IMF: Vietnam to Maintain High Economic Growth Over Medium Term

When assessing the recently implemented Socio-Economic Recovery and Development Program for consumption and production boost in Vietnam, Paulo Medas said that it is time for fiscal policy to be strengthened. He first recommends taking advantage of prudent policy in recent years. Also, long-standing problems should not be overlooked during the implementation of the Socio-Economic Recovery and Development Program, since they will require deeper reforms over time.

Medas believed at this point of the program, it has proven to be a step forward in maintaining high economic growth for Vietnam, for example, the recent acceleration in the deployment of public investment.

Paulo Medas is Division Chief in the IMF’s Fiscal Affairs Department and oversees the IMF’s Fiscal Monitor and other policy and research work on public finances, including on global debt trends. His areas of research include fiscal rules, fiscal and debt crises, governance and corruption, and management of natural resources. |

Regarding the monetary policy, in 2023, borrowing from the bank is still considered risky for many businesses in Vietnam. Those who faced weaker external demand and more tepid consumption growth avoided pushing too hard to increase credit, which could cause problems in the future. Struggling businesses refused to borrow even if interest rates fell as a measure to stimulate economic growth, said Medas.

At the same time, there is a fairly large credit proportion in GDP in Vietnam after many years of very strong credit growth. In addition, bad debt is increasing. To manage risks to asset quality, it is essential to have appropriate banking regulation and supervision. IMF recommends adopting strong and modern micro- and macro-prudential policies.

The Head of IMF Vietnam recognized that the State Bank (SBV) has controlled inflation and limited exchange rate disruptions without losing foreign exchange reserves. Fiscal policy plays a key role in supporting growth, stressed Medas, and SBV must ensure financial stability in an environment of weak growth, tightening financial conditions after domestic and foreign events, and not having much room to lower policy interest rates. Another recommendation for policymakers in 2024 is to be cautious with financial stability and inflation developments

"It is likely that SBV will continue to have little room to loosen monetary policy. It should also be noted that the monetary policy framework needs to be rapidly modernized to improve operational efficiency," said the Head of IMF Vietnam.

The SBV should also eliminate tools such as credit growth ceilings and deposit interest rate ceilings. Instead, it should apply market-based mechanisms along with appropriate macroprudential measures, which allow flexible exchange rates.

According to Medas, the global growth is likely to remain modest but overall conditions for Vietnam will be more favorable, allowing for a stronger economic recovery.

"IMF forecasts that Vietnam's economic growth in 2024 will increase to 5.8%. Increased exports will help manufacturing and other export sectors accelerate after the 2023 recession. This also contributes to improving investment and consumption efficiency," he stressed.

He believed that if Vietnam continues to make the necessary economic and climate-related reforms and investments, the country can maintain high economic growth in the medium term and become a greener economy. It is important to quickly address weaknesses that could hinder growth, including addressing issues in the real estate sector and underperformance that could harm the corporate bond market and affect the lending ability of banks.

| Vietnam-Japan Friendship Association of Can Tho City Held a Congress for the New Term On September 22, the Vietnam - Japan Friendship Association of Can Tho City (Association) held a Congress of delegates for the 2023 - 2028 term ... |

| Fitch Ratings Raised Vietnam’s Long-Term Credit With A "Stable" Outlook Credit rating agency Fitch Ratings raised Vietnam's long-term national credit rating to BB+, with a stable outlook on December 8. |

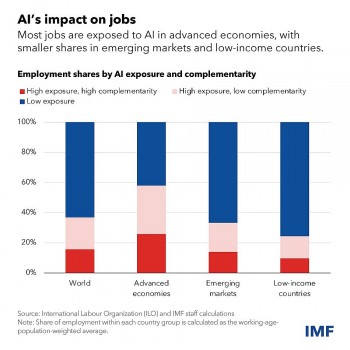

| IMF: AI Will Transform The Global Economy AI will affect 40% of jobs and probably worsen inequality, says the Head of International Monetary Fund (IMF) Kristalina Georgieva. |

Recommended

Economy

Economy