VN Ambassador Speaks Highly of Vietnam’s Marco-economy

| Vietnam’s Textile Industry to Miss Export Target Due to Covid | |

| Car Import to Vietnam Doubled Amidst Covid-19 | |

| Vietnam’s Agricultural Export Strengthen Despite Covid-19 Outbreaks |

Vietnam’s economy could achieve stable growth thanks to consistent macroeconomy policies, followed by the increasing role of the private sector. This was the opinion highlighted at the conference on the economy and stock market in Vietnam held by Dragon Capital Corporation in London, United Kingdom on September 1, 2021.

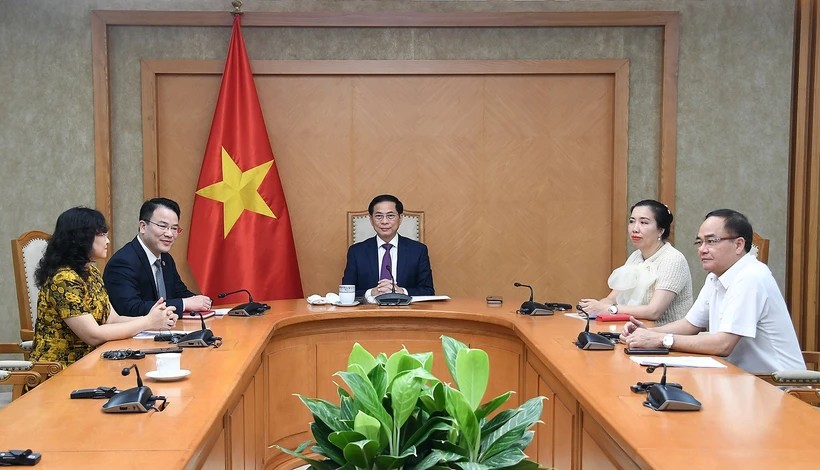

The conference was attended by the Ambassador of Vietnam to the United Kingdom Nguyen Hoang Long and British businesses interested in the Vietnam market. The participants received an update on Vietnam’s economy as the country was undergoing the fourth Covid-10 wave, characterized by the spreading of the Delta variants.

Speaking at the event, Ambassador Long affirmed the determination of the government of Vietnam in innovating and opening the market and pushing for privatization of the state businesses.

The ambassador notes that Vietnam had to achieve an economic growth rate of 6.5% - 7% annually to meet its goal of increasing per capita incomes to US$ 4,500 by 2025 and US$ 7,500 – 8,000 by 2030. This was not an easy task, especially as Vietnam was facing the negative impacts of the Covid-19 pandemic.

He believes that Vietnam’s focus on converting to high-quality economic growth models, attracting selectively investors in the high-tech sector, and green growth was a good opportunity for investors from the United Kingdom and other countries.

At the conference, the Chairman of Dragon Capital Dominic Scriven provided an overview of the economy and stock market in Vietnam and pointed out the drivers behind Vietnam’s development, including increasing the budget for infrastructure development and low interest rates. Scriven also predicted that Vietnam’s economic growth would achieve a rise of 5% growth this year.

|

| Chairman of Dragon Capital Corporation Dominic Scriven speaking at the conference on the economy and stock market in Vietnam held in London, the United Kingdom, on September 1, 2021. Photo: Vietnam News Agency. |

Scriven believed Vietnam’s strengths in attracting forest investment included good human resources, favorable forest investment policies and a highly reliable investment environment built on a history of stable growth since Vietnam started the Doi Moi (Renovation) economic reforms in 1986.

Scriven also underlined that while foreign investors would face difficulties in investing in Vietnam at the moment, the country’s economy would recover next year and thus retain a high potential for attracting investment.

Assessing Vietnam’s ability to respond to the Covid-19 pandemic, Scriven believed Vietnam had achieved successes in controlling the pandemic last year. In 2021, the government of Vietnam and local authorities had been responding timely when Covid broke out due to the fast-spreading of the Delta variants.

Scriven recommended that the government of Vietnam should distribute reasonable support packages to the community to reduce the challenges due to the impacts from Covid and highlighted that this support would directly assist the recovery of Vietnam’s economy next year.

Regarding the stock market, Scriven said Vietnam had not been recognized as an emerging market, therefore facing difficulties in mobilizing capital. As such, the government of Vietnam should develop plans to address this limitation, as indirect investors were not any less important than direct investors.

Established in Vietnam in 1994 with a total investment capital of US$ 16 million, Dragon Capital is currently the oldest independent asset management company in Vietnam. By December 31, 2019, the corporation recorded a total asset value of US$ 2.9 billion.

| Vietnam’s Alcohol-free Drinks Observe Impressive Growth in Australia In the first six months of 2021, the export of alcohol-free drinks from Vietnam to Australia was up 59% compared to the same period in ... |

| Increasing Food Costs Affect CPI in Vietnam Vietnam’s Consumer Price Index in August 2021 rose 0.25% from July, 2.51% from December 2020 and 2.82% compared to the same period a year earlier. |

| Despite Covid, Vietnam’s Steel Industry Grows Thanks to Export To address challenges in steel consumption domestically, steel businesses in Vietnam are looking to boost exports. |