US, Canada and Mexico sign agreement to replace NAFTA

|

| Canadian Deputy Prime Minister Chrystia Freeland looks on while Mexico's President Andres Manuel Lopez Obrador shakes hands with Mexico's Foreign Minister Marcelo Ebrard, during a meeting at the Presidential Palace, in Mexico City, Mexico December 10, 2019. REUTERS/Carlos Jasso |

The signing ceremony in Mexico City launched what may be the final approval effort for U.S. President Donald Trump's three-year quest to revamp the 1994 North American Free Trade Agreement (NAFTA), a deal he has blamed for the loss of millions of U.S. manufacturing jobs.

The event at the National Palace was attended by Mexico President Andres Manuel Lopez Obrador, Canadian Deputy Prime Minister Chrystia Freeland, U.S. Trade Representative Robert Lighthizer, and U.S. White House adviser Jared Kushner.

The result of a rare show of bipartisan and cross-border cooperation in the Trump era of global trade conflicts, the deal was inked the same day as he became the fourth U.S. president in history to face formal impeachment.

"They approved it today of all days," Trump told reporters at the White House, calling it the "silver lining" of impeachment.

The pact quickly got bogged down in more party pision, however, as U.S. Senate Majority Leader Mitch McConnell said he would likely wait for a vote on the deal until after the impeachment trial - likely kicking ratification into next year. Friction also emerged over how intrusive foreign enforcement of labor rules would be in Mexico.

Nonetheless, Lighthizer called it "a miracle" that unions, businesses and actors from across the political spectrum had come together, saying it was a testament to the benefits of the deal. Lopez Obrador credited Trump for working with him, while Freeland celebrated a win for multilateralism.

"We have accomplished this together at a moment when, around the world, it is increasingly difficult to get trade deals done," she said.

The U.S.-Mexico-Canada Agreement (USMCA) was signed more than a year ago to replace NAFTA, but Democrats controlling the U.S. House of Representatives insisted on major changes to labor and environmental enforcement before bringing it to a vote.

The delay at times threatened to scuttle the deal, creating investment uncertainty in all three countries and worrying U.S. farmers already suffering tariffs stemming from Trump's trade war with China.

Intense negotiations over the past week among Democrats, the Trump administration, and Mexico produced more stringent rules on labor rights aimed at reducing Mexico's low-wage advantage. Both Canada and the U.S. House Ways and Means Committee said the deal included a mechanism for verification of compliance of union rights at the factory level in Mexico by independent labor experts.

"It is infinitely better than what was initially proposed by the administration," House Speaker Nancy Pelosi told a news conference, adding that USMCA was now ready for a House vote.

Both the U.S. United Steelworkers union and the AFL-CIO labor unions endorsed the revised deal.

However, Mexico's chief negotiator Deputy Foreign Minister Jesus Seade said all disputes would be resolved through panels, and denied there would be anything like foreign labor inspectors in Mexico.

There was no immediate sign of the agreement being made public.

Some Mexican business groups fear that Lopez Obrador and Seade have ceded too much.

Gustavo Hoyos, president of employers federation Coparmex and a vocal Lopez Obrador critic, called the government "a bad negotiator." Other business groups focused on the positive and welcomed the looming end to months of uncertainty.

Seade himself said some of the changes were reasonable but not necessarily "good for Mexico."

NEW WRINKLE

Republican and Democratic U.S. lawmakers say there is broad support for revising the pact, which backers say encompasses US$1.2 trillion in annual trade across the continent and supports 12 million U.S. jobs and a third of American agricultural exports. Canada's parliament and Mexico's congress are expected to ratify the deal without major complications.

U.S. House Ways and Means Committee Chairman Richard Neal, a Democrat, said sections of the text would be reviewed by lawmakers, but he saw no reason for "unnecessary delays" in bringing it to a vote on the House floor.

However, in a new wrinkle to swift ratification in the United States, McConnell said the Republican-controlled Senate would not take up the deal before congressional recess, potentially pushing the vote into next year.

That seemed to put him at odds with Trump spokeswoman Stephanie Grisham, who said the White House would "push hard" to get the implementing bill passed before year end. Pelosi spokesman Henry Connelly said McConnell had "no excuse" not to bring up USMCA, pointing to fast approvals of previous trade pacts.

Trump launched a renegotiation of NAFTA in his first year in office, intent on delivering on his 2016 campaign promise to replace what he has derided as the "worst deal ever." Canadian and Mexican leaders reluctantly agreed to join the negotiations with their largest trading partner.

"America's great USMCA Trade Bill is looking good. It will be the best and most important trade deal ever made by the USA. Good for everybody," Trump tweeted on Tuesday. "Importantly, we will finally end our Country's worst Trade Deal, NAFTA!"

For Democrats, the deal serves as a retort to Trump and Republican assertions that their only agenda was pursuing his impeachment.

In addition to the labor provisions, Democrats said they won elimination of a 10-year data exclusivity period for biologic drugs from the agreement, which they feared would lead to higher U.S. drug prices.

But Pelosi said she lost her bid to remove liability protections for internet service providers, a provision she had called a "giveaway" to big tech companies.

Lighthizer included a last-minute demand of Mexico for a tighter definition of steel and aluminum in the deal's automotive rules of origin - to be "melted and poured" in North America. While USMCA originally required 70per cent of the metals used in North American vehicle production come from the region, it did not specify production methods, opening the door to the use of semi-finished metals from China and elsewhere.

Mexico and Canada agreed to a seven-year phase-in of the new standard for steel, Mexican officials said. The aluminum demand was dropped, but with the caveat that it would be reconsidered in 10 years./.

Recommended

World

World

Pakistan NCRC report explores emerging child rights issues

World

World

"India has right to defend herself against terror," says German Foreign Minister, endorses Op Sindoor

World

World

‘We stand with India’: Japan, UAE back New Delhi over its global outreach against terror

World

World

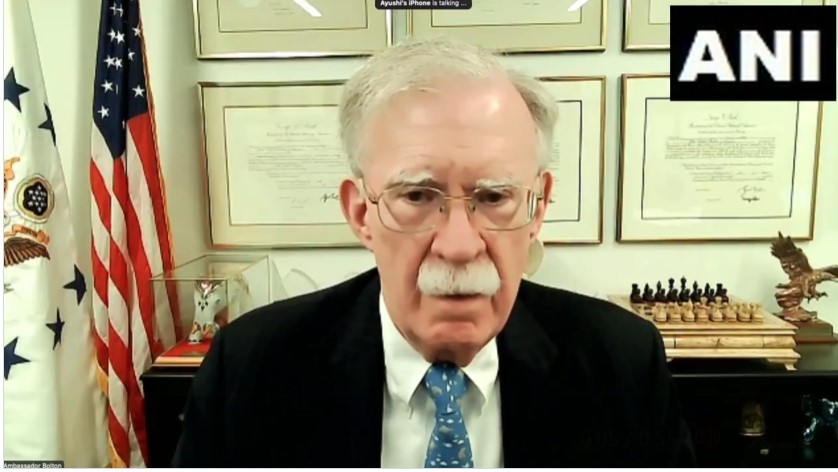

'Action Was Entirely Justifiable': Former US NSA John Bolton Backs India's Right After Pahalgam Attack

Popular article

World

World

Nifty, Sensex jumped more than 2% in opening as India-Pakistan tensions ease

World

World

India strikes back at terrorists with Operation Sindoor

World

World

India sending Holy Relics of Lord Buddha to Vietnam a special gesture, has generated tremendous spiritual faith: Kiren Rijiju

World

World