Overseas allowed to directly transfer money to bank account in Vietnam

|

| MoneyGram International, Inc. is an American money transfer company based in the United States with headquarters in Dallas, Texas. (Photo: The Street) |

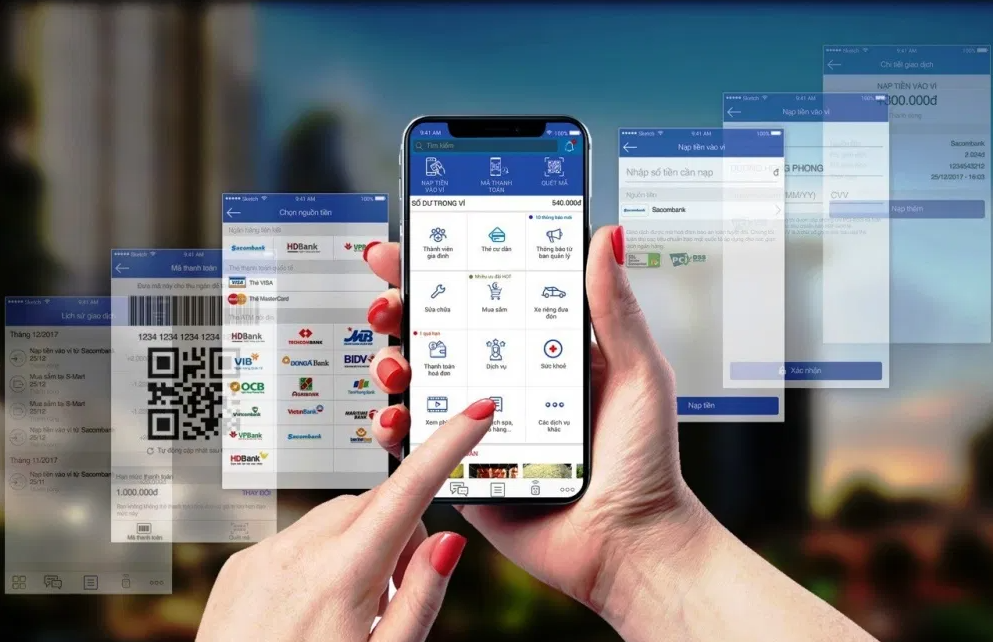

MoneyGram International, a company specializing in cross-border money transfers and payments, has announced a partnership with Visa to launch P2P fast money transfers in Vietnam. Accordingly, overseas senders can use the MoneyGram website or application to instantly transfer money to Visa cardholders in Vietnam.

Dang Tuyet Dung, Country Manager of Visa in Vietnam and Laos, said that the recipient will use Visa's debit or credit card to receive money through the Visa Direct real-time payment solution. The money received will be automatically transferred into Vietnamese currency according to the exchange rate of the card-issuing bank.

"This cooperation will contribute to boost economic growth in Vietnam and help the international money transfer process become more seamless," Dung said.

Currently, this solution allows customers to transfer money from the US, UK, and 18 European countries, including France, Germany, Spain, Hungary, Romania, Bulgaria, Czech, Poland, Greece, Ireland, Belgium. , Austria, Finland, Denmark, Estonia, Italy, the Netherlands, and Portugal to Vietnam.

|

| Dang Tuyet Dung, Country Manager of Visa in Vietnam and Laos. (Photo: Vietnam Investment Review) |

Users can transfer up to 2,500 USD per transaction and 10,000 USD per day. From now until the end of June 30, customers can transfer money to Visa debit card in Vietnam without any transfer fee.

Before this solution was introduced, customers in Vietnam often receive remittances through payment branches of banks or agents of Western Union Company. Vietnam is forecasted to be one of the 10 countries with the highest remittance value in the world. Mr. Grant Lines, Head of Revenue at MoneyGram said that joining Visa in this partnership "will help support MoneyGram's growth strategy in 2021 in one of the largest remittance markets in the world".

The amount of remittances transferred to Vietnam as of October 2020 is estimated at 15.7 billion USD, 7% lower than in 2019, but still keeps Vietnam on the list of countries receiving the biggest remittances in 2020, despite the negative effects of the Covid-19 pandemic, according to the World Bank.

|

| Before this solution was introduced, customers in Vietnam often receive remittances through payment branches of banks or agents of Western Union Company. (Photo: Pymnts) |

Total remittances sent to Vietnam reached 71 billion USD in the past 5 years with an average growth of 6% / year, of which 2018 and 2019 reached 16 and 16.7 billion USD, respectively. Vietnam is the ninth-largest remittance recipient in the world by 2020, ranking third in the East Asia-Pacific region, after China and the Philippines.

MoneyGram International, Inc. is an American money transfer company based in the United States with headquarters in Dallas, Texas. It has an operations center in St. Louis Park, Minnesota, and regional and local offices around the world. MoneyGram businesses are divided into two categories: Global Funds Transfers and Financial Paper Products. The company provides its service to individuals and businesses through a network of agents and financial institutions.

In 2014, MoneyGram was the second largest provider of money transfers in the world. The company operates in more than 200 countries and territories with a global network of about 347,000 agent offices.

| WB: Vietnam’s economy among world’s fastest growing World Bank (WB) stressed Vietnam’s economic growth again citing its impressive growth rate in the late 2020 period. |

| New small banknotes hunted for New Year lucky money in Vietnam While Tết holiday (Lunar New Year) is just around the corner, exchange services for new small banknotes are booming ahead one month in Vietnam. |

| WB: Vietnamese economy expected to grow by 6.8 percent next year The Vietnamese economy is predicted to expand around 6.8 percent next year and, thereafter, stabilize at 6.5%, according to the latest World Bank’s economic update ... |

Recommended

Economy

Economy