Global growth plunging into downturn over coronavirus, OECD says

|

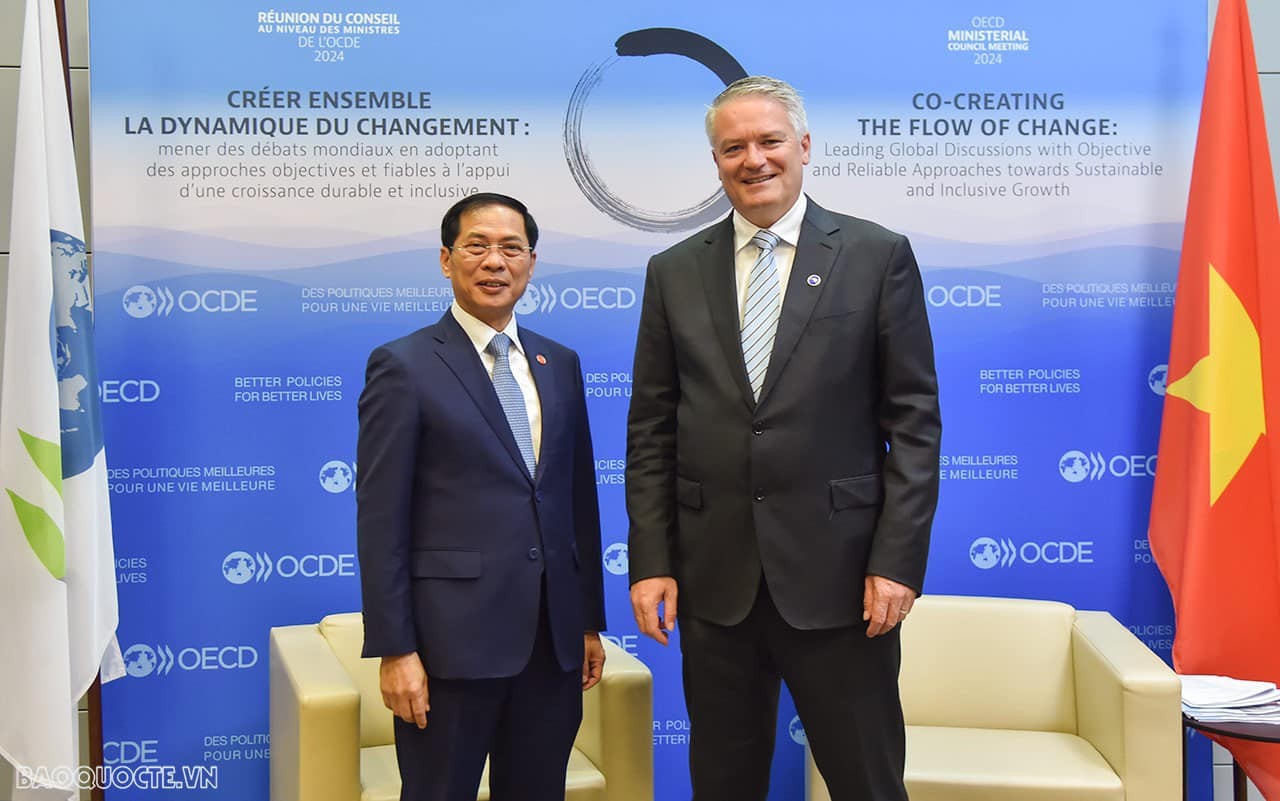

| OECD headquarter in Paris (Photo: Bloomberg) |

The global economy is set to grow only 2.4 percent this year, the lowest since the 2008-2009 financial crisis and down from a forecast of 2.9 percent in November, the OECD said Monday in an update of its outlook.

That forecast assumes the virus outbreak fades this year, but a more severe outbreak “would weaken prospects considerably,” the organization, which groups together free market economies, said.

Already the global economy risks an outright contraction in the first quarter of this calendar year, the OECD said in its first comprehensive study of the impact on the world’s major economies.

The Paris-based policy forum said the global economy could recover to 3.3 percent growth in 2021, assuming the epidemic peaks in China in the first quarter of this year and other outbreaks prove mild and are contained.

However, if the virus spreads throughout Asia, Europe and North America, global growth could drop as low as 1.5 percent this year, the OECD warned.

“The main message from this downside scenario is that it would put many countries into a recession, which is why we are urging measures to be taken in the affected areas as quickly as possible,” OECD chief economist Laurence Boone said.

In China, where the COVID-19 virus emerged in December, annual GDP growth is expected to reach just 4.9 percent, a 0.8 point drop from the OECD’s original growth forecasts announced in November.

The organization cut its forecast for Japanese economic growth to 0.2 percent in 2020 from its previous estimate of 0.6 percent — but left unchanged its 2021 outlook at 0.7 percent. Japan logged growth of 0.7 percent in 2019.

“Output contractions in China are being felt around the world,” the 36-member OECD said, as the outbreak continues to batter production, trade, tourism and business travel.

Efforts to contain the virus in China have entailed quarantines and work and travel restrictions that delayed factory restarts after the Lunar New Year holiday while also causing sharp cutbacks in service sector activities.

A virtual cessation of outbound tourism from China represented “a sizeable near-term adverse demand shock,” the OECD added.

Compared with similar events in the past, such as the SARS outbreak of 2003, “the global economy has become substantially more interconnected, and China plays a far greater role in global output, trade, tourism and commodity markets,” it said.

Growth in the euro zone was projected to remain “sub-par” at about 1 percent per year on average in 2020 and 2021, the OECD said. The U.S. economy, which grew 2.3 percent last year, is expected to see a limited impact from the virus, with growth in 2020 cut to 1.9 percent from the November forecast of 2.0 percent.

Meanwhile, Group of Seven finance ministers and central bank governors will hold a conference call at 9 p.m. Japan time to discuss measures to deal with the widening coronavirus outbreak and its economic impact, a U.S. Treasury spokeswoman said Monday.

The call is to be led by U.S. Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell.

The meeting by representatives of the Group of Seven industrialized nations signals mounting concern that the disease is doing major damage to the global economy as it shuts factories, disrupts supply lines and curtails travel. U.S. stocks surged on the news Monday, with the Dow Jones Industrial Average scoring its biggest-ever point gain.

Recommended

World

World

Thailand Positions Itself As a Global Wellness Destination

World

World

South Korea elects Lee Jae-myung president

World

World

22nd Shangri-La Dialogue: Japan, Philippines boost defence cooperation

World

World

Pakistan NCRC report explores emerging child rights issues

Popular article

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

World

World