When SMEers Catch up With the 4th Industrial Revolution

Solving small traders’ challenges

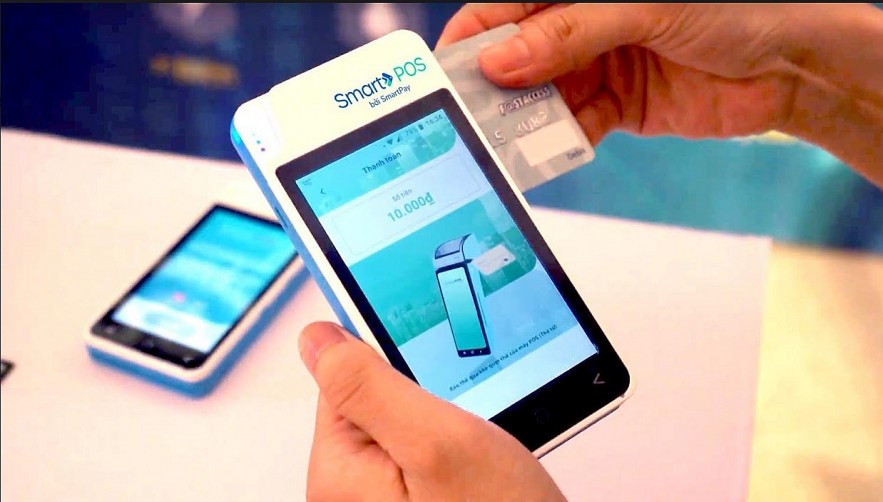

Covid-19 pandemic has changed consumers’ lifestyle and behavior. It has driven cashless payment trend as people’s main habit, even in the new normal. In the past, non-cash payment was only card transactions and online payments. Currently, consumers can use digital banking applications on smartphones to manage their accounts and make instant payments with biometric authentication. The payment with QR Code has become more and more popular thanks to its convenience and simplicity. In addition, many other contactless payment methods are also applied in many stores and shops.

|

In this context, traders must quickly grasp new trends and change payment methods. Especially, micro and small traders need to catch up faster to meet consumers’ needs. According to a study, cash transactions in Vietnam remarkably decreased from 86% (2017) to only 54% in 2021. This is both an advantage and a challenge for small traders when they have to transform themselves in the competition with big brand distribution chains in this wave of digitalisation.

According to Mr. Marek Forysiak - SmartPay Chairman and Founder, although small traders are the "heart" of the economy, financial institutions and payment service providers in Vietnam have not offered a "full" solution to support this segment in overcoming business challenges. Their biggest challenge is finding new customers. SmartPay's observations showed that small traders often, on their own, promote their products on e-commerce sites or social networks. However, due to their limited time and skills, this solution is unlikely to be widely applied.

The second challenge is retaining old customers. In fact, more and more customers prefer non-cash payment, which causes difficulties in serving them for small traders who are familiar with traditional transaction form. Moreover, traders having “caught up” with modern technology need to equip with many devices for different payment forms (via bank cards, e-wallets, QR scanning). This leads to decentralized sales revenue and takes much effort. Another challenge is traders’ limited access to capital due to banks’ complicating requirements on collateral and appraisal process.

"In the past, big banks in Vietnam did not pay attention to small traders but that has recently changed. When SmartPay started focusing on small traders, many other financial institutions have been doing the same as they also saw the potential of this segment. Small traders used to be ignored because they do their business primarily in cash. When they move from cash to cashless business, they will get more access to advanced financial services," said Marek Forysiak.

Since its establishment in 2019, SmartPay has aimed to enhance micro, small and medium traders’ life by providing technology solutions for all forms of payment and access to business capital regardless of their scale. To date, SmartPay has created a unique payment ecosystem with 700,000 traders, focusing on micro-traders who have not yet been served by the traditional financial system.

Leading POS provider

In addition, strong relationship with major strategic partners such as FE CREDIT, VPBank, CIMB…. is one of SmartPay’s major competitive advantages in developing a network of card-accepting and effective service processing agencies at competitive costs. Recently, in order to diversify payment methods and create convenience for drivers, traders and customers using BE services, SmartPay and BE Multi-Service Platform have cooperated, aiming to equip 24,000 SmartPOS devices for beCar and beFood services. The cooperation not only helps the community of 40 million SmartPay users to have more convenient access to Be Platform services, but also remarks a milestone in SmartPay’s goal of supplying 325,000 SmartPOS devices to small entreprenuers within the next 3 years. This contributes to reducing the shortage of about 1 million POS devices in Vietnam and helping SmarPay become the leading POS service provider.

Additionally, SmartPay also owns a strong technology team that can provide an exclusive payment platform with the highest quality for traders and users. Currently, SmartPay has been certified PCI DSS (Payment Card Indutry Data Security Standard) - level 1, the security standard certified by Payment Card Industry Data Security Council (PCI DSC) – the highest security standard in the industry.

In terms of revenue, by the end of 2022, GMV (Total Merchandise Value) via SmartPay has reached 4.5 billion USD since its establishment in 2019. In 2022, SmartPay’s estimated revenue is 16 million USD, increasing 71% as compared to 2021.

With its achievements, SmartPay has succeeded in Series A funding round with an investment of 10 million USD from SMBC - Japan's leading bank.

According to SmartPay representative, this investment will continue to support SmartPay's strategy of facilitating small traders' business development and becoming the leading payment service provider for small traders in Vietnam. In addition, with SMBC and FE CRDEDIT’s support, SmartPay will open up opportunities for traders to increase revenue with such services as Buy now, Pay later (BNPL), consumer durable loans (CDL) or Equated Monthly Installment (EMI) - services that were previously only available to large retail chains.

SmartPay aims to provide more than 160,000 SmartPOS by the end of 2023. By 2025, the multi-channel mechandize value is expected to reach US$8 billion (increasing 38%) with the offer of various financial products and services. At the same time, SmartPay will expand its payment acceptaing agencies to 2.4 million users and support daily business operations for more than 50% of small and micro traders with innovative solutions.

| 4th industrial revolution creates opportunities for investors in Vietnam: PM The government is changing its management to create a favorable investment environment and digitizing public services to boost national growth, said Prime Minister Nguyen Xuan ... |

| Vietnam to focus on digital transformation promotion in next decade In the past few years, Vietnam has achieved important milestones in promoting the digital economy, and the country will further stay focused on the process ... |

| Minister: tech firms play crucial role in “Make in Vietnam” programme Created in Vietnam, made in Vietnam, designed in Vietnam, manufactured in Vietnam: Vietnamese tech-enterprises are here for “Make in Vietnam". |