Scenarios for low oil prices?

|

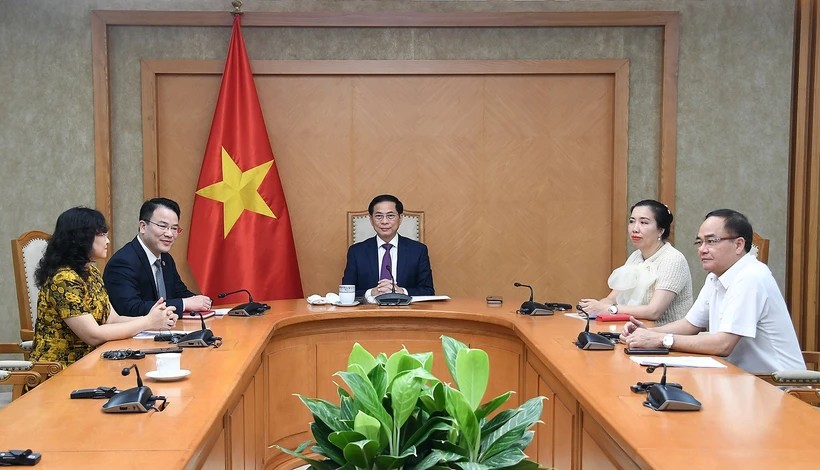

| Bạch Hổ (White Tiger) oil field. Petrovietnam is building plans for short-term shock and long-lasting low prices at $30, $35, $40, $45 and $50 per barrel. (Photo courtesy of the company) |

Oil logged its worst week since 2008 after the oil price war, initiated by Saudi Arabia early last week, delivered a double blow to nervous investors already rattled by declines in world stocks due to the spread of the novel coronavirus, or COVID-19.

The world watches, and so does Việt Nam – where export of crude oil has been contributing significantly to the State budget.

Despite a rebound on Friday, Brent crude lost 24 percent of its value last week, trading at US$34.97 per barrel – the biggest weekly drop since December 2008. The US West Texas Intermediate (WTI) crude also slipped about 20 percent to $31.73 per barrel.

“Việt Nam will not be immune to the crisis,” economist Nguyễn Trí Hiếu told Việt Nam News, but said the impacts could be double-edged.

When the crude oil price decreases, it would push down the cost of imported petroleum products, benefiting transport businesses and manufacturing industries which consume a lot of petroleum.

“Cheaper freight costs also result in lower cost for business which in turn helps curb inflation,” Hiếu said but warned that a steeper fall in oil price would threaten to hit the country’s revenues.

Reverse in export-import

The year 2018 marked a milestone that shifted Việt Nam from a net exporter of crude oil to net importer after seeing a surge in importation to serve the country’s refining demand.

In 2018, Việt Nam exported 3.96 million tonnes of crude oil, a steep fall compared to an average of 8.3 million per year during 2012-17. Meanwhile, the import volume rose to 5.17 million tonnes, seven times higher than the annual import figure during 2012-17.

The export turnover in 2018 reached just over $2 billion, down substantially from $8.2 billion in 2012. By contrast, import turnover increased from $647 million in 2012 to $2.74 billion in 2018.

This trend continued in 2019, when Việt Nam exported 3.98 million tonnes of crude oil, fetching $2.03 billion, and imported 7.6 million tonnes for $3.6 billion. Import of refined petroleum products was 9.8 million tonnes worth $5.95 billion, data from the General Statistics Office showed.

Meanwhile, the contribution of oil revenue to the State budget is declining, from about 30 percent in the early 2000s to about 3.5-4 percent in recent years.

As of December 15, 2019, oil was estimated to contribute VNĐ53.3 trillion (more than $2.3 billion) to the State budget, equivalent to about 3.5 percent of total budget revenues.

However, the State budget revenue in 2019 was based on the planned oil price of $65 per barrel and in 2020, the oil price may be projected at $62-64 per barrel. According to many studies, the loss of $1 in oil prices could affect the budget revenue by about VNĐ1 trillion.

“Oil is still an important source of revenue for the State budget,” Hiếu said.

If the oil price fell below $40 per barrel, the net effect on the economy would be adverse while the price above this level could be acceptable, he said.

Scenarios for low oil prices

On Wednesday, Việt Nam National Oil and Gas Group (PetroVietnam) issued a directive providing urgent tasks and solutions to cope with the double impacts of the COVID-19 pandemic and the decline in oil prices.

The group has requested its units to prepare the plan for short-term shock and the situation of long-lasting low prices at $30, $35, $40, $45 and $50 per barrel. Details of the group’s financial situation corresponding to the above prices and recommendations must be submitted for consideration.

The group also demanded its subsidiaries to actively monitor and update market information on supply and demand, prices of crude oil and petroleum products and build specific plans and scenarios for coping.

Oil prices are forecast to be volatile in the near future after Saudi Arabia and the United Arab Emirates pledged to raise production and lower prices following the collapse of talks on supply restraint between the Organisation of Petroleum Exporting Countries (OPEC) and Russia.

Though Russia is seen to have an upper hand with competitive production cost compared to most other oil producers in the world, OPEC may be in a better position at this time due to sharp declining demand from other economies which are suffering from the pandemic as well as from airlines with mass flight cancellations, according to Hiếu.

“Russia may have to reduce production if demand continues to fall. This will depend on how the pandemic is evolving in the coming months and its impacts on the world economy,” he said.

Goldman Sachs expected a record oil surplus of six million barrels per day by April.

The oil spat may be short-lived and the world is seeing “who will blink first”.

| Vietnam economic growth: History, today and future vision Been through several stages of development, Vietnam's economy is growing strongly. This article summarizes the transition and progress of Vietnam's economy after 1945. |

| Pork price was asked to be reduced by Vietnamese Ministry Minister of Agriculture and Rural Development Nguyen Xuan Cuong said that the ministry would request 17 big cattle-breeding firms to reduce pork price. |

| Vingroup steps up to industrial real estate Vingroup has turned a startup venture into a newly industrial real estate investment. |

Economy

Economy

Oil price today: Cheaper than bottled water, below zero for first time in history

Recommended

Economy

Economy