Prospects for Vietnam’s Healthcare Industry optimize investors

According to Julia Nguyen, author of the article "Why investors should be optimistic about Vietnam's healthcare industry", Vietnam is currently undergoing economic and demographic transformations that provide great potential for its healthcare industry. In 2019, Vietnam’s healthcare expenditure was approximately US$17 billion, equivalent to 6.6 percent of its GDP according to FitchSolutions. The firm also expects that healthcare spending will reach US$23 billion in 2022 at a compound annual growth rate (CAGR) of 10.7 percent.

The COVID-19 outbreak certainly dampened economic activity in Vietnam, but it is unlikely to reverse ongoing socioeconomic changes. Rather, health stands firmly as the top priority and concern for both the Vietnamese people and the government.

We provide an overview of the opportunities for the healthcare industry in light of the current developments in Vietnam and survey three key sub-sectors: medical equipment and devices, pharmaceuticals, and digital healthcare.

Fast-growing middle class and aging population

The healthcare sector in Vietnam has a lot of potential due to the demographic and socioeconomic changes currently underway. Vietnam’s rapid economic development has boosted demand for higher quality and specialized healthcare services, especially among the growing middle class.

|

| Vietnam healthcare. Photo: asiahealthcaremarketresearch |

Vietnam is the world's 13th largest country at more than 90 million people, with approximately 60% under the age of 30. This young, vibrant country achieved middle income status and by 2013, GDP per capita had surpassed ~US$1,900, with that figure nearly 2.5 times higher in the country's commercial capital, Ho Chi Minh City, according to Asiahealthcaremarketresearch.

The COVID-19 outbreak has proven that health is, and will certainly continue to be, a priority for most Vietnamese. Moreover, growing concerns over food safety, pollution, and unsafe living and working conditions have also made people more willing to spend on medicines and healthcare.

According to the United Nations Population Fund (UNFPA), the country has entered the “aging phase” since 2011. It is expected that by 2038, 20 percent of Vietnamese people will be over 60 years old. As more women join the workforce, a declining fertility rate will accelerate the aging of the population, straining the social welfare system.

Expansion of health insurance and hospital system

Social health insurance is the main public financing method for healthcare in Vietnam. With 87 percent of the population currently covered under this scheme according to the World Health Organization (WHO), the government continues to work towards achieving universal healthcare coverage.

Under a new document issued by the Ministry of Health (MoH), provincial departments of health and Vietnam Social Security branches are asked to encourage participation in and implementation of health insurance across the country. The government has also recently set new social insurance, employment insurance, and health insurance contribution rates that apply to both national and expatriate workers and employers.

To prevent overcrowding and ensure that both urban and local patients can access medical services, the government continues to finance the construction of new hospitals. Since public hospitals rely on a government budget, the country will need to mobilize various sources of investment to upgrade its medical facilities. Further, the healthcare system also suffers from a shortage of qualified physicians, especially those in specialized fields.

Meanwhile, private hospitals and clinics have sprung up in major cities to cater to the middle-class segment.

To help it shoulder the burden of rising healthcare costs, the government is increasingly looking at investment from the private sector and international firms. These changes mean that there will be more business opportunities in the healthcare sector in Vietnam in the upcoming years.

Medical equipment and devices

On February 28, 2020, the government enacted Resolution No.20/NQ-CP to license the export of fabric face masks in response to high demand from different markets such as the US, the EU, and Canada. This has helped local businesses, namely textile and garment workers who reported rising orders after the enactment of the resolution. Face masks are not the only products that have been sought after during the pandemic: ventilators, gloves, gowns, and testing kits from Vietnam have also been accepted around the world.

Most medical equipment, however, needs to be imported. There are very few local manufacturers of sophisticated and specialized devices that meet international standards. In public hospitals across the country, there is a lack of sufficient equipment for surgery and intensive care units. Furthermore, the existing equipment is outdated and needs to be replaced. As such, because local production cannot meet demand, the Vietnamese government encourages the import of medical equipment by setting low import duties and no quota restrictions.

Medical devices producers can look forward to opportunities created by trade agreements such as the European Union Vietnam Free Trade Agreement (EVFTA). Improvements in regulatory standards, exchange of information on customs requirements, and the simplification of customs procedures are a few of the anticipated benefits from the implementation of the EVFTA.

Pharmaceuticals

An average of 55 percent of medicines in Vietnam are imported every year. One of the reasons for Vietnam’s reliance on imports is that most domestic companies lack research and development capabilities, and do not meet the European Union Good Manufacturing Practice (EU-GMP) or Pharmaceutical Inspection Co-operation Scheme Good Manufacturing Practice (PIC/S-GMP) standards required to manufacture high-quality generic drugs.

Further, Vietnam imports more than 90 percent of drug inputs, half of which are from China. With the closure of many Chinese factories due to environmental concerns, the price of raw materials has surged, decreasing the profit margins of Vietnamese companies.

The implementation of the EVFTA will remove tariffs for pharmaceutical products from the EU, and allow foreign companies to import and sell pharmaceuticals to Vietnamese distributors and wholesalers.

Currently, there are only two multinational companies, Sanofi-Aventis (France) and AstraZeneca (Britain-Sweden), that have medicine import licenses. Although the presence of more foreign pharmaceutical companies will improve the supply of high-quality medicines, domestic companies may be negatively affected by the increased foreign competition.

Digital healthcare

In light of the COVID-19 pandemic, the MoH in coordination with the Ministry of Information and Communications (MIC) launched a telemedicine program on April 18, 2020. Developed by Viettel Group, the country’s largest telecommunications service company, the program provides remote healthcare services by connecting patients and doctors through a virtual platform. With 70 percent of the Vietnamese population living in a rural or remote area, telehealth will help improve access to quality healthcare while reducing its costs.

The private sector was also quick to take advantage of the shift towards technology-enabled healthcare services. Many start-ups already present in Vietnam before the COVID-19 outbreak have expanded and optimized their operations.

However, the burgeoning health tech sector is still in its infancy, attracting significantly less investment than other related sectors such as payments or e-commerce. The sector also largely depends on the development of Industry 4.0 technologies such as 5G networks, artificial intelligence (AI), and the internet of things (IoT).

To help the health tech sector sustain the momentum post-pandemic, companies not only have to appeal to investors and consumers but they also have to be integrated with Vietnam’s national health framework. The government will have to play a bigger role in encouraging collaboration between industry players and other stakeholders, provide incentives, and formulate clear policies.

On June 22, 2020, the MoH approved a five-year project on remote medical examination and treatment involving 24 hospitals. Apps and medical services will be developed to manage files and knowledge systems, as well as helping patients find medical information, make their appointments, and consult doctors.

Thus, though there is still a lot of room for the health tech sector to grow, the digital transformation of healthcare in Vietnam is already well underway.i

| British newspaper praised Vietnam as attractive destination to globalists and frontier-market investors An article published on the Economist newspaper recently highly appreciated the potentials of Vietnam's economy and its attraction to foreign investors. |

| Foreign Investors in Vietnam, new chance for Gasoline retail: The market share is going to shift The Ministry of Industry and Trade is proposing to allow Foreign Investors to participate further into the petroleum industry, specifically in retail. |

| Vietnam - a safe and attractive destination for foreign investors With successful efforts in combating Covid-19, Vietnam has been acknowledged by the foreign investors community as a safe and attractive investment destination. |

Recommended

National

National

Vietnam News Today (May 31): Vietnam Strongly Supports Laos’s National Development

National

National

Vietnam News Today (May 30): Vietnam, Venezuela Reinforce Ties Through People-to-people Diplomacy

National

National

Vietnam News Today (May 29): Vietnam and Hungary to Expand Cooperation into New Areas

National

National

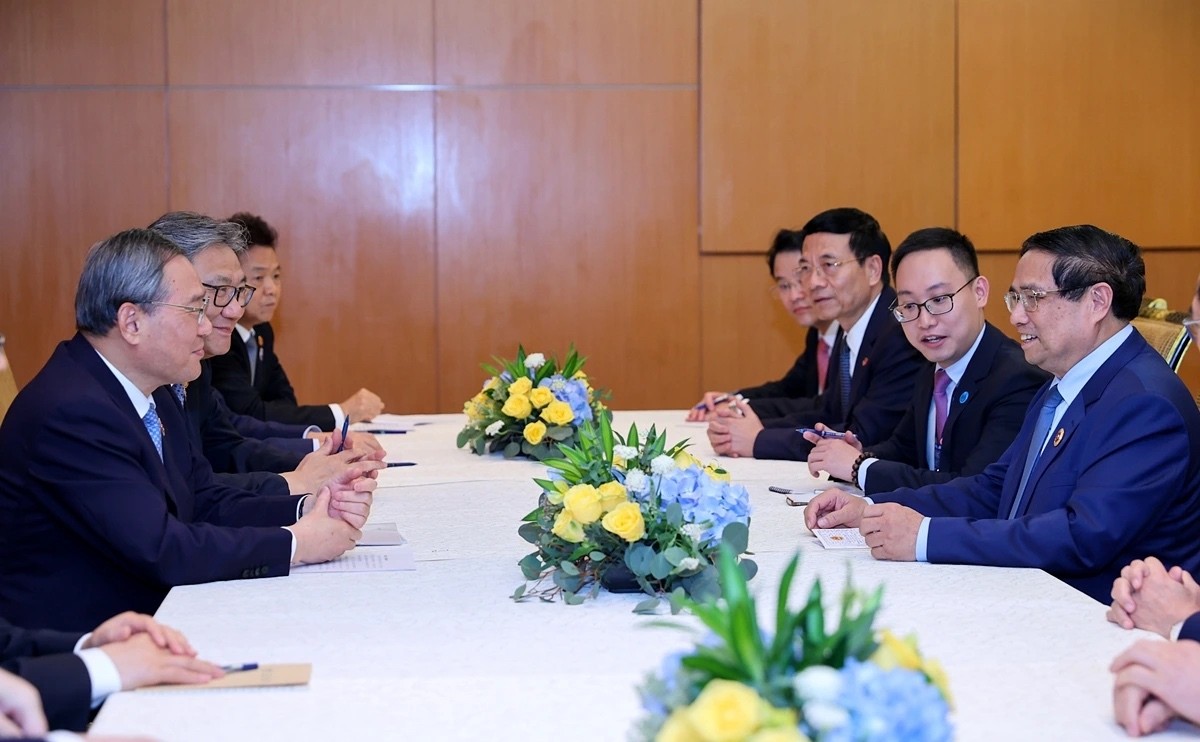

Vietnam News Today (May 28): Vietnam and China Discuss Strategic Cooperation Orientations

Popular article

National

National

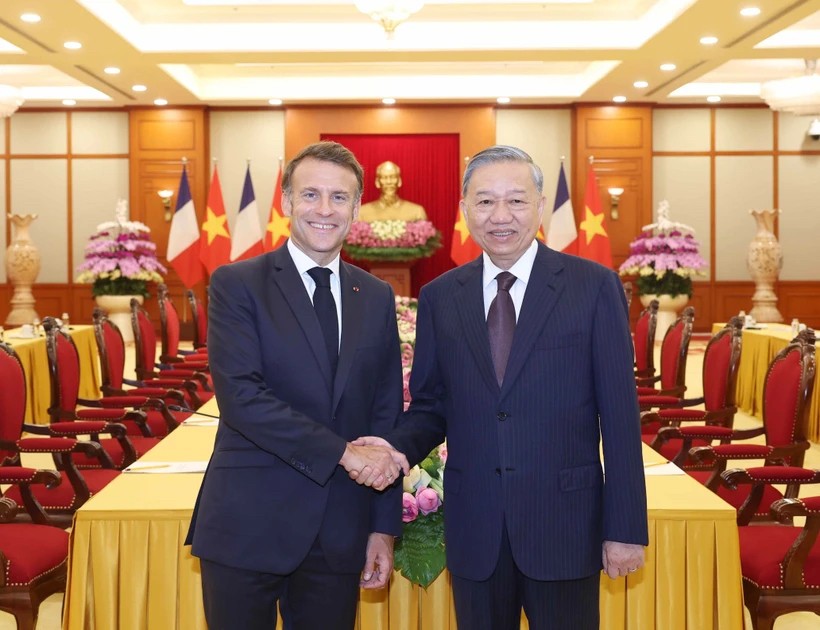

Vietnam News Today (May 27): Vietnam Treasures Multifaceted Collaboration with France

National

National

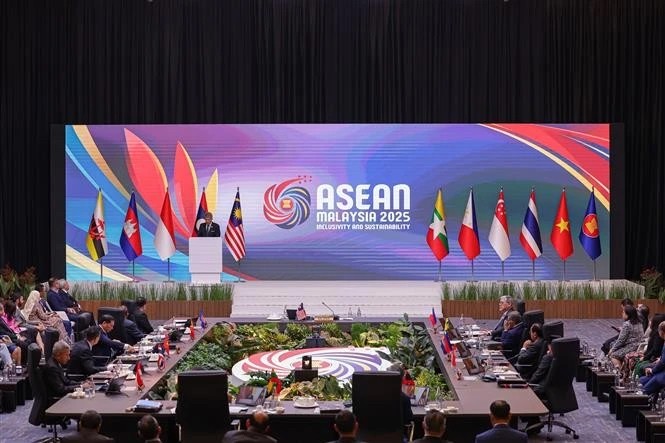

Vietnam Commits to Building an Inclusive, Sustainable and Cohesive ASEAN

National

National

Vietnam Proposes Vision for Responsible Digital Journalism Cooperation

National

National