ETS's net outflow in ASEAN reached US$283 million in Q1

| VUFO donates 1270 USD to COVID-19 prevention fund | |

| COVID-19: UNFPA provides 7,000 hand sanitizer bottles for Vietnam | |

| Support Vietnam's most vulnerable in coronavirus crisis |

|

| Photo: CafeF |

The figure accounts for 3.7 per cent of total net sell value made by foreign investors across emerging and frontier markets in the region.

The net ETF outflow from Vietnam ranked fourth out of five markets with the value of $ 41 million. The four other markets are the Philippines, Thailand, Indonesia and Malaysia.

But the percentage of ETF flow over foreign traded value in Vietnam was 10.3 per cent, the highest among five markets, reported by Vietnamnet.

“This could be due to the fact that ETFs are a favored investment product in Vietnam, with the value of funds pouring into Vietnam from the first quarter of 2017 to the fourth quarter of 2019 over market capitalization being at the top of the region (0.55 per cent)”, VNDS said.

According to VNDS, total ETF inflow in the 2017-19 period in Vietnam reached $ 540 million, the highest among five ASEAN markets. The region’s total value was $ 1.58 billion. But the Vietnamese market capitalization was only $ 97.9 billion as of March 31, 2020 - the lowest among five markets and far behind the four others.

In the first quarter of 2020, Vietnam-focused ETFs - VN30 ETF, VNM ETF, FTSE ETF and Premia VN ETF - withdrew a total of $ 47.4 million from the domestic market, VNDS said.

In the first three month period, net asset value of Vietnam-focused foreign ETFs had "a sharp average reversed of 29 per cent year-to-date amid market turmoil" as the market went through a rough time amid the spread of COVID- 19 and its impact on the global economy.

Foreign ETFs managed a total of $ 373 million worth of assets as of April 6, 2020, comprising mainly blue-chip stocks such as conglomerate Vingroup (VIC), dairy producer Vinamilk (VNM) and residential property developer Vinhomes (VHM), according to Vietnamnet.

An Exchange-Traded Fund (ETF) is a group of stocks that traders can buy or sell on an exchange through a broker. These stock groups represent an economy or an economic sector. As a result, investors and traders can invest in the economy or economic sector that they are interested in instead of having to select individual securities.

Like stocks, ETF funds are listed on stock exchange. That means traders can buy and sell ETFs during the open hours. The number of shares in the ETF fund may change daily due to the frequent appearance of new and existing stocks being acquired. Its price thus is displayed in real time.

ETFs are not just for institutional investors or major investors in the financial markets. ETF has low cost because traders do not have to pay any entry fee or withdrawal fee. However, traders still have to pay a small securities transaction fee. ETF funds have a lower level of risk and beta because investing in different financial assets is less risky than investing in a single company. There is no minimum investment for ETF, since this is the limit set by the stock exchange, according to Admiral Markets.

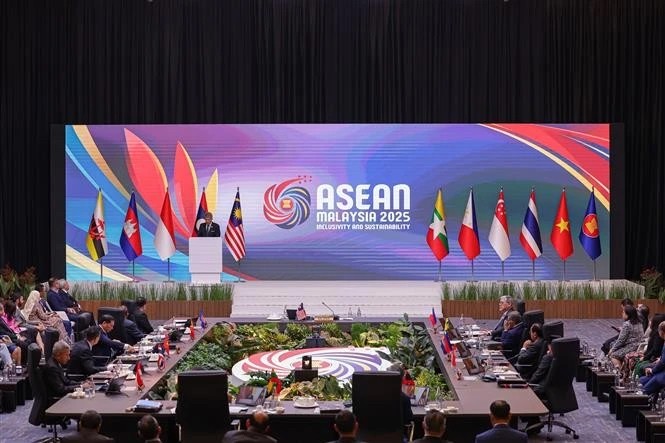

| PM: Vietnam to continue supporting virus-stricken countries Prime Minister Nguyen Xuan Phuc chaired the online Special ASEAN+3 Summit with China, Japan and the Republic of Korea (RoK) on April 14 on the ... |

| Declaration of Special ASEAN Summit on Coronavirus Disease 2019 issued Leaders attending the online Special ASEAN+3 Summit on COVID-19 response on April 14 shared experience and sought concrete measures to soon stamp out the pandemic. ... |

| COVID-19 pandemic fight: If we unite, no danger can subdue us Prime Minister Nguyen Xuan Phuc called for closer cooperation and solidarity among ASEAN countries to fight the pandemic, saying that “if we unite, no danger ... |

Recommended

Economy

Economy