E-commerce Reports 2021-2022: Vietnam Leads The Region in Digital Transformation

|

| A person makes online purchases using a credit card. Photo by Shutterstock/LDprod. |

Vietnam ranked first in cross-border online shopping frequency in Southeast Asia, with more than 100 purchase orders per year on average, according to a recent e-commerce report by Singapore-based logistics firm Ninja Van Group in partnership with Europe’s largest parcel delivery network DPDgroup.

| 'E-commerce Southeast Asia (SEA) Barometer Report 2021 - Uncovering SEA Online Shoppers & Delivery Preferences' report was released recently by Singapore-based logistics firm Ninja Van Group in partnership with Europe’s largest parcel delivery network DPDgroup. The study was conducted in six countries, namely Singapore, the Philippines, Malaysia, Indonesia, Thailand, and Vietnam, involving over 9,000 respondents in July 2021. |

With an average of 104 purchase orders per year, Vietnam took the lead in e-shopping frequency, followed by Thailand with 75 orders and Singapore and the Philippines with 58 each.

Representing large proportions in Vietnamese orders were fast-moving consumer goods (FMCG) products, clothing and footwear, the report said.

Besides the top position in purchase orders, Vietnam ranked second in international e-shopping, with 59 percent of Vietnamese respondents saying that they have ordered or shopped many times on foreign websites, slightly lower than Singapore.

Vietnam also accounted for 15% of the total online shopping market in Southeast Asia, second only to Thailand with 16 % and equal to the Philippines.

Since the COVID-19 pandemic broke out two years ago, the region has seen an increase of around 70 million online shoppers, and the number is expected to grow to some 380 million by 2026, Ninja Van Group reported.

The firm stated that it delivers about two million parcels per day across the region covered in this report during the past 12 months, reflecting strong e-commerce growth.

“We believe that Vietnam is one of the potential markets thanks to its sustainable and apparent growth in recent years,” said Phan Xuan Dung, chief customer officer of Ninja Van Vietnam.

Multinational cybersecurity firm Kaspersky Lab recently described Vietnam as the safest country in Southeast Asia against the threat of financial attacks targeting banks, payment systems and online stores.

|

| Mr. Yeo Siang Tiong, Kaspersky Lab’s general manager for Southeast Asia. Photo: Channel Asia |

Mr. Yeo Siang Tiong, Kaspersky Lab’s general manager for Southeast Asia, said that the company's statistics showed the rate of scams related to banks, payment systems and online stores in Vietnam was lower than other countries in the region. The fraud rate was 26.36% in Vietnam while it was 40.87% in Indonesia, 46.77% in Malaysia, 64,03% in the Philippines, 51.6% in Singapore and 56.35% in Thailand.

"Vietnam is definitely ready for rapid digital transformation as well as ensuring a safer financial environment for organisations and individuals due to strong infrastructure and threat intelligence sharing," Yeo said.

Regarding Vietnam's efforts in ensuring security against attacks on the financial sector, Yeo said the increase in online transactions in the country during the COVID-19 pandemic was parallel with the rise of frauds through the use of fake pages of popular payment systems such as Visa, Mastercard and PayPal.

| Kaspersky Lab is a Russian multinational cybersecurity and anti-virus provider headquartered in Moscow, Russia. It was the first Russian company to be included into the rating of the world’s leading software companies, called the Software Top 100 (79th on the list, as of 6/29/2012). Kaspersky Lab is ranked 4th in Endpoint Security segment according to IDC data for 2010. |

The online transactions and shopping of users are increasingly improved, and this can be attributed to the ongoing efforts of the Government of Vietnam to raise awareness on financial and data security in the context of mobile banking and e-wallets flourishing in the region.

According to the Fintech and Digital Banking 2025 - Asia Pacific report by Backbase, mobile transactions are forecast to increase by 300% in Vietnam by 2025, thanks to the booming digital economy.

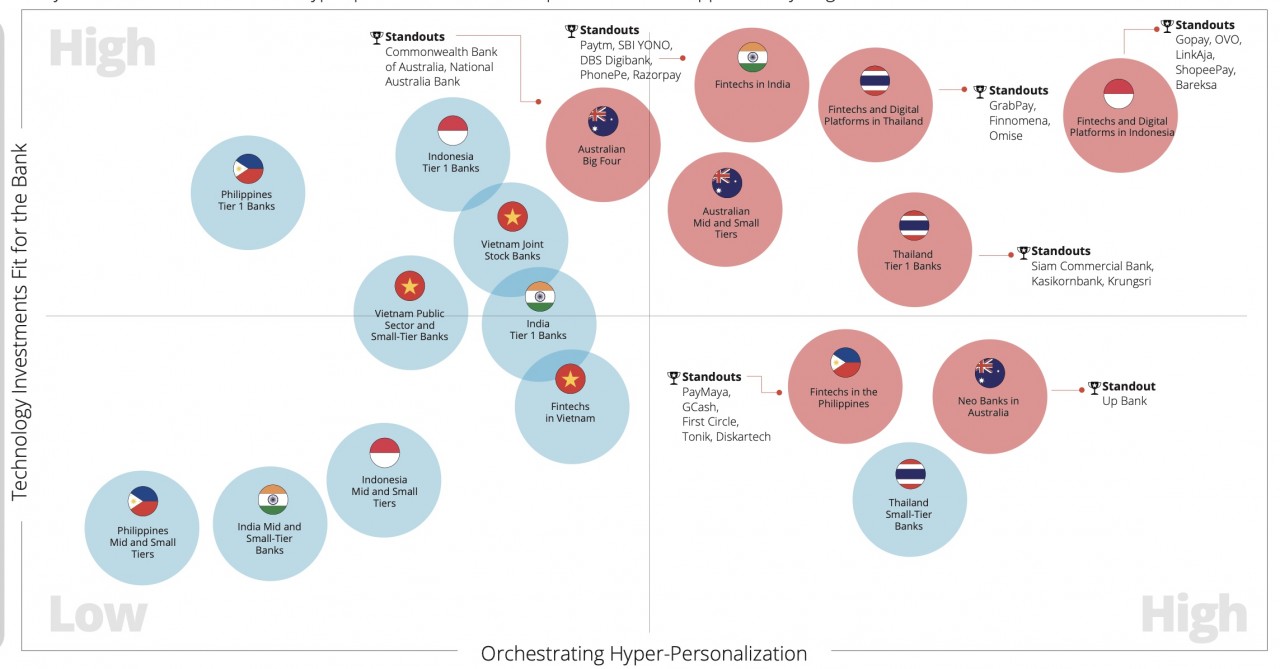

Vietnamese banks that will develop their own unique brand of digital with high technology investments fit include Vietnam Joint Stock banks. Meanwhile, Fintechs in Vietnam is widening the gap against other organizations in the low technology investments fit and approaching Vietnam's public sector and small-tier banks, whose position is between the high and low technology investments fit.

|

| Screenshot from the Fintech and Digital Banking 2025 - Asia Pacific report by Backbase |

| How the Digital Age Affects Vietnam's Youth The lives, studies and daily activities of young people today are all affected by the use of social networks, smartphones, tablets and the Internet. |

| Vietnam Attracts International Agricultural Technology Companies The program to promote innovation and investment in agricultural technology (GRAFT Challenge Vietnam 2021), has selected 9 international enterprises with innovative technology solutions, in the ... |

| Vietnam, UK Bolster Cooperation Vietnam considers the UK as one of the leading strategic partners in Europe and the world and is ready to strengthen cooperation between the two ... |

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

Popular article

World

World

US, China Conclude Trade Talks with Positive Outcome

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

Easing of US-China Tariffs: Markets React Positively, Experts Remain Cautious

World

World