Experts: Card usage insecure in Vietnam

ATM cards make up a lion’s share of some 80 million bank cards in Vietnam but the security of these plastics is very low as they use old technology, experts at Banking Vietnam 2015 warned.

ATM cards account for 88% of total bank cards in the country and international debit cards for a mere 4.22%, heard the two-day conference that ended in Hanoi on Tuesday. As ATM cards were issued based on old technology, it is easy for criminal organizations to fake them and steal personal data of cardholders.

Nguyen Dang Hung, deputy general director of Vietnam National Financial Switching Joint Stock Company (Banknetvn), told the event that banks should apply modern technology for their cards in the face of rising card fraud in this market.

“Although many banks have installed surveillance devices and cameras at their ATM booths to prevent card fraud, many cardholders have still fallen victim to information theft,” Hung said.

As many as 350 counterfeit cards were detected in 2011 with losses amounting to VND62.5 billion (US$3 million). In 2013, some Bulgarians installed devices at a number of ATM booths in Nha Trang City of Khanh Hoa Province to steal cardholder data and then withdrew over VND100 million from their bank accounts.

|

An office worker withdraws cash from an ATM booth in HCMC. Many cardholders have fallen victim to data theft though banks have installed surveillance devices and cameras at ATM booths to prevent card fraud – Photo: the Saigontimes

A Chinese was discovered to use 14 fake cards with different bank brands to get money from ATM machines last year.

Experts at Banking Vietnam 2015 called for local banks to switch to chip cards to enhance security and protect customers from losses. Many countries have issued chip cards to minimize fraud as it is hard to fake chip cards.

Malaysia used to be one of the countries with the biggest number of fake cards in the world, but the country has changed all magnetic cards into chip ones.

Hung noted that as countries like Malaysia have shifted to using chip cards, more criminal organizations and inpiduals might have moved to Vietnam.

According to experts, banks are hesitant to switch to chip cards as it costs an additional US$1 to issue one chip card compared to the magnetic version.

Experts also urged banks to enhance security measures for electronic payment systems and payment services on advanced technologies to minimize crime-related losses.

According to a 2014 report of security firm Kaspersky, there were nearly two million attacks using money stealing malware via online banking services last year. Vietnam ranked seventh in terms of vulnerabilities for card users./.

VNF/Saigontimes

Most read

Thank-you Message of State Funeral Board, Family of General Secretary Nguyen Phu Trong

Hundreds of People's Organizations Worldwide Sent Condolences over General Secretary Nguyen Phu Trong Passing

Recommended

Viet's Home

Viet's Home

Endless Streams Of People Mourn General Secretary Nguyen Phu Trong

Viet's Home

Viet's Home

Vietnam’s Weather Forecast (July 27): Intense Heat In The North And Heavy Rain In The South

Viet's Home

Viet's Home

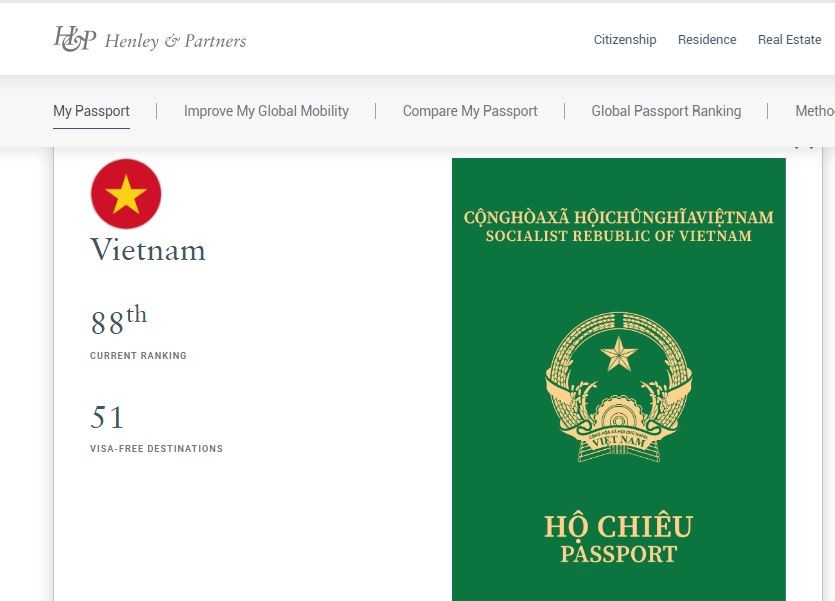

Vietnam Ranks 88th in World's Powerful Passport Index

Expats in Vietnam

Expats in Vietnam

Memorial Service for General Secretary Nguyen Phu Trong Held in Japan

Popular article

Viet's Home

Viet's Home

Chip ID Cards Required for General Secretary Nguyen Phu Trong's Memorial Service

Viet's Home

Viet's Home

Vietnam’s Weather Forecast (July 26): Intermitten Sun In Hanoi And Heavy Rain In Ho Chi Minh City

Viet's Home

Viet's Home

1954 Geneva Agreement - A Glorious Milestone in Vietnamese History

Viet's Home

Viet's Home