Learning Stock Investment from Netflix's Squid Game

|

| Squid Game (Photo: Indie Wire) |

Squid Game has recently been a hit on Netflix, topping the platform's global charts and being the first Korean movie to take the number one ranking in the US. Squid Game's plot concentrates on 456 people, for various reasons, facing financial difficulties and joining a game of death within six days to fight for a prize of KRW 45.6 billion (about US$ 38 million).

The Korean drama follows Cho Sang Woo, a prominent competitor, who graduates from prestigious Seoul National University and is the pride of his neighborhood. Cho Sang Woo works as an investment leader for a securities company, but due to investment mistakes, he falls into debt and had to sell his mother's house and shop. He joins the game, reaches the final round, but (spoilers!) does not win the medal.

From the Squid Game plot, some lessons can be drawn for those hoping to earn money from stock investing.

|

| Photo: CafeF |

Smart people can lose in stock investment

In stock investing, being smart or well-educated is not a decisive factor for success. Cho Sang Woo, despite being smart, talented, and having the advantage of information access, still failed miserably.

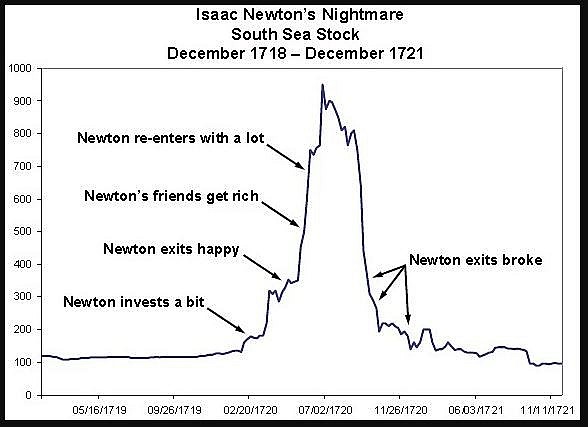

Many real-life smart people fail in the stock market. Physics and mathematics genius Isaac Newton once lost while investing in the South Sea Bubble in 1720, leading to his famous quote: "I can calculate the motion of heavenly bodies, but not the madness of people."

Newton's story is an example of the harshness of securities investment. Besides intelligence, one needs to build transaction principles of the enterprises he wants to invest in. He also needs sensitivity and a little luck.

Warren Buffett once said: "Investing is not a game where the guy with the 160 IQ beats the guy with a 130 IQ." Also according to him, "Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway," which demonstrates intelligence is not the only factor leading to success in the stock market.

|

| Cho Sang Woo in Squid Game (Photo: The Cinemaholic) |

Assets pledging is not recommended

In Squid Game, Cho Sang Woo pledges his house to have money for stock investment, which leaves him deep in debt. Pledging all assets is a life-and-death game with a high risk of failure. To lower the risk, one should not put all the eggs in one basket. Real estate, gold, bonds should be considered.

Financial leverage in the investment process is a double-edged sword, offering both large profits and great risk. Therefore, the use of leverage in the investment should be cautiously considered. Investors should prepare backup plans and be ready to sell stock when the situation is not as good as expected.

Losing control in the investment and "full margin" is common, even for professional investors. In Vietnam, there were cases where a securities investment company put everything in only one stock to make big profits when the market would turn favorable for them. However, as the market crashed in 2018, they suffered big loss.

|

| Squid Game (Photo: Lao Dong) |

Derivatives market does not offer easy chances

In Squid Game, Sang Woo initially suffers not too big loss from stock investment. Yet participating in the derivatives market identifies the failure, leaving him in deep debt.

The stock market, especially derivatives market, has a great attraction, but it has never been an easy chance to make money. Derivatives are a "zero-sum game" market, which means some investors will only profit from the mistakes of others. Many investors think of derivatives as having a high "gambling" nature, rather than a sustainable path.

In Vietnam, the strong volatility of the market in derivatives maturity days has left many investors in suspicion that there is a "manipulator" hand of "sharks" in a market. Le Hai Tra, Chief Executive Officer at Ho Chi Minh City Stock Exchange said on his Facebook a few years ago that in the derivatives market, up to 95% of investors would suffer losses while only 5% gain benefits.

| 2021 GDP growth to Depend on Effectiveness of Pandemic Control This year’s GDP growth would depend a lot on the effectiveness of pandemic control, said a Vietnamese expert. |

| No FDI Enterprises Move Investments Out of Vietnam No enterprises have moved their investment out of Vietnam due to the impact of the Covid-19 pandemic. |

| How Can Foreigners Invest in Real Estate in Vietnam? Foreign individuals who want to set up a foreign-invested real estate business in Vietnam must carry out the procedures for issuance of an investment certificate |

Recommended

Handbook

Handbook

Vietnam Moves Up 8 Places In World Happiness Index

Handbook

Handbook

Travelling Vietnam Through French Artist's Children Book

Multimedia

Multimedia

Vietnamese Turmeric Fish among Best Asian Dishes: TasteAtlas

Handbook

Handbook

From Lost to Found: German Tourist Thanks Vietnamese Police for Returning His Bag

Handbook

Handbook

Prediction and Resolution for the Disasters of Humanity

Handbook

Handbook

16 French Films To Be Shown For Free During Tet Holiday In Vietnam

Handbook

Handbook

Unique Cultural and Religious Activities to Welcome Year of the Snake

Handbook

Handbook