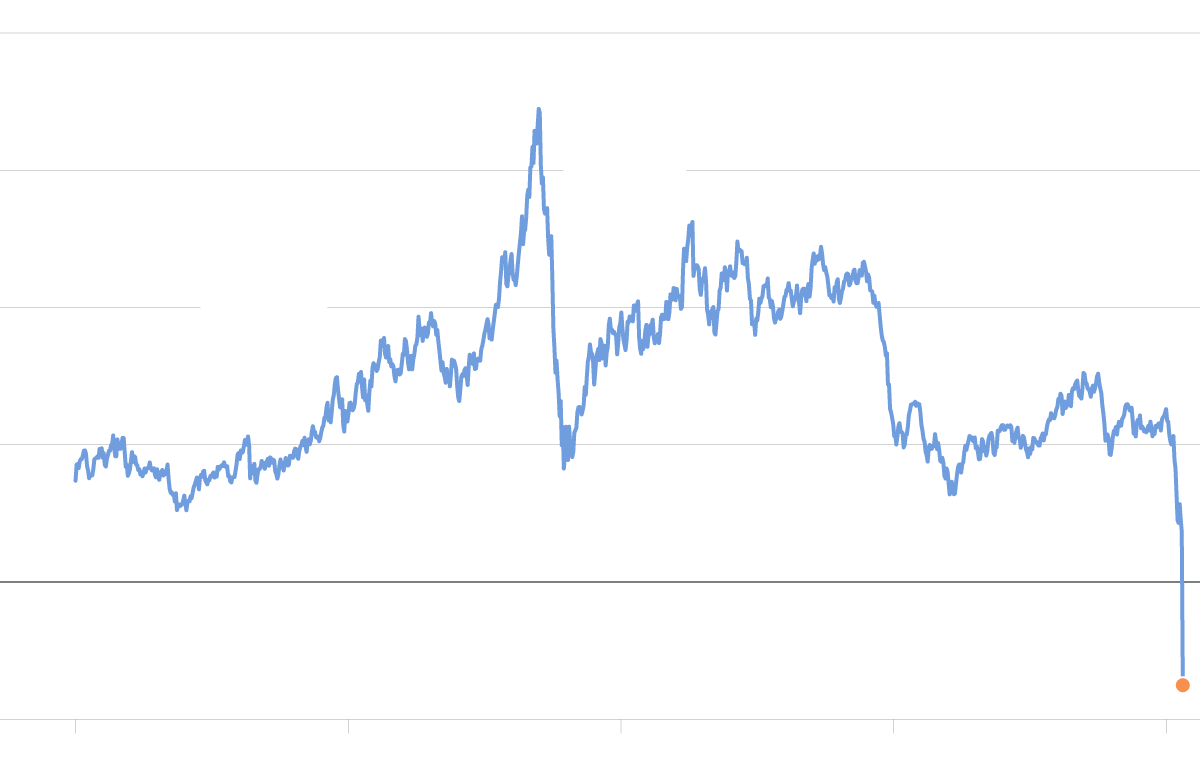

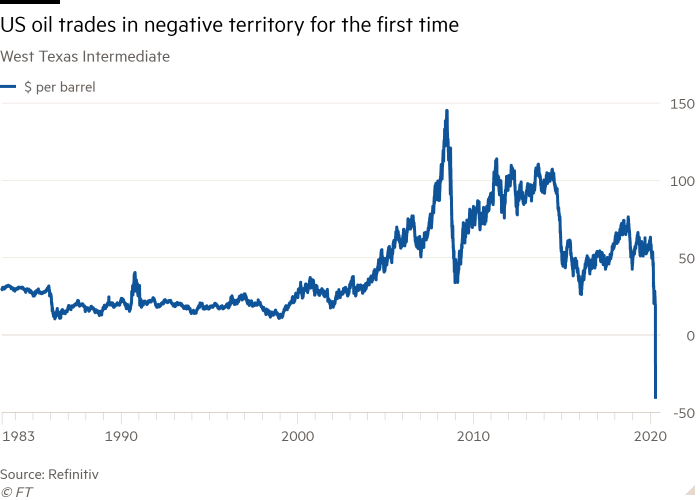

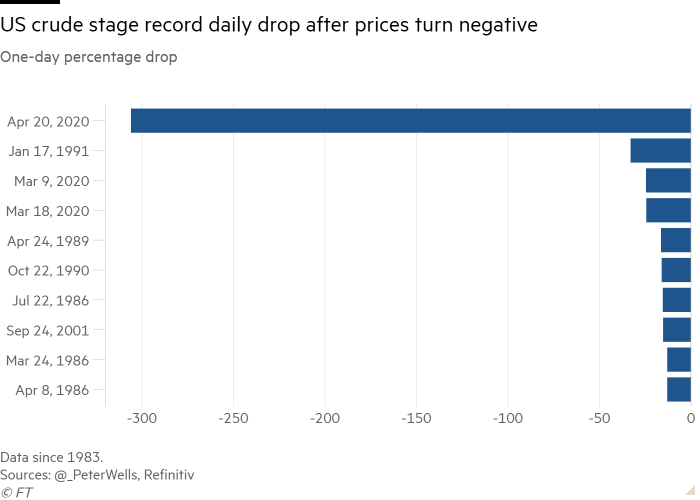

Oil price futures plunged below zero for the first time on Monday as demand for energy collapses amid the coronavirus pandemic and traders sought to avoid owning crude with nowhere to store it.

Stocks were also slipping on Wall Street in afternoon trading, with the S&P 500 down 1.2%, but the market's most dramatic action by far was in oil, where benchmark U.S. crude for May delivery plummeted to negative $35.20, as of 2:30 pm.

The price of the main U.S. oil benchmark fell more than $50 a barrel to end the day about $30 below zero, the first time oil prices have ever turned negative.

|

| WTI crude, adjusted for inflation, plotted weekly. Source: Refinitiv. Chart: The New York Times |

Much of the drop was chalked up to technical reasons - the May delivery contract is close to expiring so its trading volume was light, which can exacerbate swings. But prices for deliveries even further into the future, which were seeing larger trading volumes, also plunged. Demand for oil has collapsed so much that facilities for storing crude are nearly full.

| Last week, Saudi Arabia, Russia and other petroleum-exporting nations agreed to cut their oil production by 9.7 million barrels per day through June, in an attempt to ease the market glut. However, some oil markers still continued to nosedive, with Brent loosing almost 6% of its value on |

|

Benchmark U.S. crude oil for June delivery, which shows a more "normal" price, fell 16.5% to $20.90 per barrel. Big oil producers have announced cutbacks in production in hopes of better balancing supplies with demand, but many analysts say it's not enough.

"Basically, bears are out for blood," analyst Naeem Aslam of Avatrade said in a report. "The steep fall in the price is because of the lack of sufficient demand and lack of storage place given the fact that the production cut has failed to address the supply glut."

Halliburton swung between gains and sharp losses, even though it reported stronger results for the first three months of 2020 than analysts expected. The oilfield engineering company said that the pandemic has created so much turmoil in the industry that it "cannot reasonably estimate" how long the hit will last. It expects a further decline in revenue and profitability for the rest of 2020, particularly in North America.

Brent crude, the international standard, was down $2.46 to $25.62 per barrel. .

| What is the lowest oil price in history? Oil hit $0.01 a barrel before falling to as low as negative $40 and eventually settling at negative $37.63, the lowest level recorded since the New York Mercantile Exchange began trading oil futures in 1983. |

|

Why the oil price is falling?

Oil Prices Keep Slipping As Demand Drops By Record Amounts The specific sell-off on Monday is partly due to market mechanics, because the May futures contract for West Texas Intermediate is about to expire. During normal times, traders just sell these contracts and roll on to those of future months.

Is it a good time to invest in oil stocks?

Oil stocks have crashed as a result, falling far lower than the rest of the stock market, even after its recent rebound. ... To put it plainly, with limited exceptions, right now is not a great time to buy oil stocks.

Stock close lower

In the stock market, the mild drops ate into some of the big gains made since late March, driven lately by investors looking ahead to parts of the economy possibly reopening as infections level off in hard-hit areas. Pessimists have called the rally overdone, pointing to the severe economic pain sweeping the world and continued uncertainty about how long it will last.

The Dow Jones Industrial Average was down 444 points, or 1.9%, to 23,797. The Nasdaq was down 0.4%.

Energy stocks took the sharpest losses, with those in the S&P 500 down 3.7%. But the losses were widespread, with all 11 sectors in the index down.

"The government can declare whatever they want in terms of encouraging people to get out and do stuff," said Willie Delwiche, investment strategist at Baird. "Whether or not broad swaths of society do that remains to be seen. It's going to take seeing people start to get out and do stuff again. That will be the necessary positive development, not just declaring getting things open."

More gains from companies that are winners in the new stay-at-home economy helped limit the market's losses Amazon rose 1.7%, and Netflix jumped 4% as people shut in at home buy staples and look to fill their time. Both were close to setting record highs. .

In Tokyo the Nikkei 225 fell 1.1% after Japan reported that its exports fell nearly 12% in March from a year earlier as the pandemic hammered demand in its two biggest markets, the U.S. and China.

The Hang Seng index in Hong Kong lost 0.2%, and South Korea's Kospi fell 0.8%.

European markets were modestly higher The German DAX was up 0.5%, the French CAC 40 was up 0.7% and the FTSE 100 in London gained 0.7%.

In a sign of continued caution in the market, Treasury yields remained extremely low. The yield on the 10-year Treasury slipped to 0.62% from 0.65% late Friday. It started the year near 1.90%. Bond yields drop when their prices rise, and investors tend to buy Treasurys when they're worried about the economy.

Stocks have been on a generally upward swing recently, and the S&P 500 just closed out its first back-to-back weekly gain since the market began selling off in February. Promises of massive aid for the economy and markets by the Federal Reserve and U.S. government ignited the rally, which sent the S&P 500 up as much as 28.5% since a low on March 23.

More recently, countries around the world have tentatively eased up on business-shutdown restrictions put in place to slow the spread of the virus.

But health experts warn the pandemic is far from over and new flareups could ignite if governments rush to allow "normal" life to return prematurely.

The S&P 500 remains about 15% below its record high in February as millions more U.S. workers file for unemployment every week amid the shutdowns.

Many analysts also warn that a significant part of the recent recovery in stocks is due to the expectation among some investors that the economy will rebound sharply once economic quarantines are lifted. They're essentially predicting that a line chart of the economy will ultimately resemble the letter "V," with a wild ride down but then a quick pivot to a vigorous recovery.

That may be to optimistic. "We caution that a U-shaped recovery is also quite likely," where the economy bottoms out and stays at that low level for a while before recovering, strategists at Barclays warned in a recent report.

Without strong testing programs for COVID-19, businesses likely won't feel comfortable bringing back their full workforces for a while.

"With risk assets now overbought, the chance for a correction has increased," Morgan Stanley strategists wrote in a report.

| World oil prices dropped to 15 USD/barrel, a record low in the past 20 years US crude oil price has dropped to its lowest level in two decades in the first trading session of the week while world oversupply pressure ... |

| Oil price dropped to its lowest level since 2002 The oil industry is having a nightmare when oil prices have fallen to the lowest level since 2002. |

| Vietnam’s oil and gas giant projected to loss billions of dollars Vietnam's national oil and gas group Petrovietnam may incur a loss of up to US$3 billion in revenue if prices of crude oil can not reach a ... |

| Scenarios for low oil prices? On Wednesday, Việt Nam National Oil and Gas Group (PetroVietnam) issued a directive providing urgent tasks and solutions to cope with the double impacts of ... |

Economy

Economy