Bitcoin price today: Bitcoin price revives, cryptocurrency market thrives Thursday

Bitcoin offshoots were among big winners on CoinDesk’s big board, including bitcoin gold (BTG) up a whopping 18 percent, bitcoin sv (BSV) climbing 16 percent and bitcoin cash (BCH) in the green 6 percent. BCH had its first halving of mining rewards Wednesday and BSV is expected to reach that milestone Friday. All 24-hour price changes are as of 20:50 UTC (4:50 PM EST) Wednesday.

In the traditional markets, Asia’s Nikkei 225 index closed up 2 percent. This continues a week in Japan where unprecedented stimulus amid the declaration of a state of emergency has not stopped markets from going up.

Europe’s FTSE 100 ended the day down slightly, at 0.28 percent. This erased two days of gains as U.K. Prime Minister Boris Johnson remains in intensive care for coronavirus-related health concerns.

Bitcoin price analysis by Coin Telegraph

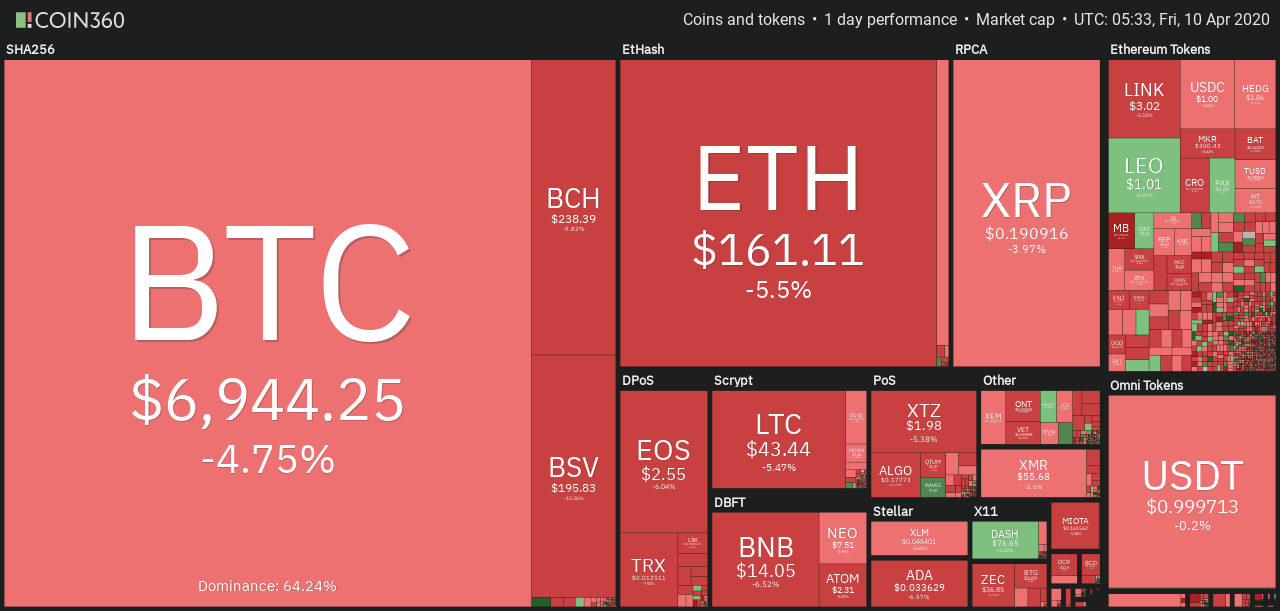

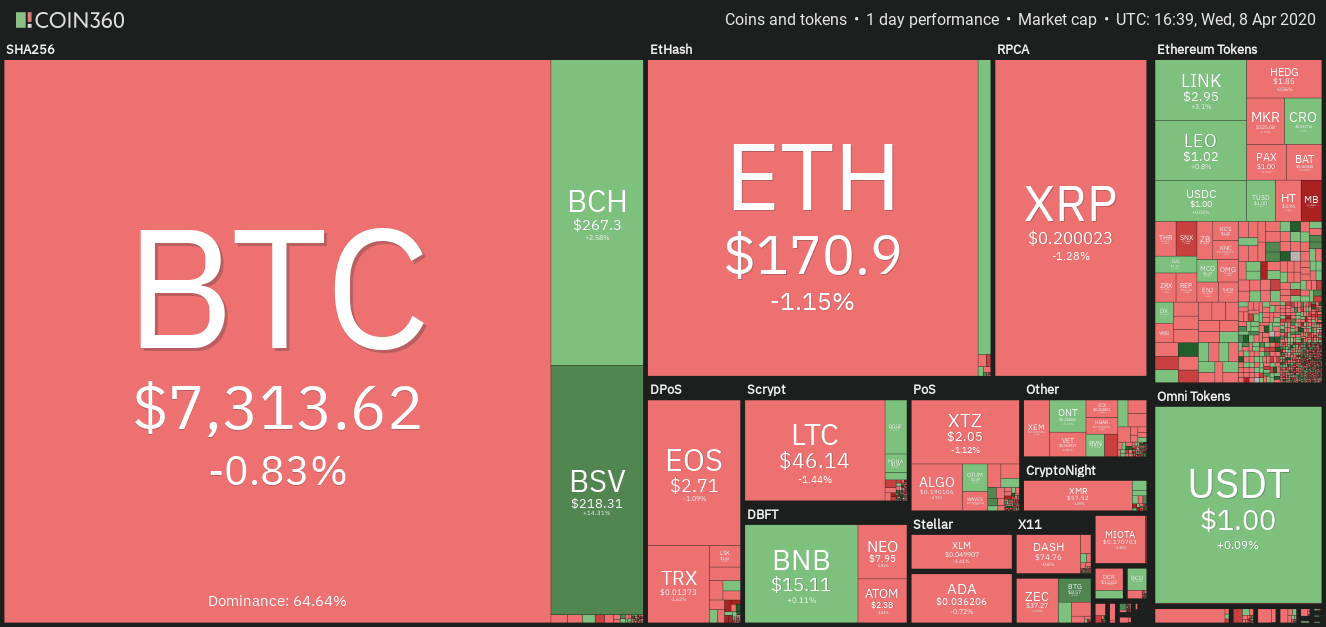

|

| Daily cryptocurrency market performance. Source: Coin360 |

Venture capital investor Tim Draper said that all the money that is being printed will reduce the value of fiat currencies. That could encourage investors to start using Bitcoin, which has a limited supply and cannot be manipulated by governments. Draper also believes that the current crisis will increase the interest in digital financial innovations like Bitcoin, smart contracts and artificial intelligence.

The total market capitalization of the crypto space has risen above $200 billion, which is a positive sign.

BTC/USD

Bitcoin (BTC) is facing resistance at the 50-day simple moving average. This shows that the bears are not willing to give up without a fight. However, if the bulls can keep the price above the 20-day exponential moving average for the next few days, it will signal strength.

|

| BTC–USD daily chart. Source: Tradingview |

A strong rebound off the 20-day EMA ($6,782) will indicate aggressive buying on dips. This will increase the possibility of a break above the 50-day SMA ($7,413). The first target to watch on the upside is $8,000.

We anticipate the bears to again mount a stiff resistance at $8,000. However, if this level is also scaled, the rally can extend to $9,000.

Our bullish view will be negated if the BTC/USD pair turns down from the current levels and plummets below the 20-day EMA. Such a move will be the first sign that the relief rally has weakened.

For now, the long positions can be protected with a stop loss of $5,600. The stops can be raised to $6,500 after the bulls propel the pair above $7,500.

ETH/USD

Ether (ETH) surged on April 6, which triggered our trade recommendation given in an earlier analysis. After the sharp up move, the bulls are currently facing resistance at the 50-day SMA ($178).

|

| ETH–USD daily chart. Source: Tradingview |

The ETH/USD pair might retest the breakout level of $155.612. A strong bounce off this level will increase the possibility of a breakout of the 50-day SMA. If successful, the target levels to watch on the upside are $208.50 and $250.

However, if the bears sink the pair below $155.612 and the 20-day EMA ($148), it will signal weakness. The traders can keep the stop loss on the long positions at $135.

XRP/USD

The bulls are finding it difficult to propel XRP above the 50-day SMA ($0.20). This shows that the bears are unwilling to throw in the towel without a fight. However, if the bulls can defend the support at the 20-day EMA ($0.18), it will signal demand at lower levels.

|

| XRP–USD daily chart. Source: Tradingview |

If the XRP/USD pair breaks above $0.216, a rally to $0.25 is possible. The moving averages are on the verge of a bullish crossover, which is also a positive sign.

Contrary to our assumption, if the pair turns down from the current levels and dips below $0.16, it will signal weakness. Therefore, the long positions can be protected with a stop loss of $0.155.

BCH/USD

Bitcoin Cash (BCH) broke out of $250 on April 6, which triggered our buy proposed in an earlier analysis. Today, the bulls scaled the price above the 50-day SMA ($266) but are struggling to hold on to the intraday gains.

|

| BCH–USD daily chart. Source: Tradingview |

This suggests that the bears are active at higher levels. If the BCH/USD pair dips back below the 20-day EMA ($236), a drop to $200 is possible. Below this level, the pair will turn negative. Therefore, the traders can keep the stop loss on the long positions at $197.

Conversely, if the pair surges above $281, a rally to $350 is likely. Therefore, the traders can trail the stop loss to $220 after BCH sustains above $281 for four hours.

BSV/USD

Bitcoin SV (BSV) has broken out of the 50-day SMA ($195), which is a positive sign. The next target is $233.314 and above it $268.842, which are 50% and 61.8% Fibonacci retracement levels of the recent decline.

|

| BSV–USD daily chart. Source: Tradingview |

The moving averages are on the verge of a bullish crossover, which is another positive sign. If the BSV/USD pair climbs above $221, the stop loss on the long positions can be trailed higher to $165.

Our positive view will be invalidated if the buyers fail to hold on to the gains and the price turns around and drops below $166. A break below $146.96 will be a huge negative.

LTC/USD

Litecoin (LTC) broke out and closed (UTC time) above the overhead resistance at $43.67 on April 6, which triggered the trade suggested by us in an earlier analysis. The bulls are facing resistance close to the 50-day SMA ($49.19).

|

| LTC–USD daily chart. Source: Tradingview |

If the bulls can sustain the LTC/USD pair above the breakout level of $43.67, it will increase the possibility of a rally to $63.

However, if the bears sink the pair below the 20-day EMA ($41.87), it will signal weakness. The trend will turn in favor of the bears on a break below the critical support at $35.8582. Therefore, the stops on the long positions can be kept at $35.

EOS/USD

EOS is facing resistance at the 50-day SMA ($2.87), which is sloping down. The bears will try to sink the price back below the recent breakout level of $2.4001. If successful, a drop to $2.0632 is possible.

|

| EOS–USD daily chart. Source: Tradingview |

However, if the EOS/USD pair rebounds off $2.4001, it will signal buying on dips and will increase the possibility of a breakout of the 50-day SMA.

Above this resistance, a move to $3.1802, followed by a rally to $3.86 is likely. Therefore, the traders can keep the stop loss on the long positions at $2.

BNB/USD

Binance Coin (BNB) broke above the downtrend line on April 6, which triggered our buy recommendation given in an earlier analysis. Currently, the bulls are facing selling at the 50-day SMA ($15.56).

|

| BNB–USD daily chart. Source: Tradingview |

We anticipate a minor correction or consolidation for a couple of days, after which the BNB/USD pair could start its journey toward its target objective of $21.50. The upsloping 20-day EMA and the RSI above 50 levels suggests that the bulls are at an advantage.

Contrary to our assumption, if the bears sink the pair below the breakout level of $13.65, it will signal weakness. For now, the stop loss on the long positions can be kept at $11.

XTZ/USD

Tezos (XTZ) broke above the overhead resistance of $1.9555 on April 7, which is a positive sign. Though the bulls could not sustain the price above the downtrend line, we like that the price has stayed above the breakout level of $1.9555.

|

| XTZ–USD daily chart. Source: Tradingview |

The 20-day EMA has started to turn up gradually and the RSI is in the positive zone, which suggests that bulls are making a comeback.

Above the downtrend line, the 50-day SMA ($2.22) might offer resistance but we expect it to be scaled. The target level to watch on the upside is $2.75 and then $3.33. Therefore, the traders can buy if the XTZ/USD pair closes (UTC time) above $2 and keep a stop loss of $1.40.

LEO/USD

The failure of the bulls to sustain Unus Sed Leo (LEO) above $1.04 attracted selling on April 7. The altcoin dipped to an intraday low of $0.991, which triggered our suggested stop loss on the long positions at $1.

|

| LEO–USD daily chart. Source: Tradingview |

Though the LEO/USD pair rebounded off the 50-day SMA ($0.994), the bulls are struggling to push the price back above $1.04.

If the pair turns down from the current levels and breaks below the 50-day SMA, a drop to $0.955 is possible. Conversely, if the bulls can scale the overhead resistance at $1.057, a new uptrend is likely.

| Vietnam's economy remains stable against external shocks - reported by World Bank A report by World Bank shows that while Vietnam suffered from the COVID-19 outbreak and the chaos taking places on global financial markets, Vietnam's economy ... |

| Tokyo Olympic 2020 postponement: How much losses suffered by Japan’s economy? The historic decision to postpone this year's Olympic Games over the coronavirus pandemic is likely to pile on the pain for Japan's economy. The impact would ... |

| Vietnam’s garment exports down 3.5% during Jan-Feb Vietnam’s garment export saw a reduction of 3.5 percent year-on-year to US$5.3 million in the first two months of 2020, due to the impact of ... |